The USD/JPY pair is rising higher after ending its temporary decline. The bias is bullish, so further growth is favored. DXY's current rebound and the yen's drop help the pair to resume its upward movement.

The Japanese banks will be closed on the occasion of the 4-day Bank Holiday. Fundamentally, the US dollar was expected to grow after the Fed announced that it would hike rates several times next year. It seems that the DXY was too overbought.

Yesterday, the US Unemployment Claims and the Chicago PMI reported better than expected data. The US dollar index continues to stay higher above the 96.00 psychological level. The yen could decline if its futures reach new lows.

USD/JPY Targeting New Highs

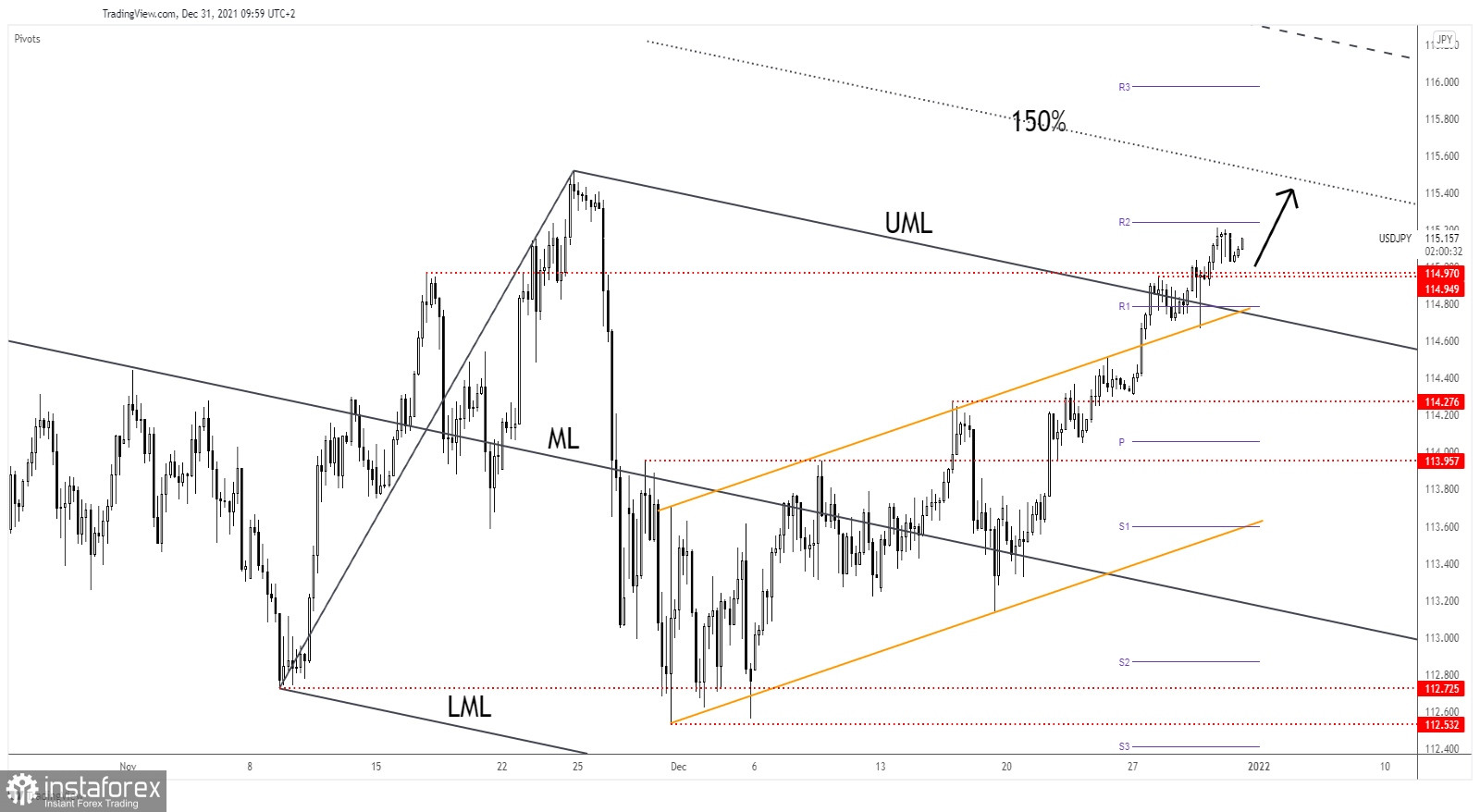

USD/JPY failed to reach and retest the 114.97 and 114.94 downside obstacles signaling strong upside pressure. As long as it stays above these support levels, the bias remains bullish and the rate could still approach and reach the weekly R2 115.24. Also, the 150% Fibonacci line is seen as an important upside target after validating its breakout above the descending pitchfork's upper median line (UML). The false breakdown with great separation below the upper median line (UML) and through the weekly R1 (114.78) confirmed strong buyers.

USD/JPYForecast!

As long as it stays above 114.97, USD/JPY could extend its upwards movement towards fresh new highs and upside targets. A minor consolidation above this level may offer new long opportunities. Jumping and closing above the 115.21 yesterday's high activates a sharp growth.

The upside scenario could be invalidated if the USD/JPY drops and closes below 114.70.