Good day, dear traders!

At yesterday's trading, the pound/dollar currency pair showed fairly strong growth. We will move on to the technical analysis of GBP/USD later, but for now a little bit about the topical topic of COVID-19. As we remember, until recently, the US dollar was in demand as a safe asset, at a time when the coronavirus was rampant in Europe and other countries of the world. However, the situation has changed dramatically recently. Market participants are no longer willing to use the dollar as a safe-haven currency, even though the situation with the spread of a new type of coronavirus infection continues to worsen in the United States itself. As of last night, the daily increase in COVID-19 infections in the United States has already exceeded 70,000 people. A huge, terrifying figure! In addition to Texas, Florida, and California, North and South Carolina, Arizona, and some other American states were added to the hotbeds of the pandemic. The US continues to confidently hold a sad lead in the number of daily COVID-19 infections. But in Brazil, the situation with the spread of coronavirus has stabilized, and the number of diseases per day hovers around the mark of 40,000. At the same time, many experts believe that Brazil has reached a plateau and in the future, the number of infected people will decrease.

If you look at today's economic calendar, you can see the absence of any significant macroeconomic reports. Unless the attention of market participants can attract the index of economic activity from the Federal Reserve of Chicago, which will be published at 13:30 London time.

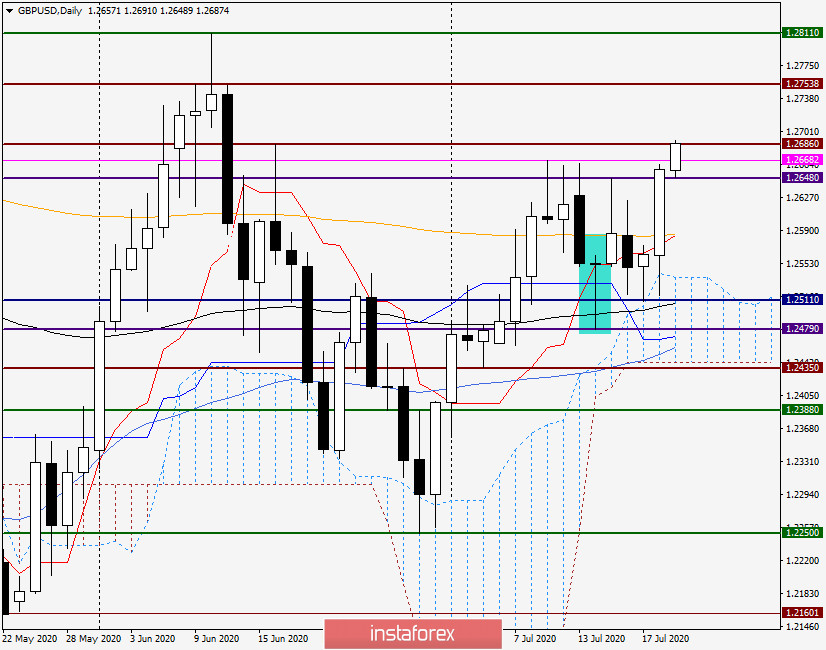

Daily

So, as a result of yesterday's strong growth, the pair broke through the nearest resistance at 1.2648 and closed the Monday session at 1.2658. However, the bulls have not yet solved all their tasks for the pound. Now they will continue to lift the rate and test for a breakdown of the sellers' resistance at 1.2668 and 1.2686. This is exactly what is happening at the moment of writing this article. The pound/dollar pair is trading near 1.2673 and shows a desire to continue moving in the north direction. If the mark 1.2686 is truly broken, the quote will go to the strong technical zone of 1.2700-1.2730, where its further direction will be decided.

If all the players' efforts to increase are futile and a reversal model of candle analysis appears on the daily chart, there is a probability of at least a corrective pullback to the previously broken levels.

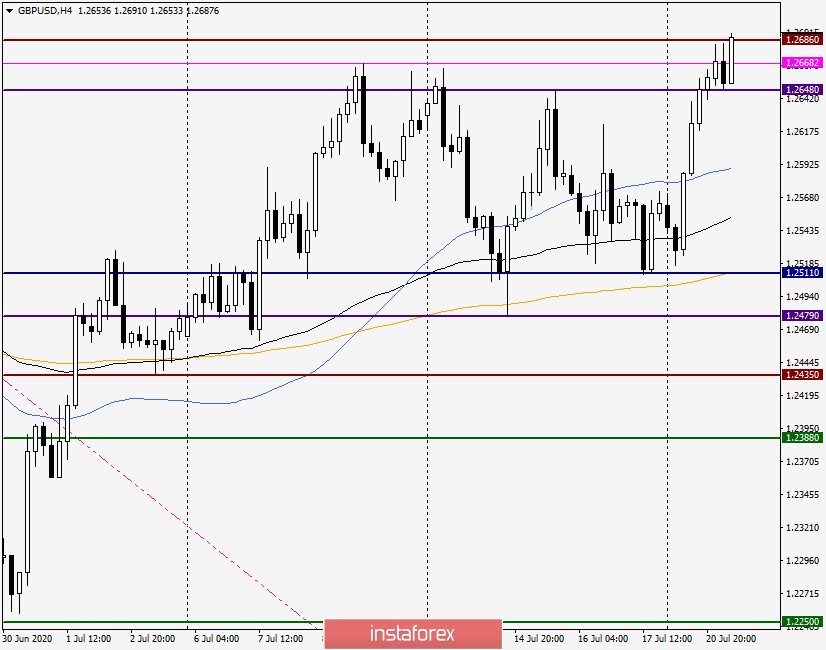

H4

The four-hour chart clearly shows how strong support for the price was provided by the 200 exponential moving average, colored in orange. In general, events develop quite rapidly, and the pound sterling at the moment of completion of this article is already testing the resistance of sellers at 1.2686 for a breakdown. If this level is broken and the pair is fixed above it, I recommend trying to buy on the rollback to the broken mark. A larger area for opening long ones can be defined as 1.2685-1.2650. The current situation for positioning in the pound/dollar pair is quite difficult. Although the pair is tearing up, I consider it risky to buy under the resistance of 1.2686 or at its breakdown. At the same time, it is not necessary to exclude the option in which the pound bulls will not fulfill their mission, as a result of which the four-hour and (or) hourly charts near 1.2686 will show reversal patterns of Japanese candles. If such a situation occurs, it is time to think about sales. We are looking for an option to open short positions at more favorable prices in the area of 1.2700-1.2730, however, it would also be nice to see reversal patterns of Japanese candlesticks in this area.

Good luck and big profits!