US stock index futures witnessed volatile trading on Wednesday even as European stocks plummeted amid a spike of sovereign bond yields as investors digested the Federal Reserve's plan to accelerate the tightening of its monetary policy.

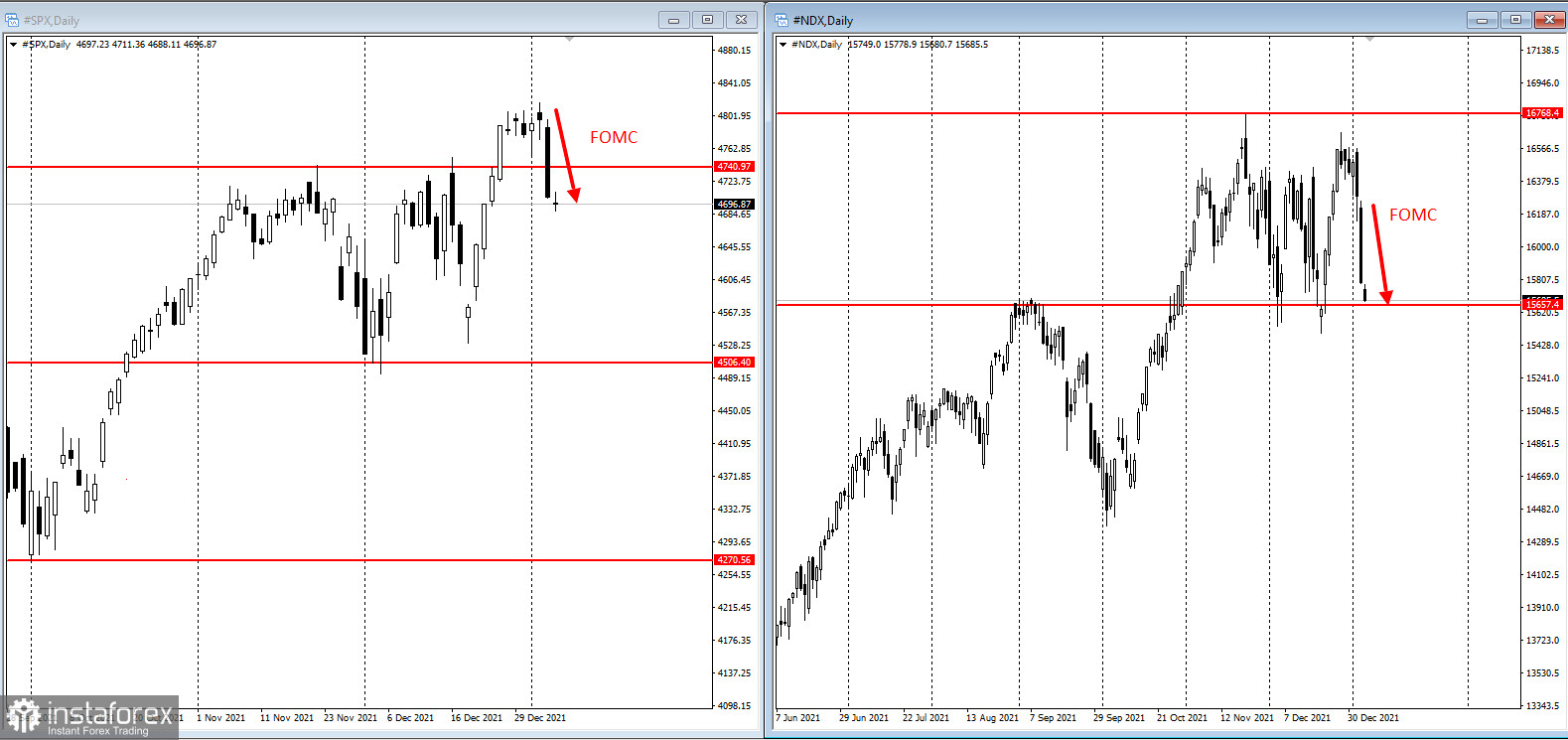

Contracts for the high-tech Nasdaq 100 index dropped by 0.4%, extending the previous fall of 0.9%. S&P 500 Index futures lost 0.2% after falling by 0.5% earlier in the session. Treasury yields rose for most maturities with a regular gap of three basis points between 2-year and 30-year yields. In the meantime, the US dollar advanced.

Currently, the Fed has become the center of the investment outlook for 2022, overriding other concerns regarding the pandemic and China's regulatory crackdown. Minutes from the Fed's December meeting confirmed the view of the central bank officials that economic recovery and higher inflation could lead to faster rate hikes and a tighter balance sheet.

Some investors, however, expected the stock markets to withstand the turbulence.

"At current levels, we do not think that higher (real) yields are a game-changer for global equity markets," Mathieu Racheter, the head of the equity strategy at Julius Baer, wrote. "As for the market dynamic, there may be a shift from long-term equities that were among the most profitable ones in 2021 towards more economically sensitive sectors," he added.

On Wednesday, the Nasdaq 100 fell the hardest since March.

Carol Shleif, the Deputy Chief Investment Officer at BMO Family Office, said, "We're preparing people for volatility. We had another record double-digit year, and yet investors' mood is pretty gloomy. We definitely think that the readjustment of volatility will increase this year because there is still a lot to be dealt with."

Next in the spotlight will be the US jobs data for December that is due to be released on Friday.

According to senior analyst Jeffrey Halley, "markets have been nervous about inflation all week as the reality of the Fed's tightening looks beyond the horizon. The start of monetary normalization will make price movements a lot more "honest" than in the past 18 months."

Meanwhile, some countries re-impose restrictions in the face of surging Omicron cases. Hong Kong reintroduced social restrictions and stopped flights from eight countries. Tokyo raised its alert level after reporting nearly 400 new cases in one day. China has introduced new restrictions on people leaving the US as cases grow there as well.

Key events of the week:

- St. Louis Fed's Bullard discusses the US economy and monetary policy on Thursday.

- Fed's Mary C. Daly discusses monetary policy on Friday.

- Schnabel from the ECB speaks on Saturday.