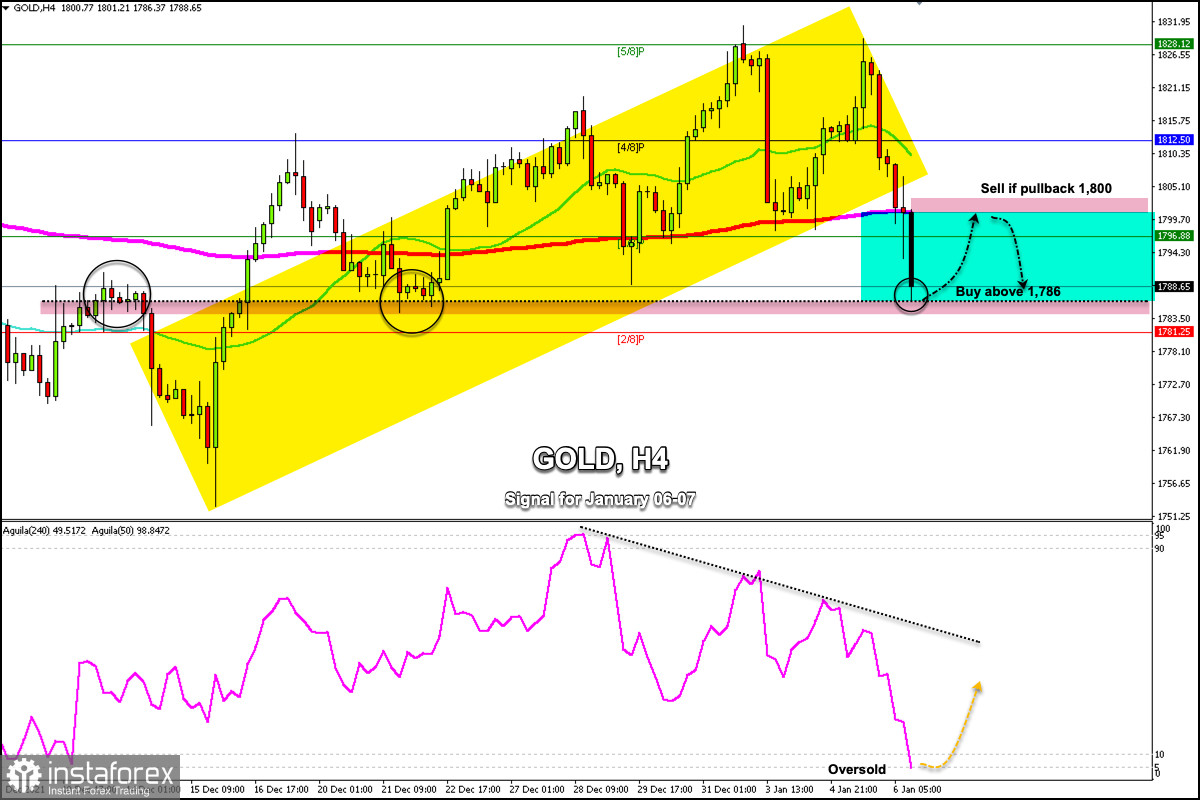

Since its high yesterday at 1,828 (5/8), gold has fallen below the SMA of 21 and below the EMA 200. As the price of gold has settled below these two moving averages, the outlook has changed to negative. A pullback to the psychological level of 1,800 would be an opportunity to sell.

In less than 24 hours, gold has lost $ 40 compared to yesterday's price. This decline and weakness of the precious metal is due in part to the rally in US yields. Yields of benchmark 10-year Treasuries are above the 1.70% key mark.

Another factor that contributed to the weakness of gold was the US dollar's strength. The US dollar perked up after the announcement of the FOMC minutes in which officials revealed that they are prepared to respond to the soaring inflation by raising interest rates as soon as possible.

The Fed's aggressive outlook boosted Treasury yields and in turn raised demand for the US dollar. Consequently, gold lost its safe-haven appeal and fell towards the support level of 1,786.37.

According to the 4-hour chart, we can see that gold is trading around 1,788. This area on previous occasions has acted as strong support, further down is a support located at 1,781 that represents the pivot point of 2/8 Murray.

The eagle indicator has reached the 5-point zone which represents the extremely oversold market. In the next few hours, a technical correction could occur and we could have the opportunity to buy above 1,781 or above 1,786 with targets at 1,796 and 1,800.

Support and Resistance Levels for January 06 - 07, 2022

Resistance (3) 1,804

Resistance (2) 1,800

Resistance (1) 1,794

----------------------------

Support (1) 1,781

Support (2) 1,765

Support (3) 1,750

***********************************************************

Scenario

Timeframe 4-hours

Recommendation: buy above

Entry Point 1,786

Take Profit 1,796 (3/8), 1,800 (200 EMA)

Stop Loss 1,780

Murray Levels 1,812 (4/8), 1,828 (5/8)

***********************************************************

Alternative scenario

Recommendation: Sell if pullback

Entry Point 1,800

Take Profit 1,890, 1,781 (2/8)

Stop Loss 1,806

Murray Levels 1,781 (2/8) 1,765 (1/8)

*********************************************************