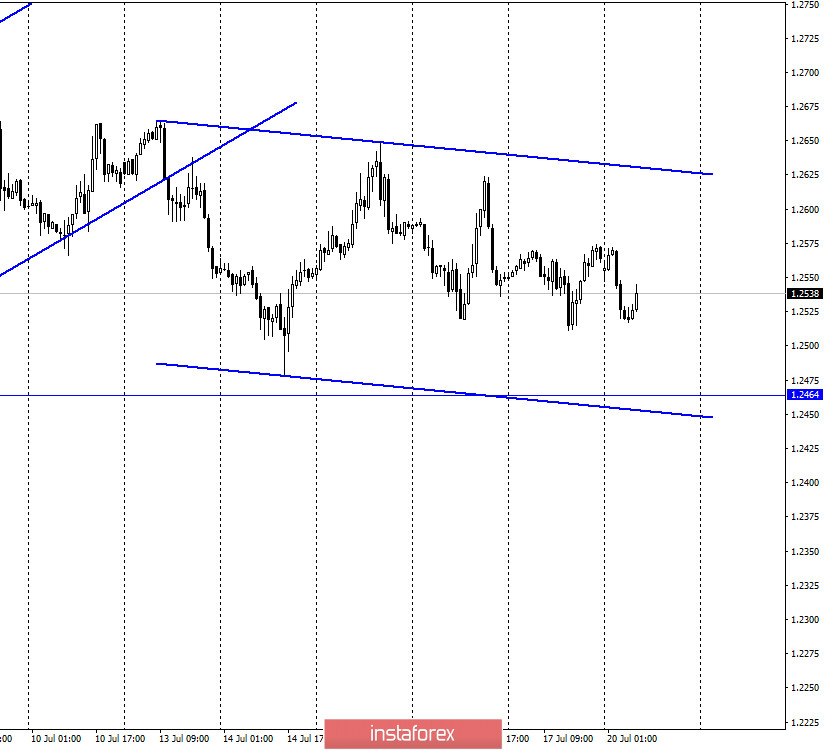

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the GBP/USD pair performed a new reversal in favor of the US currency and began a new process of falling in the direction of the lower line of the downward trend corridor, which defines the current mood of traders as "bearish". In general, I can not call the current decline strong or noticeable. However, the bearish trend cannot be denied due to the unambiguous trend corridor. Traders seem to find it very difficult to sell the pair, as the news from America continues to arrive very sad. The coronavirus epidemic does not subside, and the country's own anti-records on morbidity are updated daily. Thus, in the near future, the American economy may again feel all the negative consequences of the fact that a pandemic is raging in the country. Unemployment may start to rise again, and economic and business activity may decline. In any case, it is naive to believe that at a time when 70-80 thousand people are infected every day, the US economy will grow and recover. The Fed and the US Congress will soon have to agree and adopt a new program to stimulate the economy, which has been repeatedly mentioned by Treasury Secretary Steven Mnuchin.

