When does dollar rise? There are many factors that drive its rate up, but all those are actually based on one thing - when the US economy surpasses its global counterpart. Under that circumstance, money flows like a river to the United States and the Fed tightens monetary policy. This was what happened this year, when the USD index gained more than 5%, which was its best result since 2015.

Early this year, the OECD forecasted global GDP to grow 4.2% in 2021, after a 4.2% contraction in 2020. But the recession turned out to be less deep (-3.4%), and the recovery was faster than expected (+ 5.6% ). US GDP was also projected to expand by 5.6%, higher than the forecast a year ago - 3.2%.

The US clearly outperformed the rest of the world, prompting massive inflow to dollar and the stock market. Accordingly, the S&P 500 made 70 record highs and gained 27%. Meanwhile, the indices of developing countries dipped by 5%, and the rate of currencies paired with dollar fell to the lowest level since 2006.

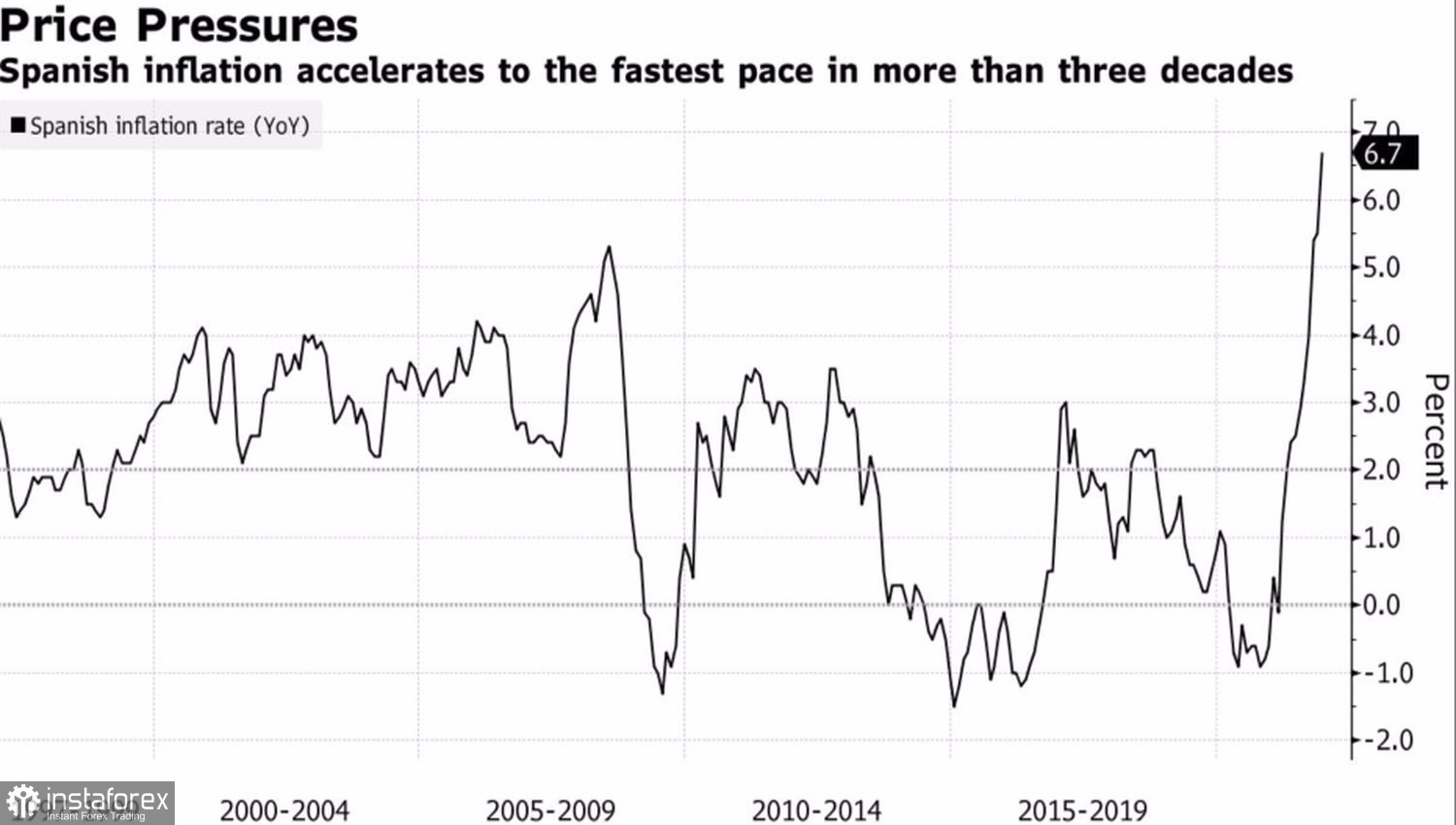

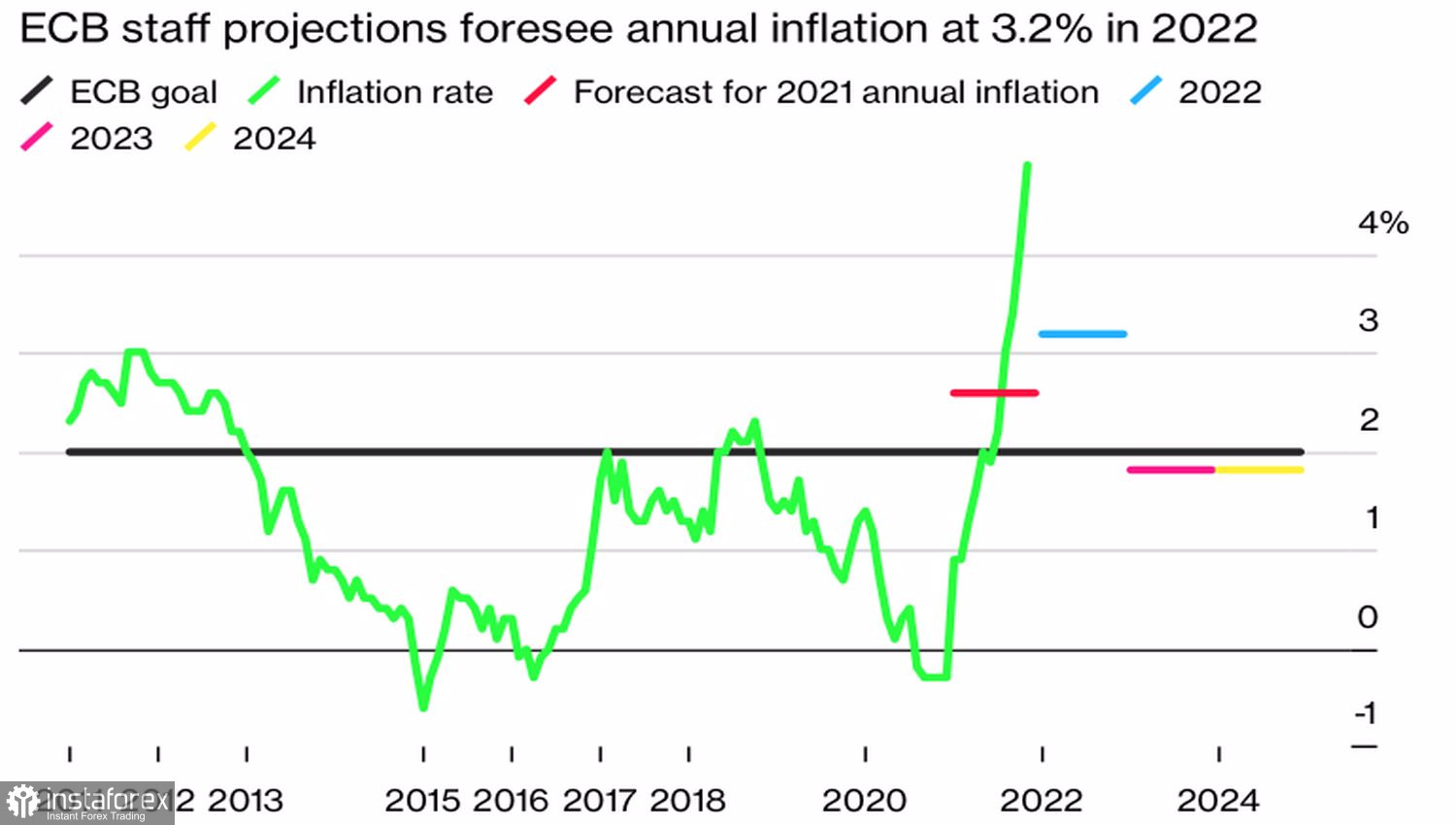

A strong economy, inflation accelerated to the highest levels in almost 40 years and the rapid recovery of the labor market give the Fed grounds to raise interest rates. Expectations of hikes in 2022 at three FOMC meetings boosted demand for dollar, but the USD index usually grows 6-9 months before the first act of monetary restriction, and then begins to show mixed dynamics, as it was in 2015-2016. The reason is that the Fed is the leader of the pack, followed by everyone else, including the ECB, which intends to raise rates in 2023. Heads of the central banks of the Netherlands and Australia, Klaas Knot and Robert Holtzman, spoke about this , along with the acceleration of inflation in Spain and the confident pace of consumer prices in the eurozone.

