Hello, dear colleagues!

Despite the fact that yesterday's data on initial applications for unemployment benefits in the US were significantly better than the consensus forecast of 1 million 120 thousand and in fact amounted to 963 thousand, this did not save the US dollar from another round of decline in the pair with the single European currency. The main attention of market participants is focused on the program of additional stimulation of the world's leading economy, the debate on which has reached an impasse. US President Donald Trump, in his usual style, threatened to ban any money for the convenience of postal voting. In fact, financial support for the postal service and the modernization of the electoral infrastructure are the main contradictions in the negotiations between Congress and the White House administration. Let me remind you that the program of additional incentives for the American economy to correct the situation caused by COVID-19 cannot be agreed for the second week. Thus, an already depleted and weak dollar came under even more selling pressure across a wide range of the market.

Today's economic calendar is full of quite important events that EUR/USD traders should pay attention to. At 10:00 (London time), the Eurozone will provide reports on revised GDP data for the second quarter, as well as the trade balance, without seasonal adjustments, and changes in the number of employed over the same time period.

However, the main block of today's macroeconomic statistics will start coming from the United States at 13:30 London time, when retail sales will be published. Then at 14:15 (London time), reports on industrial production will be received, and at 15:00 (London time), inventory in warehouses and the consumer sentiment index from the University of Michigan will be presented.

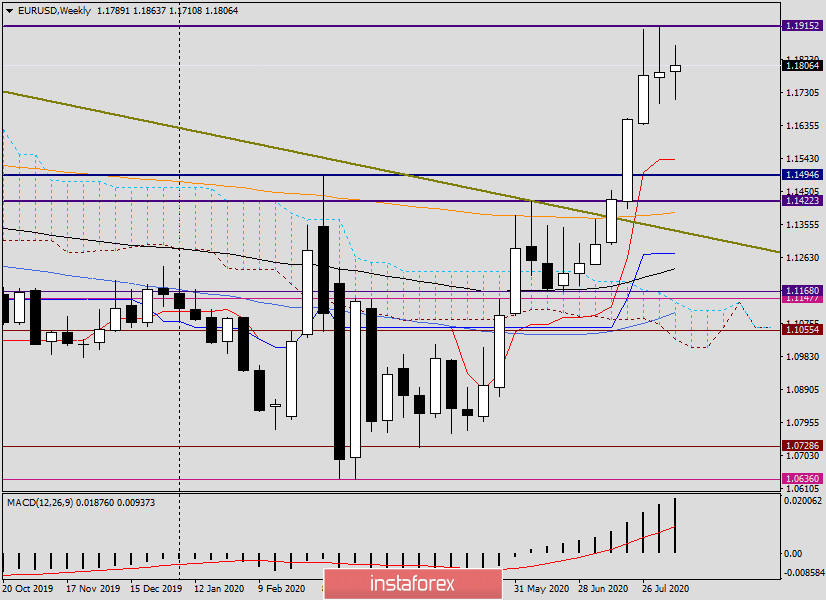

Weekly

It is quite possible that the events listed above will have an impact on today's price dynamics of the main currency pair and the closing results of the entire trading week. At the moment, the market is still unable to determine the direction, and trading is taking place near the opening price of the week 1.1790. Since the euro/dollar currency pair is considered daily, the weekly timeframe is usually shown and analyzed on Mondays, taking into account the completion of past weekly trading. Today I decided to make an exception, because the situation is quite interesting and quite unusual.

At the time of writing, the current weekly candle actually has no body, and the candle itself (along with its shadows) is located inside the previous undefined candle model, which still more assumes the downward dynamics of the instrument.

If the current candle retains its current shape, there will be even more reasons to expect the subsequent implementation of the downward scenario. In this case, the pair risks falling to the area of 1.1540, where the Tenkan line of the Ichimoku indicator passes. As it has been repeatedly noted, the bull market will get real prospects for its continuation only if the strong resistance of sellers breaks through at 1.1915 and consolidates above this level.

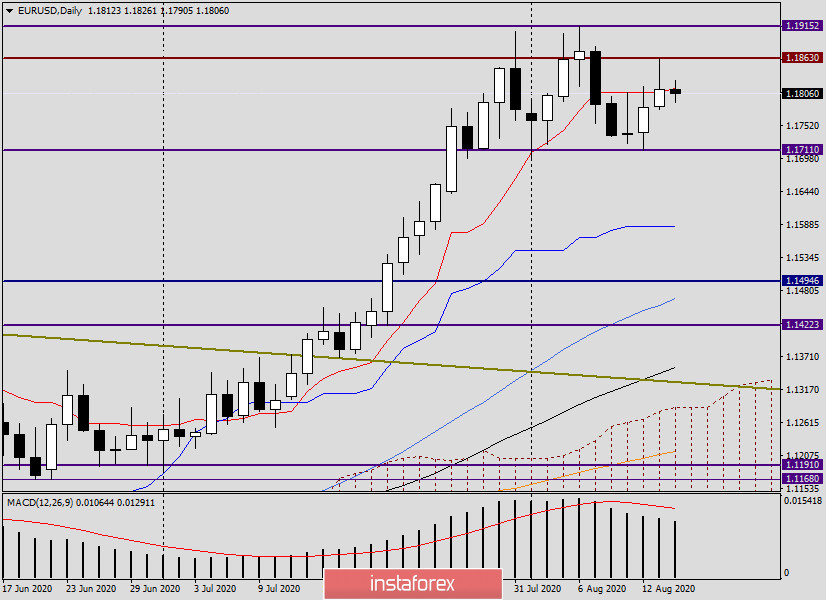

Daily

Despite the fact that Thursday's trading ended slightly above the daily Tenkan line, the closing price below the important and strong level of 1.1800 and the long upper shadow of yesterday's candle do not inspire much optimism. If the euro bulls manage to finish today's trading above yesterday's maximum values of 1.1863, there will be a real opportunity to retest the key resistance level of 1.1915. As we can see, the current support continues to remain relevant near another significant level of 1.1700. The census of the minimum values on August 12 at 1.1711, as well as the completion of daily and weekly trading at 1.1700, will show that serious sellers have returned to the market. This factor will suggest a further weakening of the single European currency against the US dollar.

Given the uncertainty of the market and the last day of weekly trading, both scenarios are possible. You can try buying after the pair drops to the price zone of 1.1745-1.1715, and selling will become more relevant after fixing the quote below the level of 1.1785. For those who do not want to take risks and move open positions to Monday, it is better to stay out of the market today.

Good luck!