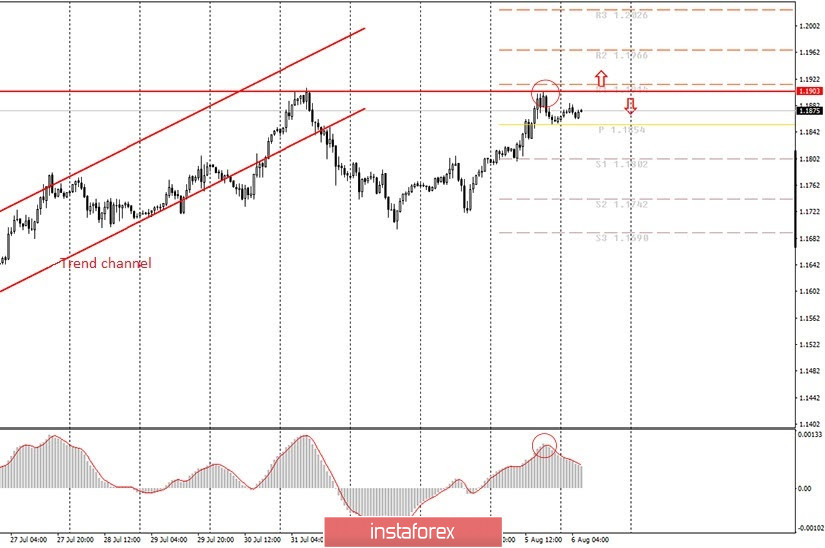

Hourly chart of the EUR/USD pair

The EUR/USD pair made no attempt to resume its downward movement during the past trading day. We expected a rebound from the 61.8% or 76.4% Fibonacci levels, but instead the upward movement continued, which ended almost near the July 31 high. Therefore, at this point, we can even conclude that the option for a downward movement has been canceled. However, oddly enough, this isn't the case. The downward movement is still almost the main option, since the pair will try to turn around near the July 31 high at 1.1909. Formally, a Double Top pattern can even form (a pattern with two almost identical peaks, after which a downward trend begins). Thus, now, as long as the price does not confidently break the 1.1909 level, we still believe that the option for the pair's fall is working.

From a fundamental point of view, the recent events on the currency market do not fit into any picture for the EUR/USD pair. We have already said that the euro cannot grow forever on the news of the coronavirus epidemic in the United States. Yesterday, the single currency began to strengthen during the night, so all the macroeconomic data that were published during the day did not have much impact on the pair's movement. Of course, we can assume that a very weak ADP report, which reflects how the number of workers in the US private sector has changed (the opposite indicator of unemployment), caused new sales of the dollar, but how can we explain the lack of reaction of traders to the ISM business activity index, marked red in all news calendars, which means a high degree of significance? Thus, we are still inclined to the option that the reasons for the euro's growth on August 3 and 4 do not depend on fundamental factors. Important news was not expected from either the US or the European Union on August 5. Technical factors are much more significant for the pair, namely overcoming or not overcoming the 1,1909 level. If it is overcome, then it will be possible to think about other fundamental events that can support the euro.

The following scenarios are possible on August 6:

1) Purchases are no longer relevant, as the price has left the ascending channel. However, since the euro grew in the last two days, it is possible for the upward trend to resume. Therefore, we recommend novice traders to buy the euro if the price closes at the end of the next hour above the 1.1903 line, which passes through the last two highs. The targets in this case will be the resistance levels of 1.1966 and 1.2026.

2) Selling the currency pair is still more promising now. The price failed to overcome the 1.1903 level, and the MACD indicator turned down (shown by red circles in the illustration), so we already have a sell signal with targets at 1.1802 and 1.1742. Stop Loss order can be placed above the 1.1903 level.

What's on the chart:

Support and Resistance Price Levels - Levels that are targets when buying or selling. You can place Take Profit levels near them.

Red lines - channels or trend lines that display the current trend and show which direction it is preferable to trade now.

Arrows up/down - indicate when you reach or overcome which obstacles you should trade up or down.

MACD indicator is a histogram and a signal line, the crossing of which is a signal to enter the market. It is recommended to use in combination with trend lines (channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.