Good day, dear traders!

Despite yesterday's data on UK GDP, which showed a record drop of 20.4% over the past eleven years, the indicator was slightly better than forecasts, which were reduced to a weakening of the British economy by 20.5%. However, it is worth noting that such disappointing GDP statistics appeared in the period from April to June, that is, during the peak of the COVID-19 pandemic and the introduction of strict restrictions. But data for June showed some recovery in the United Kingdom economy and showed GDP growth of 8.7%, although the consensus forecast assumed an increase in June GDP of only 8%. This factor was perceived by market participants quite optimistically and allowed the GBP/USD pair to avoid more significant losses. Nevertheless, the decline in UK GDP over the last two quarters demonstrated a technical recession, which was the fault of the ill-fated COVID-19. Now the main question is: how long will the economic recovery take?

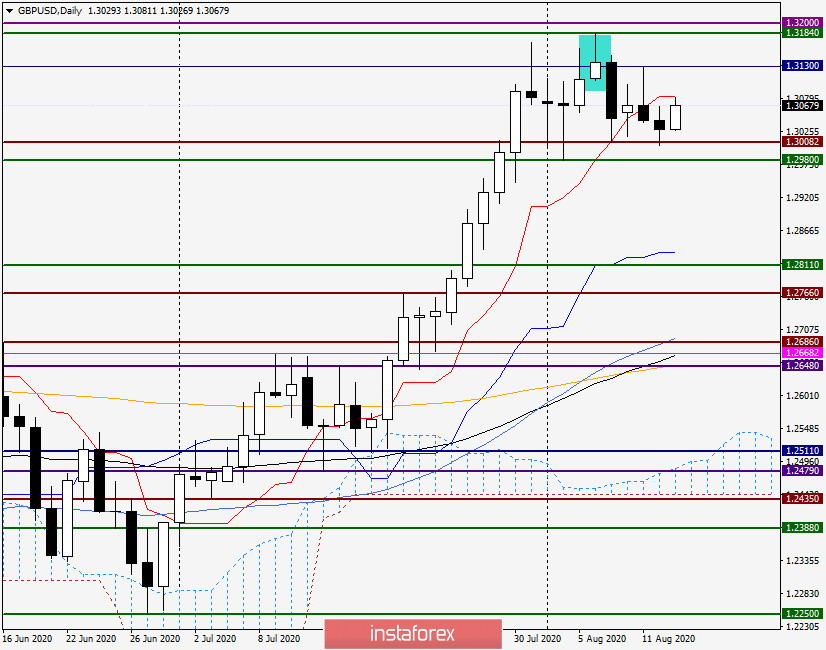

Daily

It was due to the supposed optimism associated with the June data on UK GDP, as well as the weakness of the US dollar against other European currencies (euro and franc), that the pound/dollar pair was able to hold above the key psychological level of 1.3000 and closed trading on August 12 at 1.3029.

Despite the fact that two consecutive daily candles have closed under the Tenkan line of the Ichimoku indicator, I think it is premature to consider its breakdown as true. To do this, at least three consecutive candles must close under the Tenkan. However, at the moment of writing, the pound/dollar pair shows quite good growth and is trading near 1.3077. Bulls on the pound are trying to overcome the hated Tenkan line (1.3082), which acts as a strong resistance and is currently holding back the attempts of the quote to continue moving in the north direction. If the Tenkan is still passed, the next target for buyers of the British currency will be the level of 1.3130, where the trading highs were shown on August 11. Further, to confirm its undoubted mastery of the market, it is necessary to break through the strong technical zone of 1.3170-1.3200. Fix trades above the 32nd figure. Bearish sentiment will return only after the breakdown of the key support zone of 1.3008-1.2980.

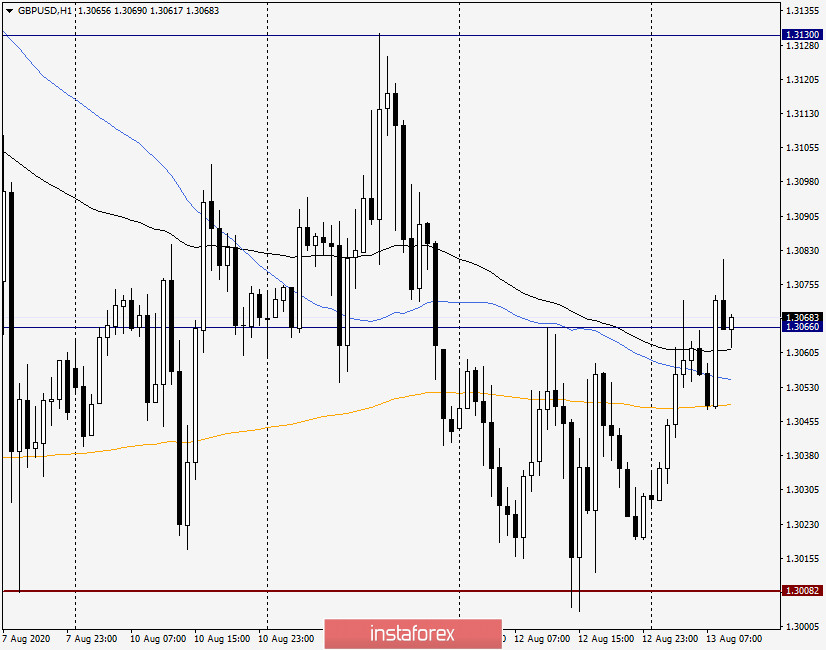

H1

After falling to the 200 exponential moving average during today's Asian session, the pair found support there and turned north. As a result of the strong growth, the quote has already broken through the 50 simple and 89 exponential moving averages. If you close above these moves of three consecutive hourly candles, on a pullback to the price zone of 1.3068-1.3058, you can try buying the British currency with the nearest goals in the area of 1.3100-1.3130. We set the profit for long positions higher in the area of 1.3170-1.3200.

At the same time, it can not be excluded that the bulls on the pound will not be able to overcome the resistance of sellers near 1.3130 or in the zone of 1.3170-1.3200. If bearish signals of candle analysis appear near the indicated prices, you can try to sell, but it is better with small goals, in the area of 1.3080-1.3060.

Looking at today's economic calendar, we see that no macroeconomic reports are expected from the UK. But from the United States of America at 13:30 (London time), information will be received on initial applications for unemployment benefits. That's all for now.

Good luck!