Crypto Industry News:

Salvadoran President Nayib Bukele announced that his country has bought more Bitcoins. His announcement began with a tweet in which he wrote: "The entire size of El Salvador is 21,000 km2. Coincidence? I do not think so!".

"Today is the last 21st day of the 21st century. At 21:00 ... We buy 21 Bitcoins on this occasion" - he wrote on Twitter.

He then posted a photo of a list of BTC buy transactions that add up to around 21 Bitcoins. "I have a receipt," he wrote.

El Salvador has been collecting Bitcoin since Bitcoin became legal tender along with the US dollar in September in the country. Including the last purchase, El Salvador acquired a total of 1,391 Bitcoins.

Before the act changing the legal status of Bitcoin came into force, El Salvador bought 400 BTC. The country then purchased 300 more BTC. President Bukele then announced that El Salvador now has 700 Bitcoins.

In October, the country bought 420 BTC and another 100 Bitcoins in November. The last big purchase was in early December - 150 BTC - for a total of 1,370 BTC.

Meanwhile, the International Monetary Fund (IMF) warned El Salvador against using Bitcoin as legal tender. The warning comes the day after President Bukele announced his plan to build a volcano-powered Bitcoin City funded by Bitcoin bonds.

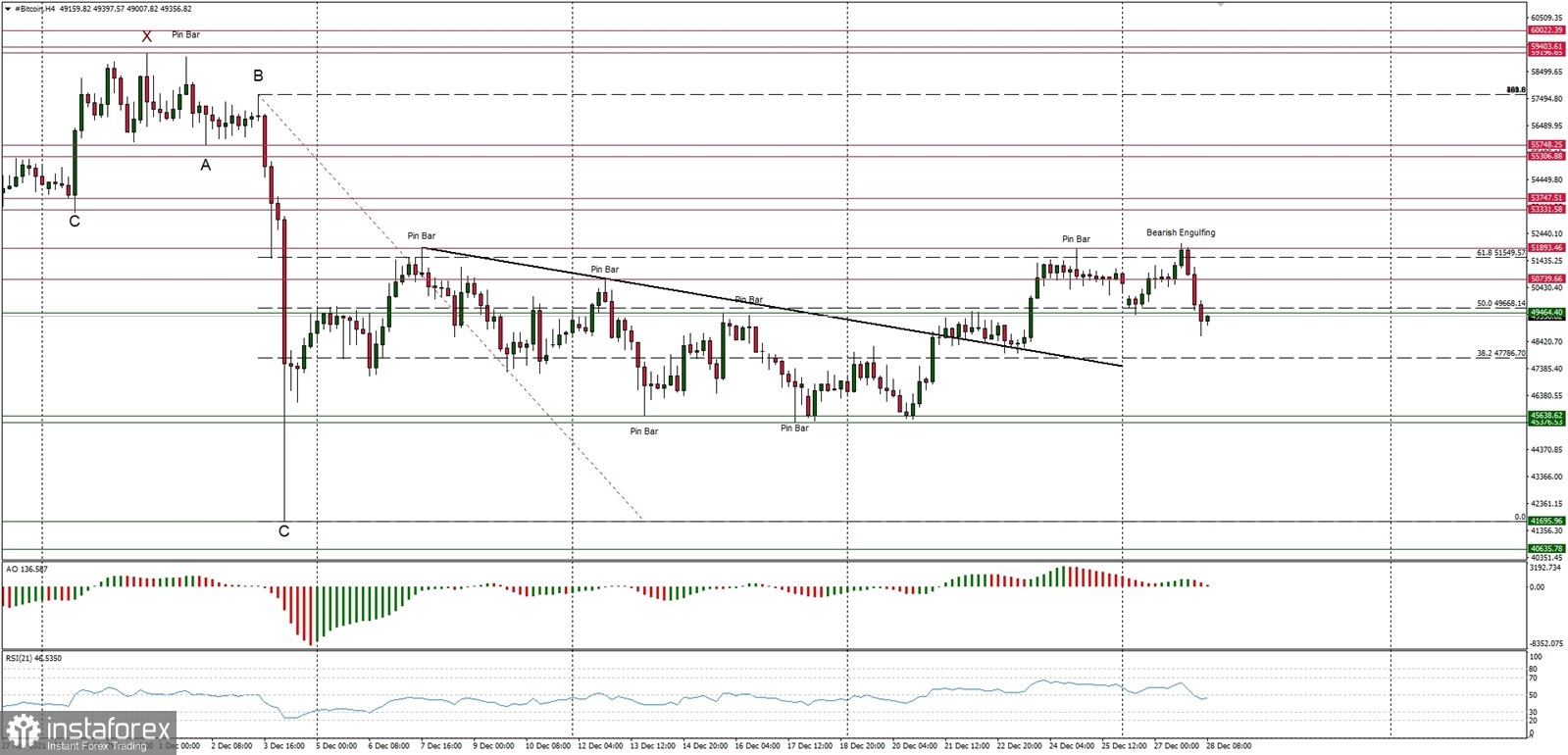

Technical Market Outlook

The BTC/USD pair had been rejected from the technical resistance seen at the level of $51,893 again and after the Bearish Engulfing candlestick pattern was made, the sell of had started. Currently the market is trading below the technical support seen at the level of $49,464 and is heading towards the next technical support seen at $47,595. The key short-term technical resistance is located at the level of $51,913 (Pin Bar high) and $53,333. Despite the recent complex and time consuming corrective decline in form of ABCxABCxABC pattern, the larger time frame trend remains up and only a clear and sustained breakout below the wave C low at $41,678 would change the outlook to bearish again.

Weekly Pivot Points:

WR3 - $60,286

WR2 - $56,809

WR1 - $53,868

Weekly Pivot - $49,723

WS1 - $47,540

WS2 - $43,220

WS3 - $41,111

Trading Outlook:

The ABCxABCxABC complex corrective cycle might be terminated at the level of $41,678 and the market is ready to continue the up trend. According to the long-term charts the bulls are still in control of the Bitcoin market and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $39,474 is clearly broken on the daily time frame chart (daily candle close below $39,000 would be considered as a long-term trend change due to the lower low placement).