Good day, dear traders!

Today's review of the USD/CHF currency pair will focus on the technical component. However, first of all, let's talk about what most worries investors, and about the macroeconomic statistics that will be published on the last day of weekly trading.

The main attention of traders is focused on the discussion and adoption of an additional program to help the American economy, which was significantly damaged by COVID-19. The debate between the US Congress and the administration of Donald Trump is being held for the second week, however, the parties have not yet been able to agree.

Since the world's leading economy has suffered the most significant losses due to the coronavirus epidemic, it needs emergency assistance about the size and purpose of which is being discussed. Most likely, the situation on this issue will become clearer next week, and we will identify the most important macroeconomic events that will be presented to the market participants on the last trading day. A large block of statistics will start arriving from the United States starting at 13:30 London time. Data on retail sales, industrial production, inventory in warehouses, as well as consumer sentiment from the University of Michigan will be published. You can find more detailed forecasts for these and other events by looking at the economic calendar. Let's start looking at the price charts of the dollar/franc currency pair, and first turn our eyes to the weekly timeframe.

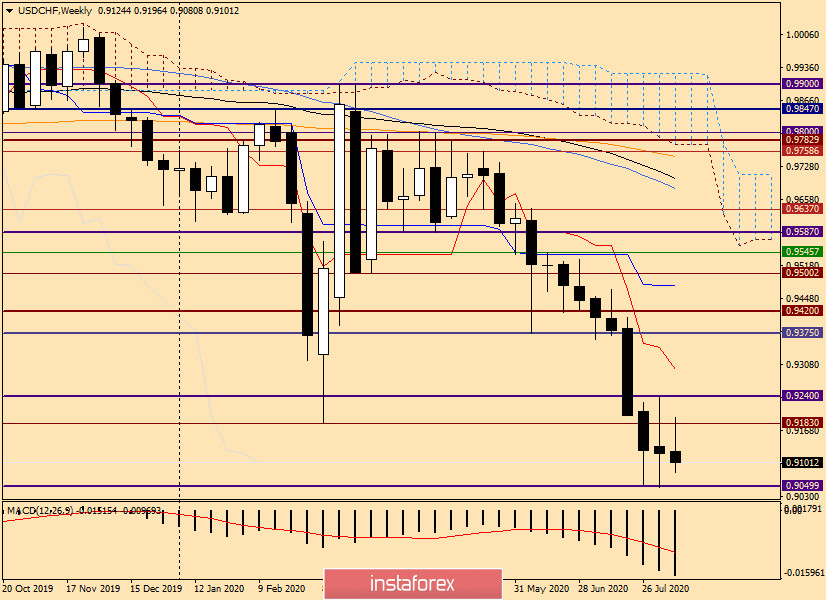

Weekly

Here it is worth noting that for the third week in a row, the USD/CHF pair is trading in the range of 0.9240-0.9050. It is logical to assume that the exit from this price range will be decisive for this currency pair, possibly in the medium term. The dollar/franc ends the current week with a decline, and the next attempts to return above the broken support level of 0.9183 remain futile.

However, after the publication of macroeconomic statistics from the US, the current situation may change. Everything will depend on specific figures and the reaction of market participants to them. If the current weekly candle, as well as the previous one, is formed in long shadows and within the designated range, there will be more prospects for the subsequent growth of the pair. In any case, in my opinion, the need to adjust the exchange rate has matured, but for this purpose, the corresponding candlestick signals should appear.

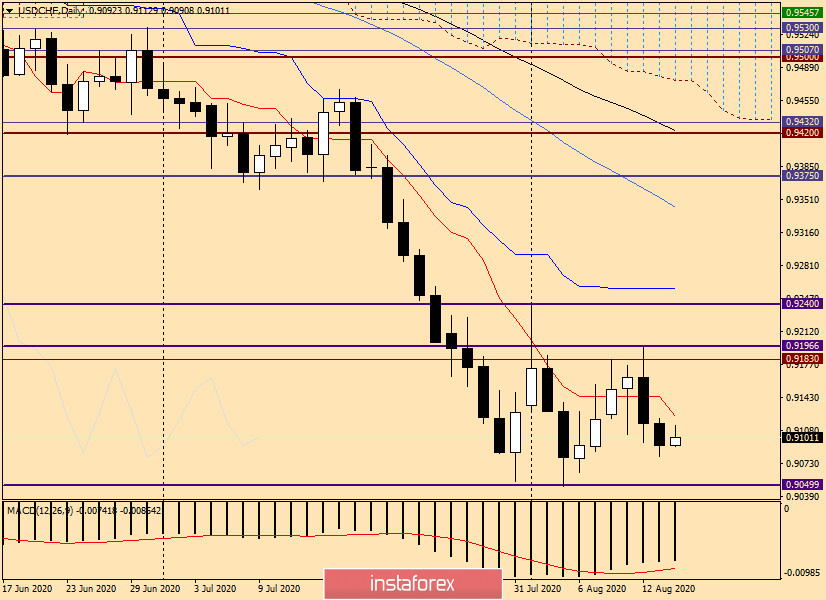

Daily

As you can see, the attempts of the bulls for USD/CHF to return trading above the important and strong level of 0.9200 failed. Before reaching this level, the pair turned in the south direction, and at the moment of completion of this article, it is trading near another significant level of 0.9100. It is worth noting that at 0.9122 is the Tenkan line of the Ichimoku indicator, which is able to provide active resistance to growth attempts. If the players on the increase manage to close today's trading above this line, the road will open to a broken support of 0.9183 and strong resistance from sellers, which passes at 0.9196. If there are reversal patterns of candle analysis near these levels on the daily, four-hour and even hourly charts, a signal will appear to open short positions for USD/CHF.

But if bullish candles appear in the price support zone of 0.9080-0.9050 on the same timeframes, it is time to think about buying.

To summarize, the most likely is the correction of the exchange rate, which means purchases. However, for greater confidence, it is better to wait until the end of today and weekly trades, after which it will be possible to make decisions about entering the market based on the closing price and candlestick patterns.

Have a nice weekend!