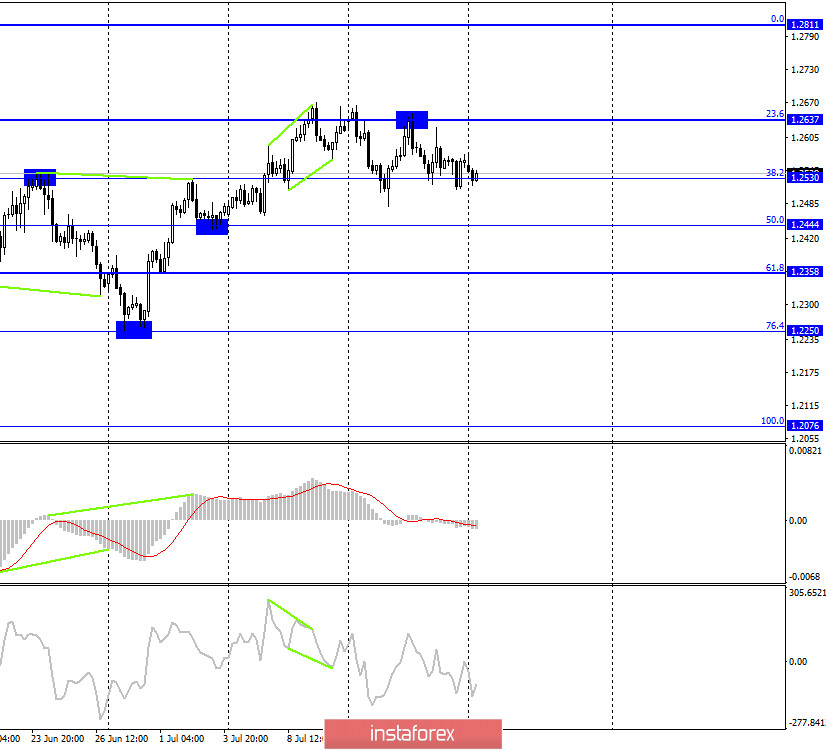

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a new fall to the corrective level of 38.2% (1.2530) and another unsuccessful attempt to consolidate the position. Thus, the rebound from this level will again allow us to count on a reversal in favor of the British dollar and some growth in the direction of the Fibo level of 23.6% (1.2637). Closing the pair's exchange rate under the corrective level of 38.2% will increase the probability of continuing the fall in the direction of the next Fibo level of 50.0% (1.2444).

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 61.8% (1.2516). Thus, the growth process can be continued in the direction of the Fibo level of 76.4% (1.2776). However, this option does not yet support the hourly chart.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

Bank of England Governor Andrew Bailey delivered a speech in the UK on Friday. He said that the British economy has started to recover, but also noted that there are high risks of a second wave of coronavirus, as well as high uncertainty about how people will feel about returning to normal life.

News calendar for the US and UK:

UK - Hearings of the Treasury Ad Hoc Committee (15:10 GMT).

On July 20, the Treasury Committee will hold a hearing in the UK, where the results of the Central Bank's recent work will be announced.

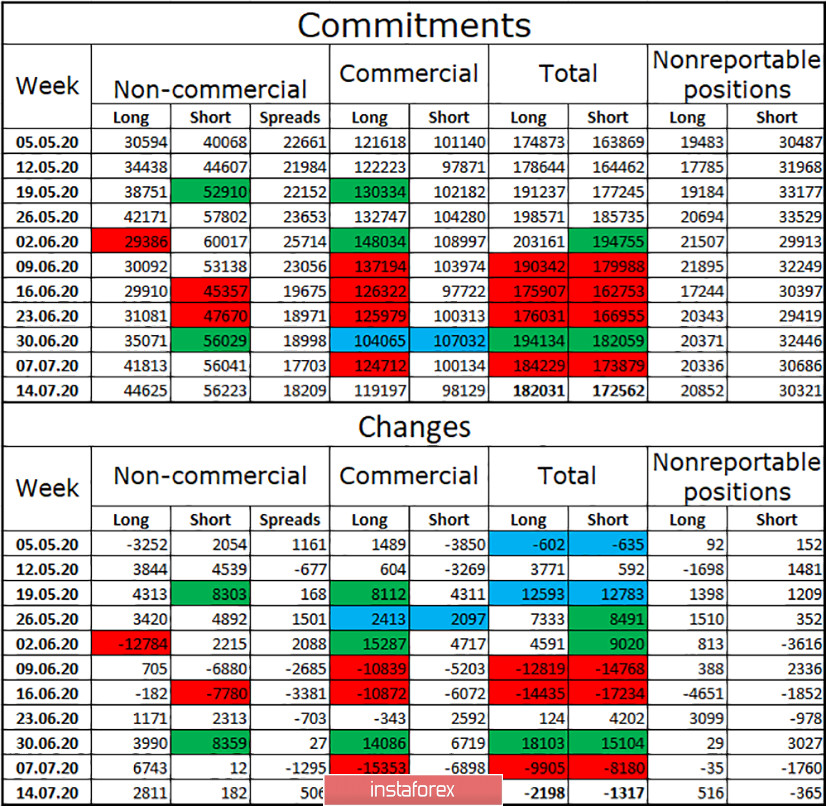

COT (Commitments of Traders) report:

The latest COT report again showed an increase in the number of long contracts among the "Non-commercial" group. However, this time, the growth was small, which means a slight drop in interest among speculators in the British. Over the past 4 weeks, the Non-commercial group has been increasing its long-term contracts. For the last two weeks, I haven't opened any short contracts. Thus, the group of speculators has no interest in selling the pound. There is interest in the purchases of the Briton, but it is declining. In general, the group of speculators has more short contracts on their hands, but the difference has been decreasing in recent weeks. In general, I believe that the British have prospects for continued growth, but bull traders need to close above the trend corridors on the hourly chart.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound again with a target of 1.2444, if the close is made below the level of 1.2530 on the 4-hour chart. I recommend opening purchases of the pair with the goal of 1.2637, if the rebound from the level of 1.2530 is made.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.