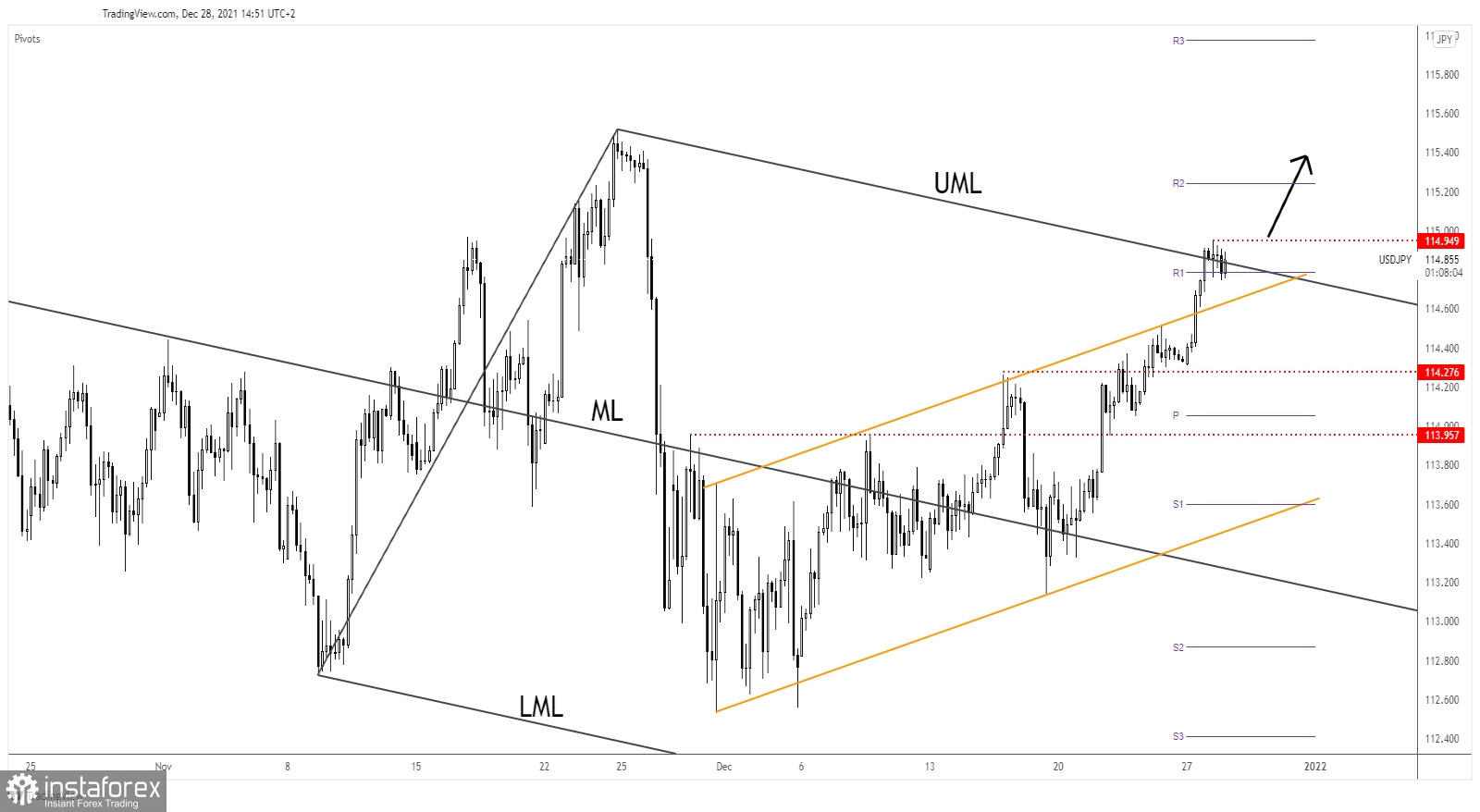

The USD/JPY pair dropped a little after reaching the 114.94 level. I have told you in my previous analysis that USD/JPY could retreat after its forming leg higher. The pair may try to test the broken upside level. If it breaks through this level, it is likely to rise higher.

A minor drop was somehow expected as Japan released some positive economic figures. Yesterday, the US Retail Sales registered a 1.9% growth exceeding the 1.8% estimates. The Prelim Industrial Production totaled 7.2% in November, while the BOJ Core CPI rose by 0.8% versus the forecast reading of 0.5%. The Unemployment Rate increased unexpectedly from 2.7% to 2.8%.

USD/JPY False Breakout?

USD/JPY tested the weekly R1 (114.78) where it has found support. Now, it is trying to come back above the upper median line (UML). I've told you in my analysis posted yesterday that the price could extend its swing higher if it stabilizes above the upper median line (UML).

114.94 high stands as static resistance. A valid breakout through this level may activate potential further growth. On the other hand, failing to stay above the upper median line (UML) and above the R1 could signal a potential drop.

USD/JPY Forecast

Jumping and closing above the 114.94 and above the 115.00 psychological level could validate potential further growth. The next upside target could be represented by the weekly R2 (115.24).