Investors are waiting for data on the US non-farm payroll. This data could have a significant impact on how markets assimilate the monetary policy outlook of the Fed. In the medium term, it could be negative for the British pound.

The FOMC Minutes revealed that current economic conditions such as the inflation outlook and the state of the labor market were considered factors that would allow a termination of the bond purchase program and 2 to 4 increases of the interest rate this year.

Without a doubt, the currencies that operate against the dollar will be affected by this Fed's agenda. We could expect the US dollar to strengthen in the medium term which will allow traders to look for opportunities to sell the euro, the pound and other currencies.

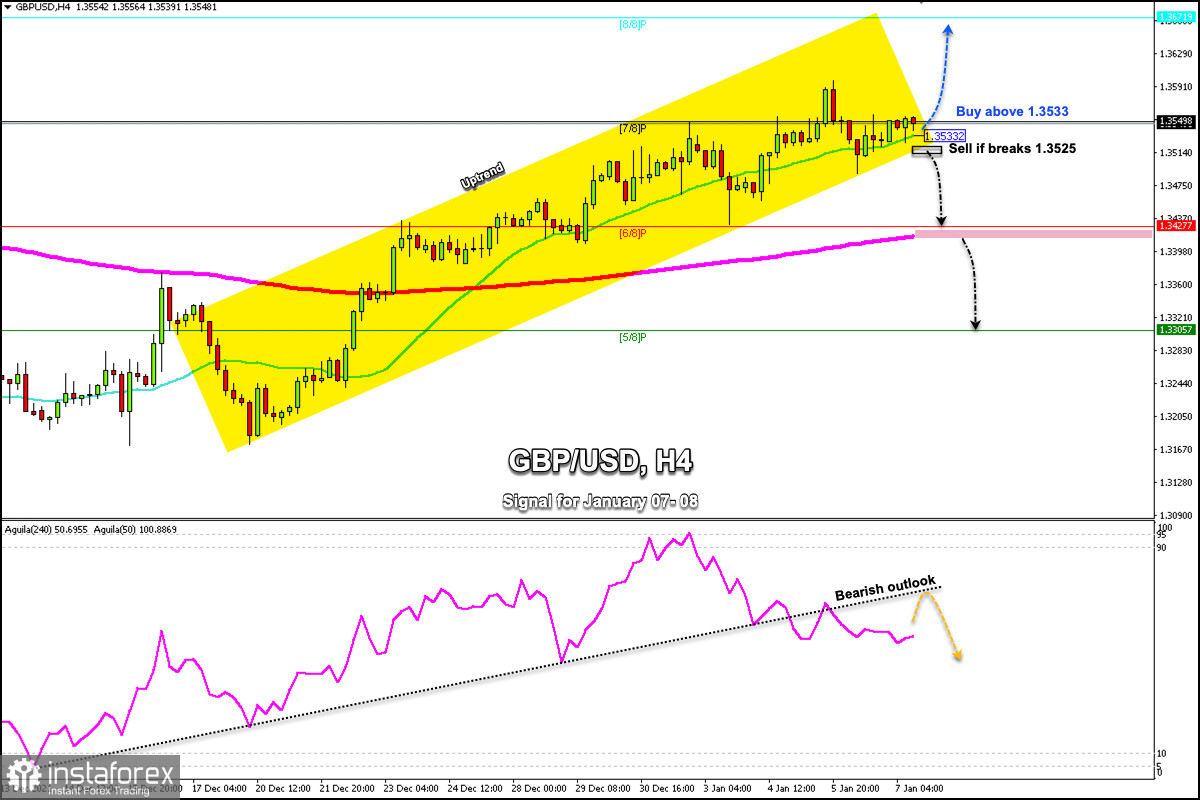

The British pound is trading above the 21 SMA located at 1.3533. The main trend formed since December 17 is still bullish and the pound is inside. There are no signs of a bearish signal, however a decline could occur if it breaks down and consolidates on the 4-hour chart below the 21 SMA around 1.3525.

Since December 13, the eagle indicator has been giving a positive signal. However, now we can see in the chart that this trend channel has been broken. The outlook could be bearish as volume is low and market strength is waning.

We can buy the pound as it remains above 1.35 30, targeting 1.36 and towards the strong resistance level at 8/8 Murray at 1.36 71.

On the contrary, we can sell if the pound trades below 1.3525, with short-term targets at 1.3480. The eagle indicator supports our bearish strategy.

Support and Resistance Levels for January 07 - 10, 2022

Resistance (3) 1.3631

Resistance (2) 1.3595

Resistance (1) 1.3564

----------------------------

Support (1) 1.3527

Support (2) 1.3487

Support (3) 1.3458

***********************************************************

Scenario

Timeframe 4-hours

Recommendation: buy above

Entry Point 1.3533

Take Profit 1.3595, 1.3671 (8/8)

Stop Loss 1.3490

Murray Levels 1.3549 (7/8), 1.3671 (8/8)

***********************************************************

Alternative scenario

Recommendation: Sell if breaks

Entry Point 1.3525

Take Profit 1.3427 (6/8), 1.3400 (200 EMA)

Stop Loss 1.3562

Murray Levels 1.3427 (6/8) 1.3305 (5/8)

*********************************************************