Hello, dear colleagues!

Who would have thought that the EU summit would last four days and become the longest in the last twenty years? The leaders of the European countries showed unprecedented perseverance, and as a result of very difficult negotiations that took place in various formats, they still reached a compromise.

The President of the European Council, Charles Michel, proposed a plan for the adoption of the EU budget for 2021-2027, as well as a compromise version of the economic recovery fund, which is already called the "new generation EU". However, this is a compromise, so that all parties agree with the proposed measures, for which some very significant changes have been made. Concessional loans for the countries most affected by COVID-19 will now amount to 360 billion euros instead of 250. But the amount of free aid had to be reduced from 500 billion euros to 390. Under these conditions, the more well-fed northern neighbors decided to share the money and help the poorer and most affected by the pandemic in the southern countries of Europe.

It is also necessary to note another rather important detail. The conditions for EU states to fully comply with the rule of law to receive subsidies have been significantly relaxed. Although the final document states that grants can only be obtained if a country adheres to European values and the rule of law, the supervision of these requirements have been significantly relaxed.

In truth, this outcome was not believed much, and I was more inclined to believe that the issues of the adoption of the seven-year EU budget and the creation of the European economic recovery fund would be postponed to the next summit of EU leaders. But no, we still managed to reach an agreement. I believe that Germany and France, which were the initiators of the European economic recovery fund, played a decisive role in this outcome. Well, as the saying goes, "good is what ends well". And it's time for us to move on to the analysis of the main currency pair of the Forex market. If you look at today's economic calendar, you will find that there are no macroeconomic reports from the Eurozone. The United States at 13:30 (London time) will publish the index of economic activity from the Federal Reserve of Chicago.

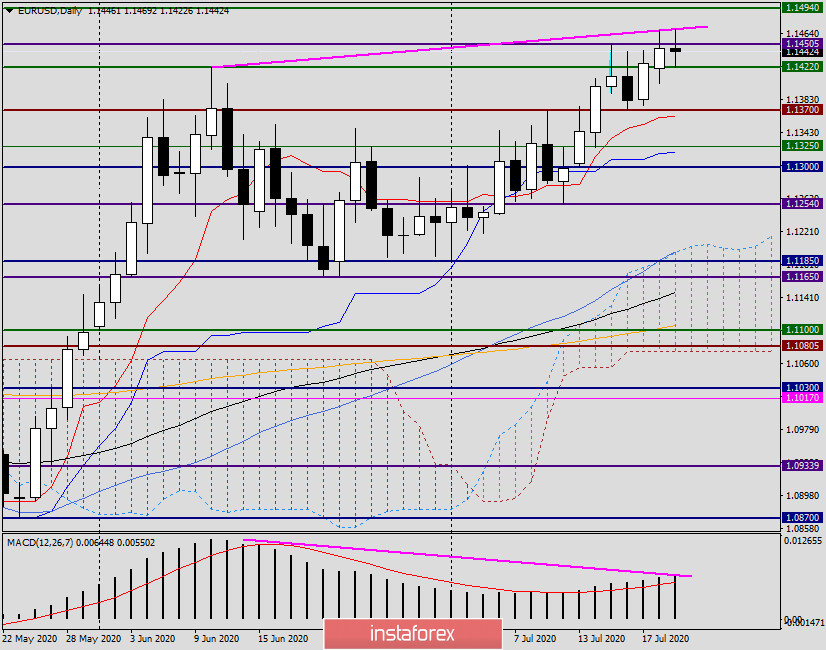

Daily

At yesterday's trading, the euro/dollar currency pair continued to demonstrate an upward trend, however, the euro bulls failed to finish the Monday session above the resistance of 1.1450. Moreover, despite the agreement reached by the EU leaders, at today's trading, the euro/dollar pair is declining. Two options are presented. Either the success of the negotiations at the EU summit was already taken into account in the price of the single European currency and the principle is - buy on expectations, sell on facts. Or market participants will still playback the positive achieved at the four-day European forum.

As for yesterday's forecasts, they were correct. Let me remind you that purchases were recommended to be considered after a decline in the price zone of 1.1430-1.1400 with targets in the area of 1.1450-1.1480. And indeed, after going down to 1.1402, the pair turned on the rise and reached the expected area. At the same time, it was assumed that the quote could meet strong resistance near the levels of 1.1460 and 1.1480. This option also turned out to be correct, it can't rise above 1.1469 euros/dollar yet.

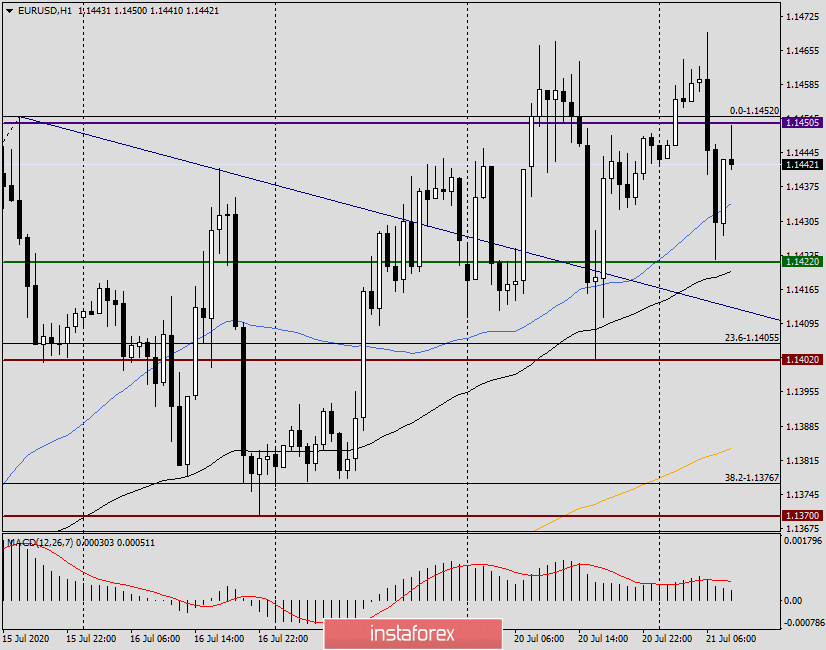

H1

At the trading of today's Asian session, the pair again gave a pullback to the broken resistance level of 1.1422 and rebounded from this level, leaving a fairly long lower shadow. At the end of the article, the quote shows the intention to resume the upward trend but meets resistance in the form of a 50 simple moving average.

Conclusion and trading recommendations for EUR/USD:

Taking into account the positive results of the EU summit and the current upward trend, I consider the main trading idea to be purchases that can be risky to try from current prices or after another decline to the support zone of 1.1430-1.1400. At the same time, it would be good to make sure that the pair is ready to resume the rise after the corresponding candle signals appear.

If bearish candlestick analysis patterns appear on the four-hour and / or hourly charts in the strong resistance zone of 1.1450-1.1480, you can try neat sales. In both cases, I do not recommend setting large goals. It is better to fix purchases in the area of 1.1455-1.1480, and sales in the price zone of 1.1430-1.1400.

Good luck!