To open long positions on EURUSD, you need:

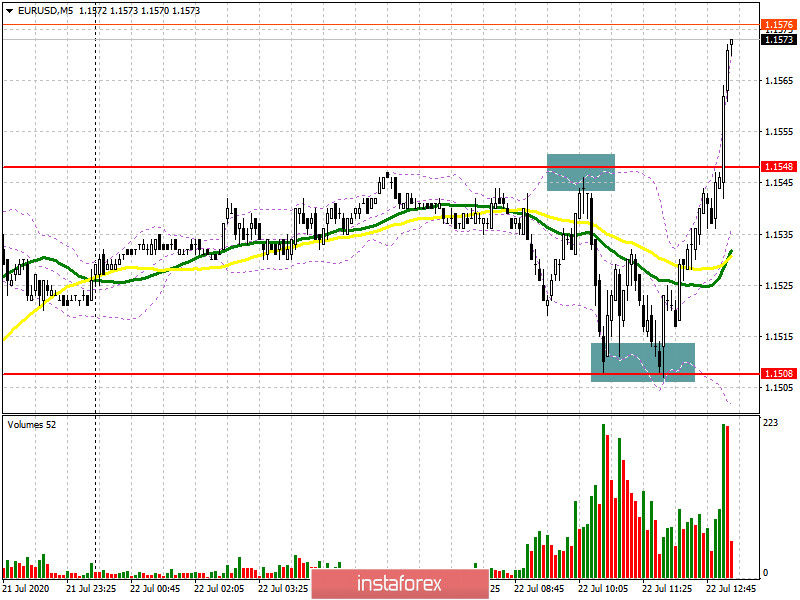

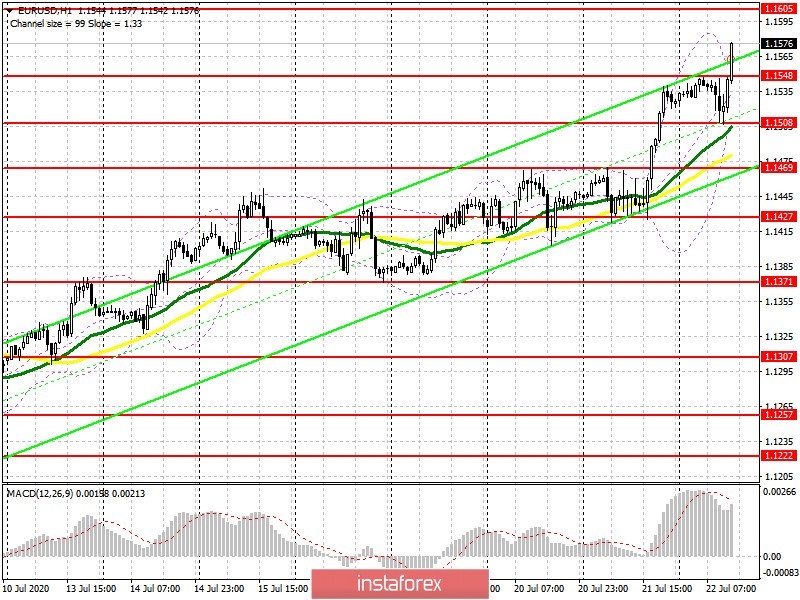

In my morning forecast, I paid attention to purchases of the European currency from the support level of 1.1508, which exactly happened. Let's look at the entry points in more detail. Given the lack of important fundamental statistics, traders took the downward correction in the pair as a call to action and continued to actively buy the euro after yesterday's news from the EU summit. If you look at the 5-minute chart, you will see that in the first half of the day there was a resistance test of 1.1548, however, it was quite risky to open short positions from there, since there was no false breakout, and going against a powerful bullish trend was not a good idea. More correct were purchasing from the support level of 1.1508, which was tested a little later in the European session. Moreover, the test was several times. It is from there that I recommended opening long positions in my morning review in the expectation of a break in the resistance of 1.1548, which is now happening in the market. The nearest target of the bulls is now the resistance of 1.1605, where small profit-taking may be noted. In the case of consolidation at this level, you can continue to buy euros in the expectation of updating the new highs of 1.1605 and 1.1648, where I recommend fixing the profits. In the afternoon, there will be a speech by the President of the European Central Bank, Christine Lagarde, which may cool the ardor of buyers a little. Therefore, in the case of a downward correction, you can open long positions from the level of 1.1548 only after a false breakout is formed there. Purchases on the rebound will now be relevant around the minimum of 1.1508, based on a rebound of 25-30 points within the day.

To open short positions on EURUSD, you need:

Bears are not in a hurry to return to such a powerful bull market and prefer to test the situation only after updating major local highs. At the moment, the task of sellers is to return EUR/USD to the support level of 1.1548, which was missed in the first half of the day. Only fixing below this range forms a bearish signal that can push the pair to the low of 1.1508. The longer-term goal is the area of 1.1469, where the moving averages also pass. They recommend fixing the profit. If the movement in EUR/USD continues along with the trend, it is best to consider new short positions only after the formation of a false breakout in the resistance area of 1.1605 or sell immediately on a rebound from the maximum of 1.1648, in the expectation that Christine Lagarde will make several negative statements about the prospects for the European economy and its recovery.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily moving averages, which indicates a continuation of the bullish trend.

Note: the Period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the General definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the upper limit of the indicator around 1.1575 will strengthen the demand for the euro. A breakdown of the lower border in the area of 1.1508 will lead to a larger sell-off of the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.