Hello, dear colleagues!

Well, here's the story before the last day of weekly trading. And yesterday was so busy that I don't even know where to start. Perhaps from the meeting of the European Central Bank (ECB) and the press conference of the President of this financial institution, Christine Lagarde.

So, at the end of its next meeting, the ECB decided not to change the parameters of monetary policy and keep it ultra soft. The main interest rate remained at zero, the margin rate remained within 0.25%, and the deposit rate remained at minus 0.50%. At the same time, the bank said that rates will remain at current low levels until the Eurozone economy recovers from the effects of COVID-19, and the inflation rate does not approach the target value of 2%. The European regulator also left the scope of the asset purchase program unchanged, adding that it can be increased if necessary, and additional tools provided for under the ECB's mandate to achieve price stability can also be included.

At her press conference following the ECB's decision on rates, European Central Bank President Christine Lagarde did not surprise market participants and did not say anything sensational. The head of the ECB stressed that there is a resumption of economic activity in the region due to the lifting of restrictive measures. However, the level of this activity is much lower than it was before the outbreak of the COVID-19 pandemic, which is not surprising, but rather natural. Lagarde once again stressed that the ECB will fully use the volume of asset purchases, which also did not come as a surprise to market participants. Asset purchases will continue until the European regulator considers that the Eurozone economy has recovered from the effects of the COVID-19 crisis. At the same time, of course, there was an element of uncertainty about the timing. Although, according to Christine Lagarde, in the second half of next year, it is possible to review the parameters of the ECB's monetary policy. The keyword here is "possible".

If we sum up yesterday's meeting of the European Central Bank and the speech of the head of this department, everything went as expected by the market. Recovery coronaries may not be quick and easy, too much damage inflicted, the pandemic developed economies. And not only developed ones. Regarding the European recovery fund, the summit on which the EU leaders will hold on July 17-18, it will include grants in addition to loans, which is quite logical and economically correct.

As for the macroeconomic statistics from the United States, which were received yesterday, the number of initial applications for unemployment benefits since March has decreased, although it was higher than the forecast value. But retail sales rose more than expected. All the details are in the economic calendar, and it's time to move on to the technical part of the review.

Daily

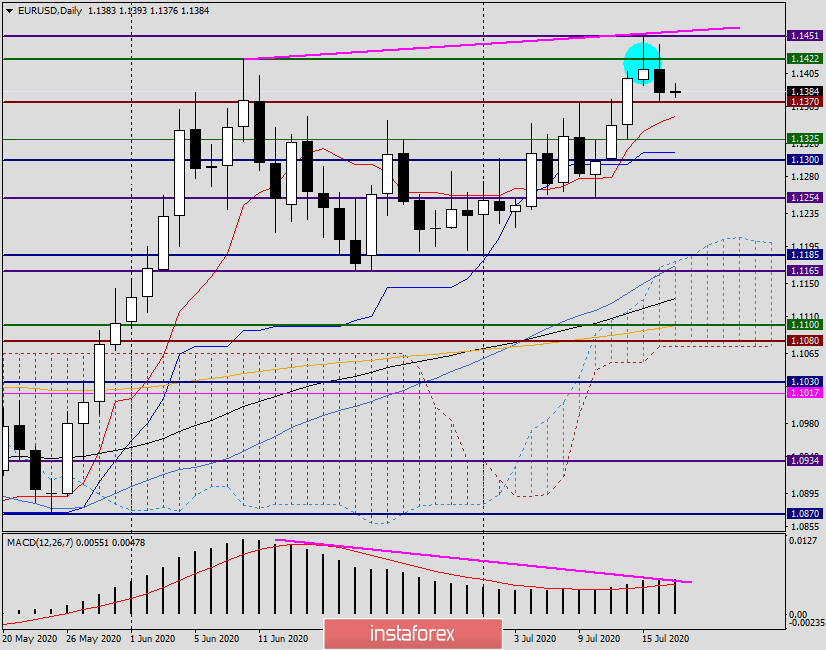

So, candles do not pass without a trace. No, sometimes, of course, the market ignores them and does not work out candlestick signals, and in general, candle analysis is a strong thing. If you know it, understand it and correctly own it - it helps a lot in trading. No wonder in every article I pay attention to Japanese candles.

For example, take the candle for July 15 and describe it. A large long shadow that exceeds the size of the body itself, and this is very important. Next, the candle was formed when an unsuccessful attempt to break through the strong resistance of sellers at 1.1422. And this is also the most important factor. I am referring to the closing price below 1.1422, which indicates that the breakout was doomed to fail and became false. All this together indicates that the candle for July 15 was a reversal, which means with a high probability the next day could be expected to decline. In fact, that's exactly what happened yesterday.

Now, what to expect from EUR/USD today. First, the market will close weekly trades today, and this is always an additional risk factor when opening deals. Second, the fight will most likely unfold around the weekly 200 exponential moving average, i.e. the closing price relative to this moving average. We will consider the weekly chart on Monday, after the closing of the current five-day trading period. If you're interested, you can check out weekly now and put up 200 EMAS. Third, on the daily timeframe, there is a bearish divergence of the MACD indicator, which signals that the pair is overbought and the probability of a decline. Once again, I would like to remind you that you do not need to trade exclusively on divergences. Diver should be perceived only as an additional signal.

So here's what we have. The support is at a strong technical level of 1.1370, the resistance is at the equally significant level of 1.1450. At the end of the article, the pair is trading near 1.1385.

For beginners, I recommend staying out of the market today. As you know, this is also a position. For those who want to trade today, I recommend looking for sales in the price zone of 1.1400-1.1420, however, it is better to open deals only after the appearance of bearish models of candle analysis on H4 and (or) H1.

Purchases can be tried from the price area of 1.1370-1.1340, but also only after the formation of the corresponding candles, which will indicate a likely rise in the exchange rate. That's about it.

Good luck!