Based on the ADP report on Wednesday, the number of jobs in the private sector in December in the United States increased by 807,000 (against the forecast of +400,000 and the previous value of +505,000). "The labor market continued to recover last month, despite all the difficulties," ADP commented.

These are very strong indicators, indicating the continued improvement in the state of the labor market and the U.S. economy. They may strengthen the tendency of Fed leaders to raise interest rates earlier. According to the minutes of the Fed's December meeting released on Wednesday, Central Bank leaders may decide to raise rates as early as March.

The strong ADP figures allow us to hope for an equally strong report from the U.S. Department of Labor: economists expect an increase in the number of jobs by 400,000 (against +210,000 in November and +531,000 in October) and a decrease in the unemployment rate to 4.1% (from 4.2% in November and 4.6% in October).

The dollar may receive additional support by reacting to the publication of strong macroeconomic statistics, which may indicate in favor of the decision on a more rapid tightening of monetary policy by the Fed. The upward momentum of the dollar intensified in December after the speech of Fed Chairman Jerome Powell in Congress.

Powell acknowledged that inflation in the U.S. should no longer be considered a temporary phenomenon, and more active actions by the Fed will probably be required to tame its further growth. Thus, he considers it necessary to accelerate QE tapering.

If the Labor Department report is also as strong as the ADP report, it will further strengthen the market participants' opinion that a more aggressive cycle of interest rate hikes in the U.S. should be expected, which is a strong upward factor for the dollar.

Meanwhile, unemployment has risen in Canada in recent months, including amid massive business closures due to coronavirus and layoffs. Unemployment rose from the usual 5.6% - 5.7% to 7.8% in March and already up to 13.7% in May 2020. If unemployment continues to rise, the Canadian dollar will decline. If the data is better than the previous value, the Canadian dollar will strengthen. A decrease in the unemployment rate is a positive factor for CAD, an increase in unemployment is a negative factor.

In August, unemployment was at 7.1%, and in November at 6.0% (versus 7.5% in July, 7.8% in June, 8.2% in May, 8.1% in April). According to the forecast, it is expected that unemployment in Canada in December remained at the same level of 6.0%, and the number of employed increased by another 27.5k. This is moderately positive data for CAD, whose quotes may grow supported by renewed growth in oil prices.

Canada is the largest exporter of oil, and the share of oil and oil products in the country's exports is approximately 22%. Despite some uncertainty in the oil market due to the coronavirus, many leading economists predict a further increase in energy prices (coal, gas, oil), including due to expectations of a cold winter and rush demand in the gas market.

Thus, at 10:30 UTC, a sharp increase in volatility is expected in the financial markets, especially in the USD/CAD pair. If the official data of the U.S. Department of Labor turns out to be disappointing, then we should expect a weakening of the U.S. dollar and a decline in USD/CAD.

Technical analysis and trading recommendations

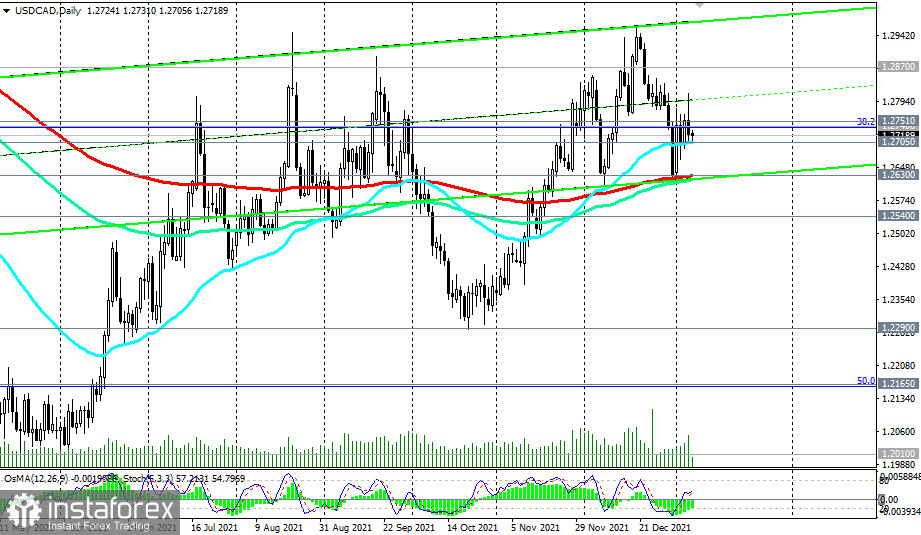

Since the beginning of November, USD/CAD has been developing upward dynamics against the background of the strengthening of the U.S. dollar due to the increased likelihood of an imminent increase in the Fed interest rate.

