The Australian dollar is still trading flat against the US dollar, stuck within the 71st figure. The AUD/USD pair cannot break out of the 100-point price range for the third week, although buyers attempted to storm the 72nd price level, and sellers tried to pull the price below the 0.7100 mark. But in the end, the pair returned to the "parity level", that is, in the area of the 71st figure. The main problem is the lack of character of both the US dollar and the aussie. The dollar index is similarly stuck within the 93rd figure, locally reacting to certain fundamental factors. AUD/USD traders are ready to follow the Australian dollar due to the absence of a pronounced trend of the US dollar – but the aussie also is also showing sluggishness, not only against the greenback, but also in many cross-pairs. The contradictory fundamental background does not make it possible for investors to make a clear choice in favor of a particular currency. And today's data on the growth of the Australian labor market also did not help with the choice.

At first glance, today's release is positive: almost all of its components were released in the green zone, exceeding the forecast values. But with more detailed study, it becomes clear why traders cooly received this release. Unfortunately, the Australian labor market continues to show weakness and unevenness, and this fact may become a cause for concern on the part of members of the Australian central bank.

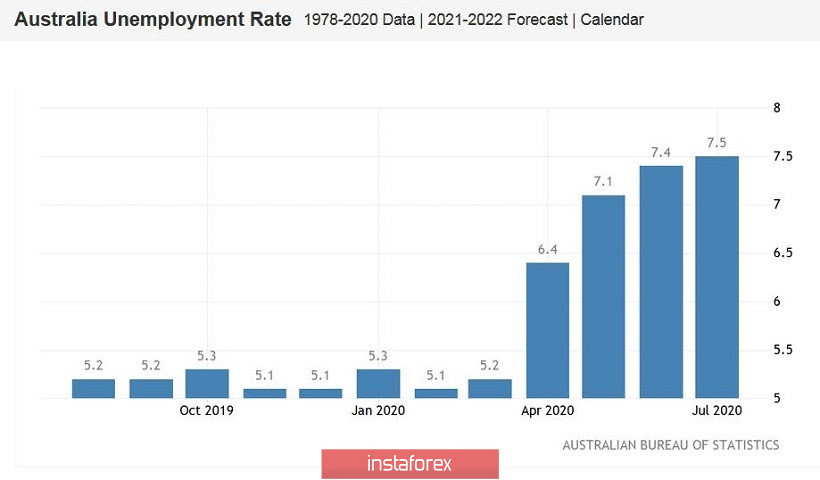

The unemployment rate came out with an indicator of 7.5%. This result is stronger than the pessimistic expectations of most experts (they predicted growth of up to 7.8%). But first, de facto unemployment is still rising, not falling. Secondly, it should be noted that the figures did not reflect the situation that has developed in the state of Victoria. Australian authorities imposed a quarantine there only in late July, gradually tightening restrictive measures until the introduction of a curfew in five million people in Melbourne. Whereas today's release covers the period up to the middle of the previous month. All this suggests that the next Australian Nonfarm report should be worse, since the country's largest state, where more than six million residents live, has actually been closed for quarantine.

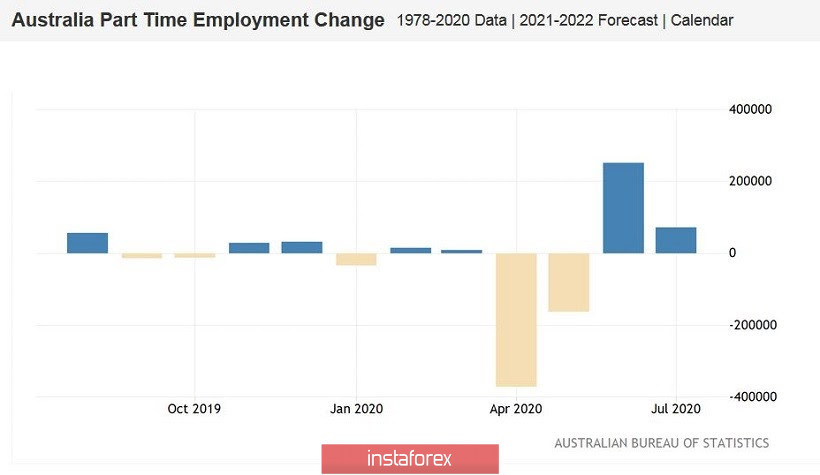

Now let's look at the structure of another indicator - the increase in the number of employees. There is a really strong dynamic here: the indicator grew by 114,000 instead of the predicted 30,000. But again, the structure of the indicator suggests that the growth was primarily due to part-time employment. While full employment showed a more modest result (a ratio of 71/43). Reports of the Reserve Bank of Australia have repeatedly pointed out that full-time positions tend to offer higher wages and a higher level of social security compared to temporary part-time jobs. Therefore, the current dynamics are unlikely to please members of the Australian central bank. Although the situation was even worse in the previous month: the indicator of full employment has gone "deep into the negative" with the rapid growth of part-time employment.

Given such unevenness in the labor market, it is not surprising that today's release on the index of inflation expectations came out in the red zone. This is a good indicator of the current mood of Australians in relation to inflation, showing a high correlation with official reports. And today's figures made it clear that the consumer activity of residents is still at a low level due to general uncertainty about the future. All this suggests that weak inflation growth will be another problem for the RBA and, accordingly, for the Australian dollar.

Let me remind you that, according to the latest data, the consumer price index collapsed into negative territory in the second quarter - for the first time since spring 2016. The indicator came out at around -1.9%. The indicator also fell below zero in annual terms, reaching -0.3%. It is worth noting here that the coronavirus crisis was at its peak in April (and partly May): Australia was quarantined, and the country only began to gradually weaken the lockdown at the end of spring. Therefore, inflationary forecasts were of a corresponding nature. But the coronavirus is not willing to let go of Australia, which is why the recovery process is so slow and ambiguous. For example, the other day Australian Prime Minister Scott Morrison said that his country is unlikely to open its internal borders before Christmas, given the next surge in the incidence. At the same time, the state of Victoria is still on "strict self-isolation", which will last at least until September 13. And many experts are confident that the authorities will extend this period for another month.

Thus, the uncertain position of the Australian dollar is understandable. The July data on the Australian labor market left more questions than answers, so it could not become a catalyst for the aussie's growth. Therefore, for the AUD/USD pair, it is possible to continue to adhere to a sales strategy with a rise to the ceiling of the 0.7100-0.7200 price range. And vice versa - consider buying when the price approaches the lower border of the price band.