Inflation in Spain

Inflation forecasts from the ECB

If the European Central Bank gets rid of QE in late 2022 and starts raising rates in early 2023, demand for euro will soar next summer. It can also be supported by Emmanuel Macron's victory in the presidential elections in France, as well as the acceleration of the eurozone GDP in the second quarter.

Dollar, on the other hand, will experience difficulties if capital gets out of the US stock market amid accelerating economic growth in developing countries. But this will occur only in late 2022.

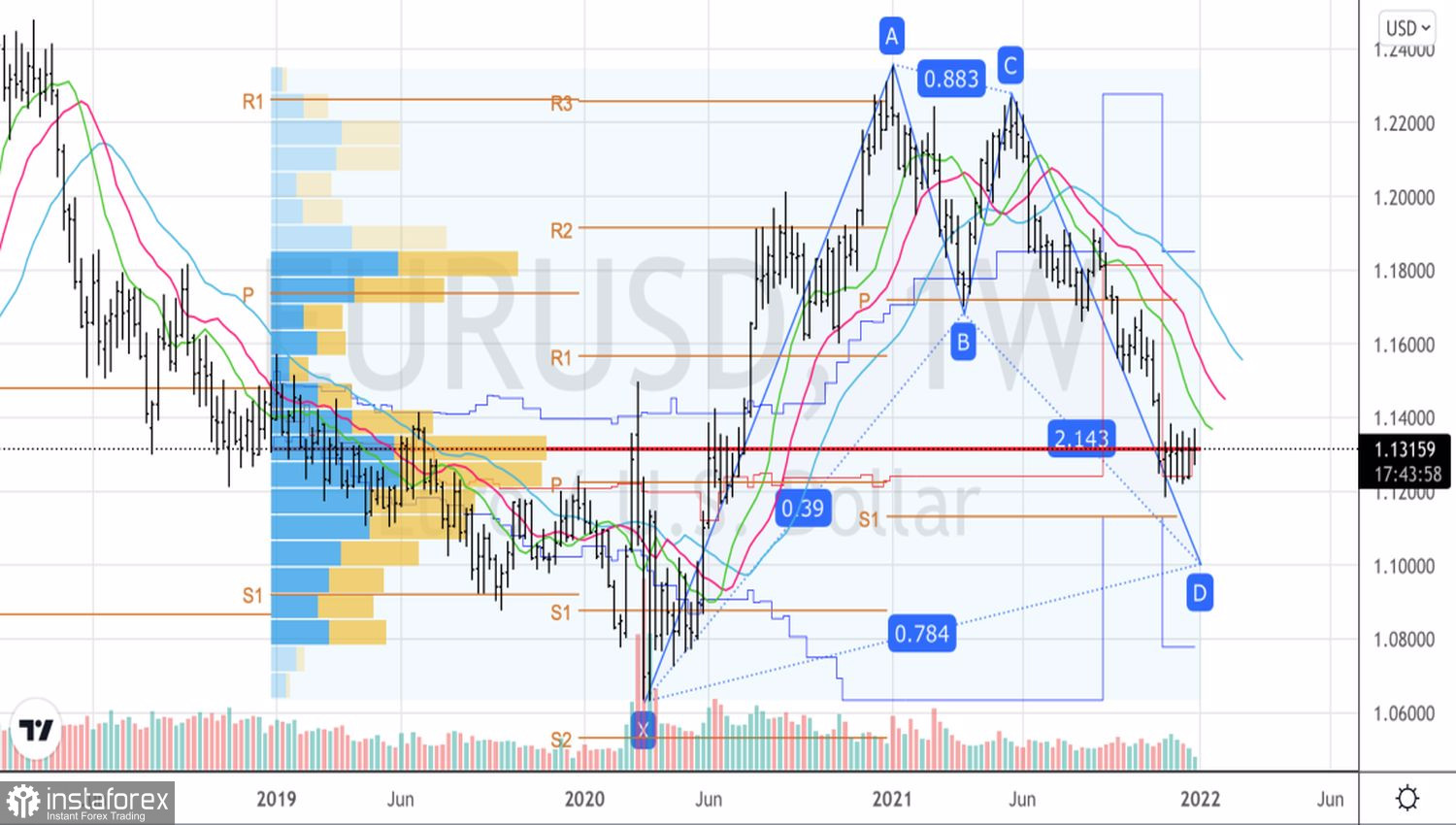

Technically, the breakout of 1.123-1.137 will allow bears to continue their decline to 1.113 and 78.6%, according to the Gartley pattern. After that, EUR/USD will rise.

EUR/USD, weekly chart