Gold is trading at 1817.65 at the time of writing and it seems determined to hit new highs. It edged higher after the US dollar index slipped lower. You already know from my analysis that, gold increases when the US dollar declines.

XAU/USD could extend its rally if the US data turns out to be worse than expected later today. The Richmond Manufacturing Index is expected to remain steady at 11 points, while the House Price Index may show a 0.9% increase. In addition, the S&P/CS Composite-20 HPI could grow by 18.6%.

XAU/USD regains ground

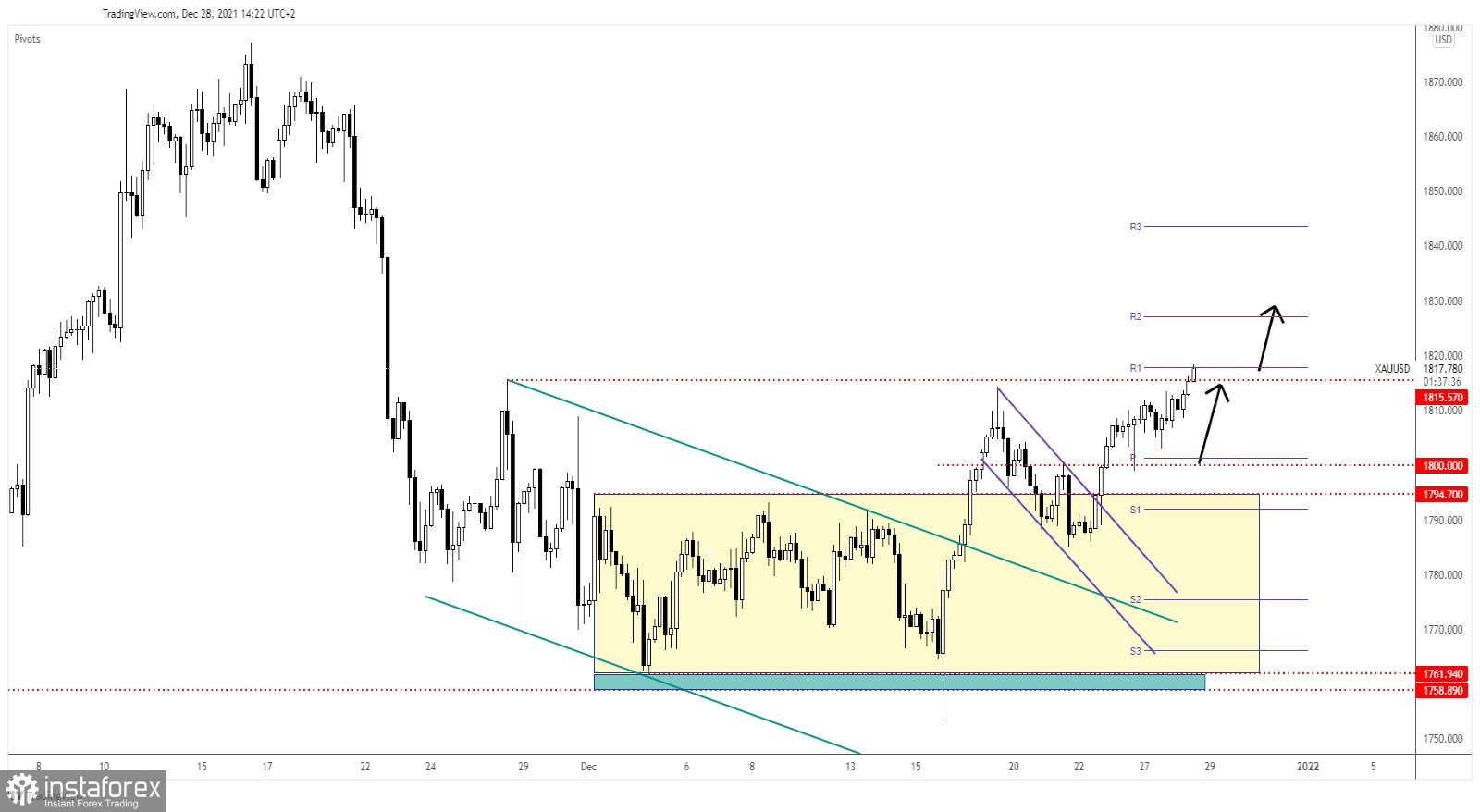

XAU/USD resume its growth as expected after registering only a false breakdown with great separation below the 1,800 psychological level. It has passed above the 1815.57 static resistance and it is trying to break through the weekly R1 (1817.87).

A larger upwards movement could be activated by a valid breakout above 1815.57. So, personally, I will wait for the confirmation of a breakout before opening positions.

Outlook

Closing and stabilizing above 1815.57 and above weekly R1 (1817.87) may activate an upside continuation and could bring new long opportunities. A minor consolidation above these obstacles could attract more buyers.