To open long positions on GBPUSD, you need:

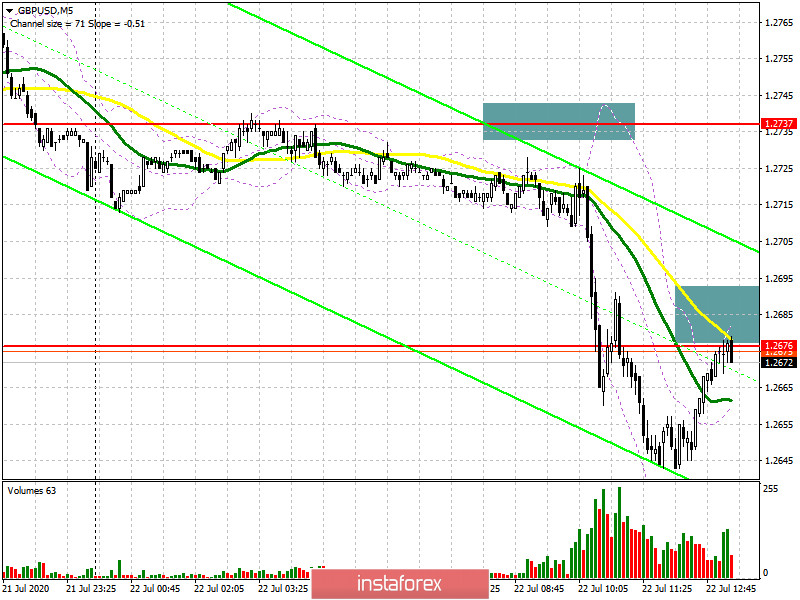

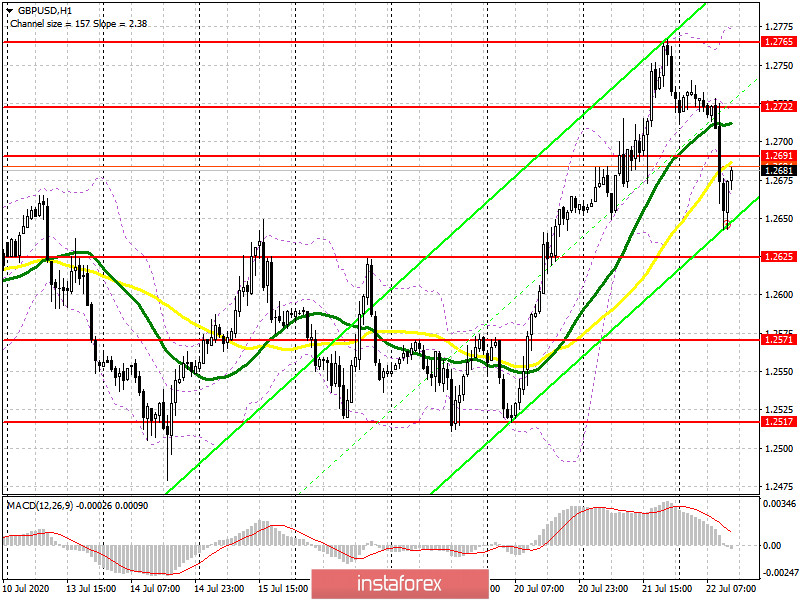

The morning formation for the sale of the British pound, which I spoke about in more detail in my forecast, successfully worked itself out. Unfortunately, if you look at the 5-minute chart, you will see that you could not wait for the formation of a signal to open short positions and a more convenient point to sell the pound. However, now the fight is being waged for the area of 1.2691, which will determine the future direction of the market. Buyers need to return to this range and only its top-down test on volume will be a signal to open long positions, counting on the continuation of the bull market, for which the morning fall will be considered only a technical correction. In this scenario, buyers will expect to update the resistance at 1.2722, where I recommend fixing the profits. A further target will be a weekly high of 1.2765. If the pressure on the pound persists in the second half of the day, it is best to consider new long positions after the formation of a false breakout in the support area of 1.2625 or buy GBP/USD immediately on the rebound from the minimum of 1.2571 in the calculation of a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need:

Sellers did a great job in the morning, however, I couldn't wait for a convenient point to enter the market, which I discussed in more detail in my morning forecast. At the moment, the main task of the bears is to protect the resistance of 1.2691, which was formed in the European session. You can open new short positions from there if a false breakout is formed in the expectation of a decrease in GBP/USD to a minimum of 1.2625, where I recommend fixing the profits. The longer-term goal of sellers remains support for 1.2571. Given that important statistics are not published today in the second half of the day, it is likely that the bulls will be able to regain the area of 1.2691. Therefore, it is possible to sell GBP/USD immediately on a rebound only from the morning high in the area of 1.2722 in the expectation of a decrease of 30-40 points by the end of the day.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 daily averages, which so far only indicates a technical correction of the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair grows in the second half of the day, the average border of the indicator around 1.2700 will act as a resistance, and you can sell the pound on a rebound from its upper border in the area of 1.2780.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.