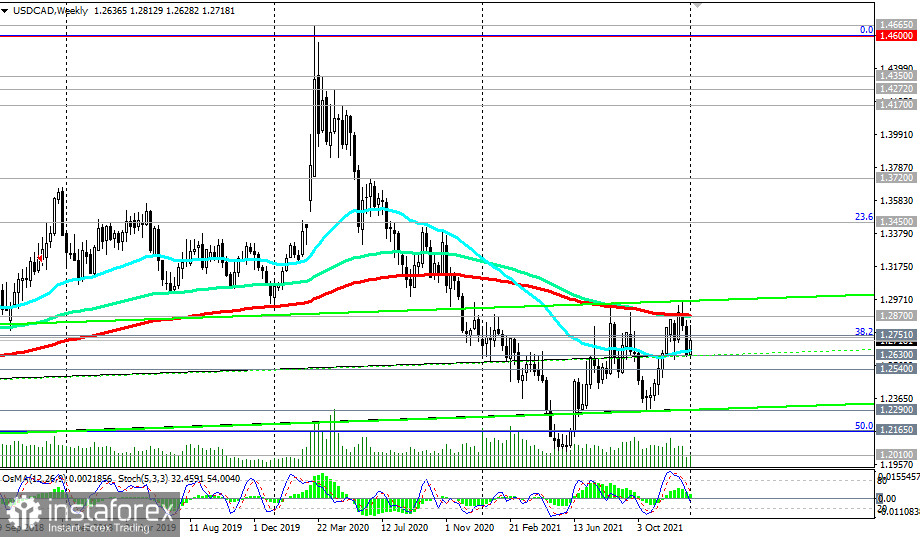

The pair is trading above the important long-term support level 1.2630 (200 EMA on the daily chart). A breakdown of the key resistance level 1.2870 (200 EMA on the weekly chart) will mean the final completion of the downward correction and the return of USD/CAD to the zone of the long-term bull market.

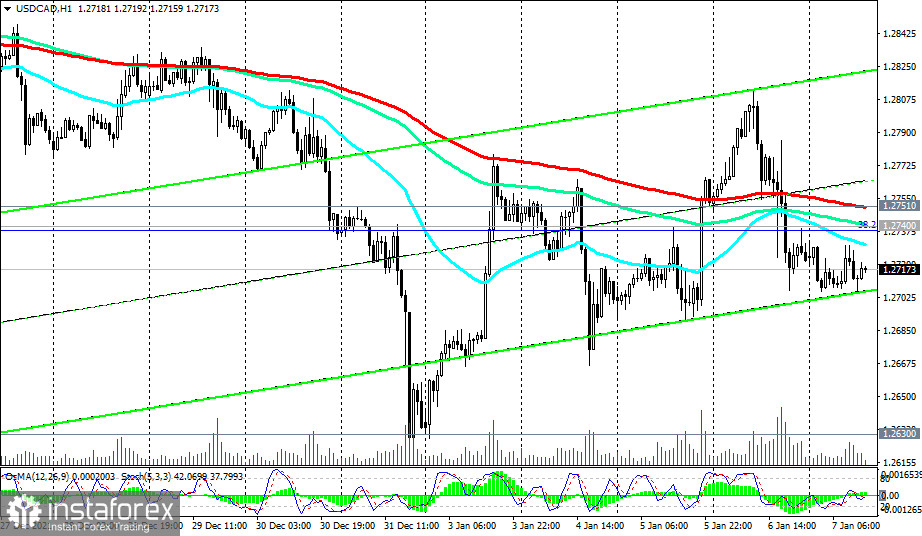

Alternatively, the USD/CAD will resume decline, and the first signals for the implementation of this scenario have already been received: the price broke through two important support levels - 1.2751 (200 EMA on the 1-hour chart), 1.2740 (200 EMA on the 4-hour chart and 38.2% Fibonacci level of the downward correction in the wave of USD/CAD growth from 0.9700 to 1.4600).

A breakdown of the key support level 1.2540 (200 EMA on the monthly chart) will mean a return of USD/CAD to the bear market zone.

Support levels: 1. 2705 1.2630, 1.2540, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2740, 1.2751, 1.2870, 1.2900

Trading scenarios

Sell Stop 1.2685. Stop-Loss 1.2760. Take-Profit 1.2630, 1.2540, 1.2290, 1.2165, 1.2010

Buy Stop 1.2760. Stop-Loss 1.2685. Take-Profit 1.2870, 1.2900, 1.3000, 1.3200