The AUD/USD pair was trading around the area of 0.7226 a week ago.

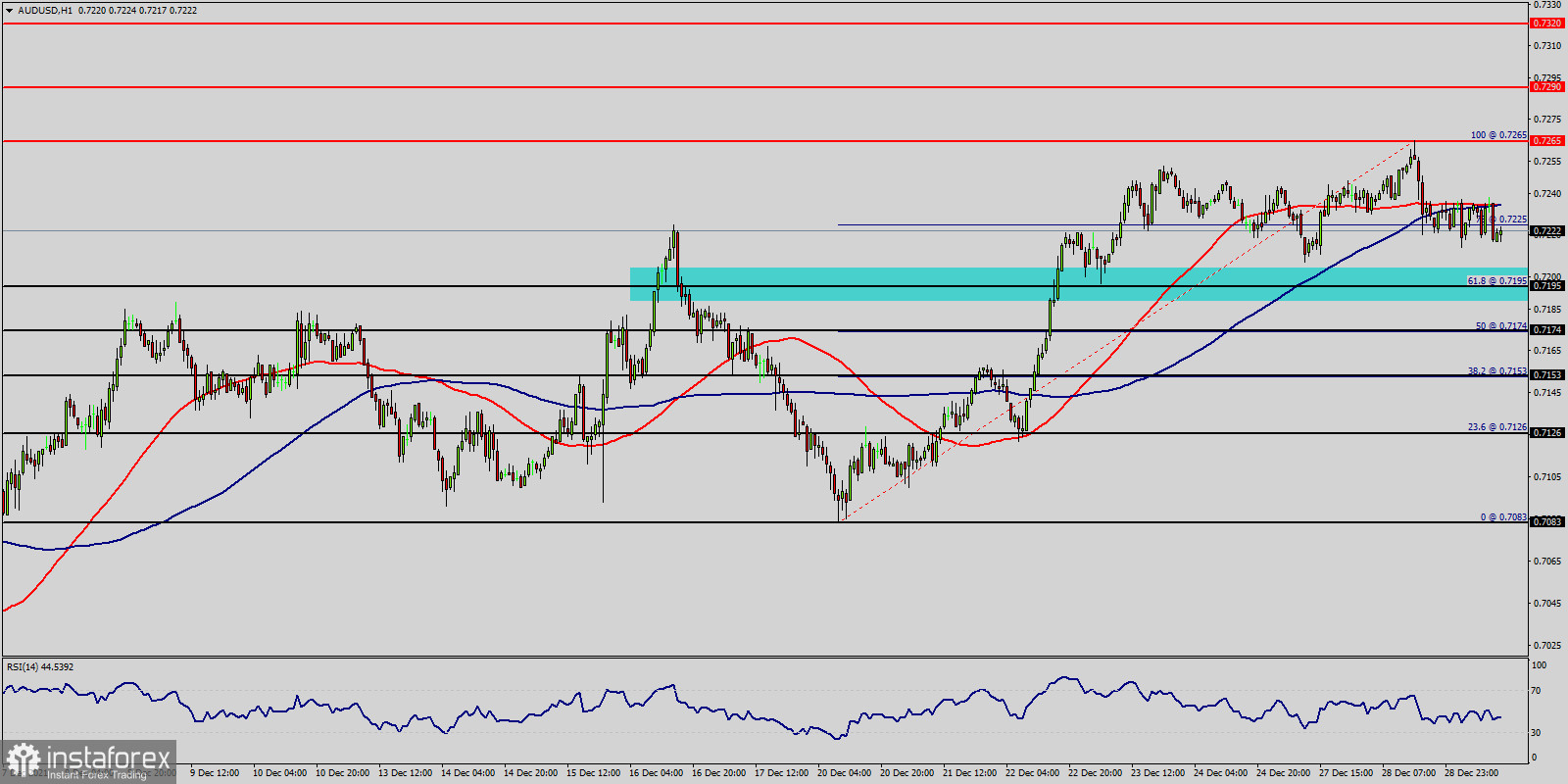

Today, the level of 0.7195 represents a weekly pivot point in the H1 time frame.

The pair has already formed minor resistance at 0.7265 and the strong resistance is seen at the level of 0.7320 because it represents the weekly resistance 3.

So, major resistance is seen at 0.7320, while immediate support is found at 0.7195.

If the pair closes below the weekly pivot point of 0.7195, the AUD/USD pair may resume it movement to 0.7153 to test the weekly support 1.

From this point, we expect the AUD/USD pair to move between the levels of 0.7153 and 0.7320.

Equally important, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100.

As a result, sell below the weekly pivot point of 0.7195 with targets at 0.7153 and 0.7083 in order to form a double bottom.

However, stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at the level of 0.7355.