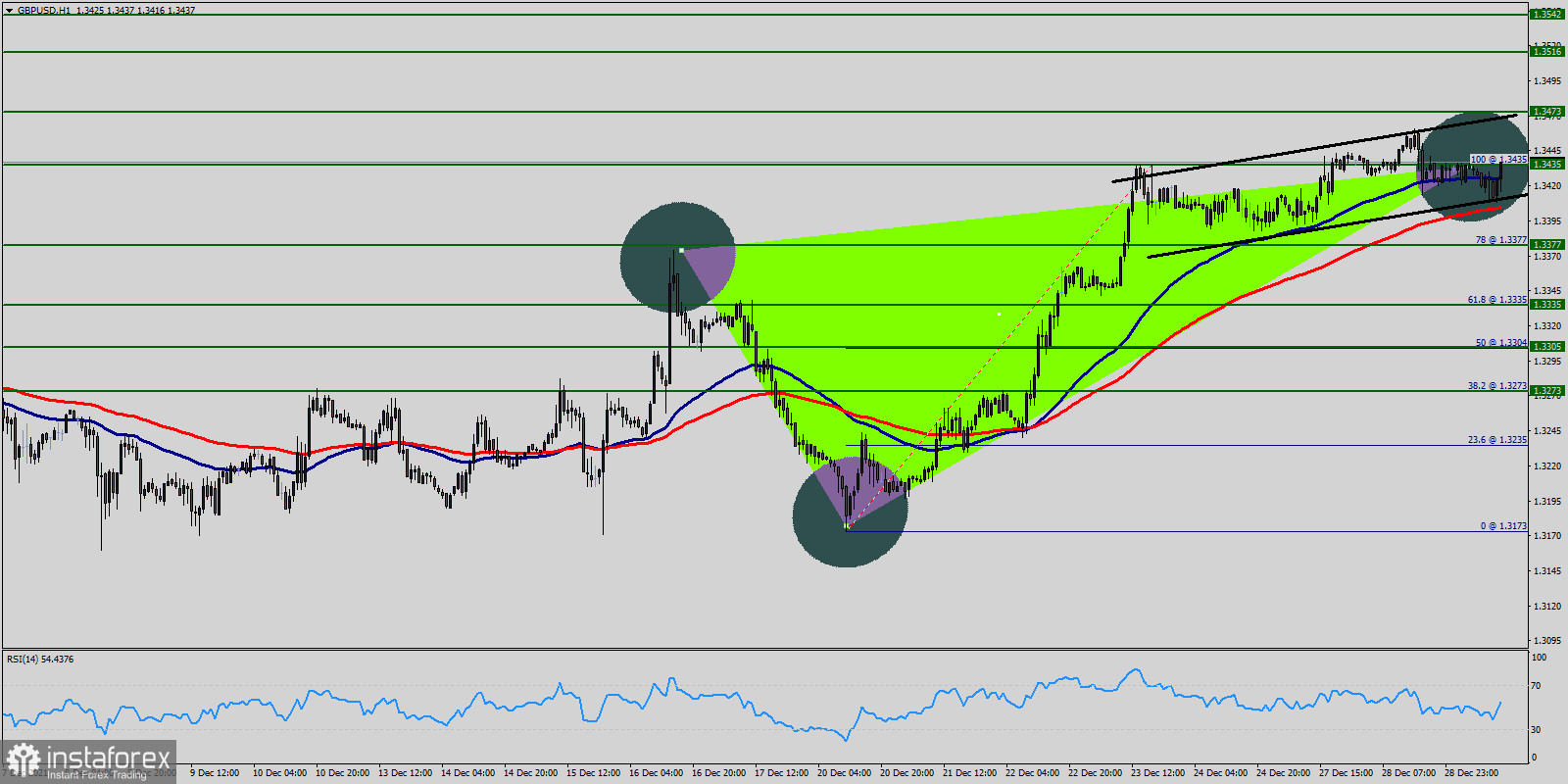

Pivot : 1.3335.

Sterling holds above the area of 1.3335 as dollar weakens. The GBP/USD pair rises from the level of 1.3335 toward 1.3430 as market mood improves.

The GBP/USD pair hits as high as 1.3435 so far, just ahead of 100% Fibonacci retracement level. As it's now close to channel resistance from the spot of 1.3435 - 1.3473.

Therefore, strong support will be found at the level of 1.3377 providing a clear signal to buy with a target seen at 1.3473. With 1.3516 resistance taken out, further rally would now be seen to 1.3516 resistance (high).

Without interruption break there should confirm long term bullish trend reversal. Outlook will remain bullish even in case of deep pull back.

If the trend breaks the minor resistance at 1.3473, the pair will move upwards continuing the bullish trend development to the level 1.3516 in order to test the daily resistance 2.

The GBP/USD pair is showing signs of strength following a breakout of the highest levels of 1.3473 and 1.3516. Furthermore, the trend is still showing strength above the moving average (100).

Thus, the market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. It'd be cautious on topping from current level.

On the downside, break of 1.3335 minor support will turn bias to the downside for correction. However, decisive break of 1.3473 will indicate upside acceleration for next key resistance at 1.3517.