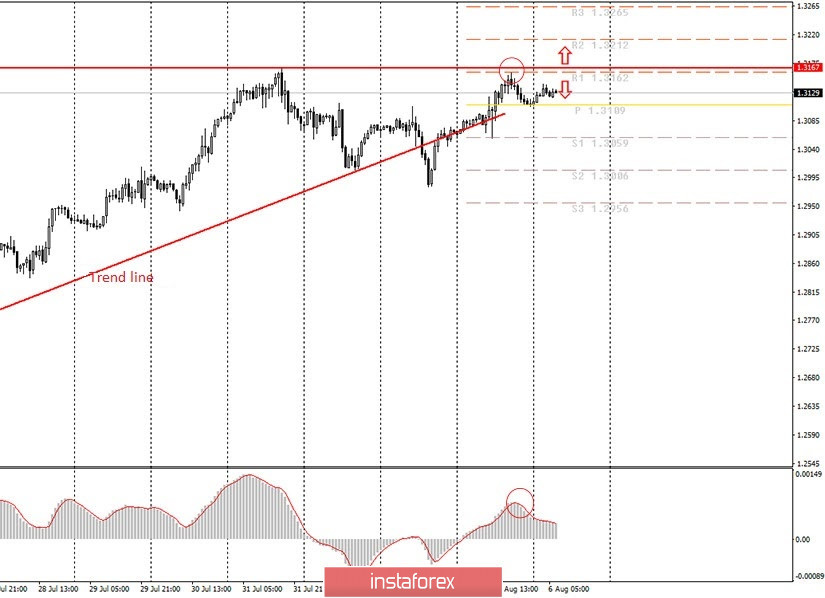

Hourly chart of the GBP/USD pair

The technical picture continues to get confusing for the GBP/USD pair. After the quotes broke the upward trend line, everything spoke in favor of the fact that a new downward trend would begin. Following a series of upward corrections, we expected a downward turn around the 1.3100 level yesterday morning. However, instead, the British pound continued to appreciate as planned. The most interesting thing is that the current situation for the pound is very similar to the euro's situation. Despite the pair's growth in the last two days, a new downward trend is still the most likely option. And this will continue to be the main option until the price overcomes the July 31 high at 1.3169. The pair stopped its growth from the day before around this level.

Today is a very important day for the British currency since the Bank of England (BoE) is set to hold its meeting – the central bank of Great Britain. We remind novice traders that there are only eight such meetings during the year. And each is potentially very important, since the central bank can change certain parameters of monetary policy that affect the entire economy and financial system of the country. At the moment, the BoE key rate is equal to 0.1% - that is, it is at the lowest value. The volume of bond purchases from the open market is 745 billion pounds (quantitative stimulus program). These are two key parameters of monetary policy and traders do not expect any of them to change tomorrow. Thus, we believe that the pound has an excellent chance of falling tomorrow if: 1) the BoE eases monetary policy (lowers the key rate or increases the volume of assets to be repurchased); 2) if the BoE notes a deterioration in the economic situation, it will worsen its GDP forecasts for the next year or two; 3) if BoE Governor Andrew Bailey hints of easing monetary policy during his press conference. If nothing like this happens, this event will have a very indirect impact on the course of trading. At the same time, most traders can begin to work with their assumptions about what actions the BoE can take and what Bailey can say. Therefore, in the morning, the pound/dollar pair can be traded in accordance with the expectations of most traders. We still believe that it is more likely that the pound will fall.

The following scenarios are possible on August 6:

1) Despite the fact that the pound/dollar pair resumed its upward movement, we believe that buying near five-month highs is not the right thing to do. Nevertheless, if the price manages to close for an hour above the 1.3167 level, which passes through the last two price peaks, it will be a signal for new small purchases with targets at 1.3212 and 1.3265.

2) Selling, from our point of view, can already be considered, since the pair rebounded off the resistance level of 1.3162, and the MACD indicator turned down (marked with circles on the chart). Stop Loss order can be placed above the 1.3167 level in case traders ignore the BoE meeting today, all potential bad news from it, or if it presents any pleasant surprise.

What's on the chart:

Support and Resistance Price Levels - Levels that are targets when buying or selling. You can place Take Profit levels near them.

Red lines - channels or trend lines that display the current trend and show which direction it is preferable to trade now.

Arrows up/down - indicate when you reach or overcome which obstacles you should trade up or down.

MACD indicator is a histogram and a signal line, the crossing of which is a signal to enter the market. It is recommended to use in combination with trend lines (channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.