The EUR/USD pair recovered a little after its amazing sell-off but the bounce-back could be over anytime. The price increased only because the Dollar Index slipped lower after the last leg higher. Fundamentally, the USD received a helping hand from the US Housing Starts and Building Permits as the indicators came in better than expected.

Today, the fundamentals could have an important impact as well. The Euro-zone Final CPI and Final Core CPI indicators are expected to remain steady. On the other hand, the US Unemployment Claims could fall from 230K to 227K, the Existing Home Sales is expected at 6.42M, while the Philly Fed Manufacturing Index may jump to 18.9 points from 15.4 in the previous reporting period.

EUR/USD Temporary Rebound!

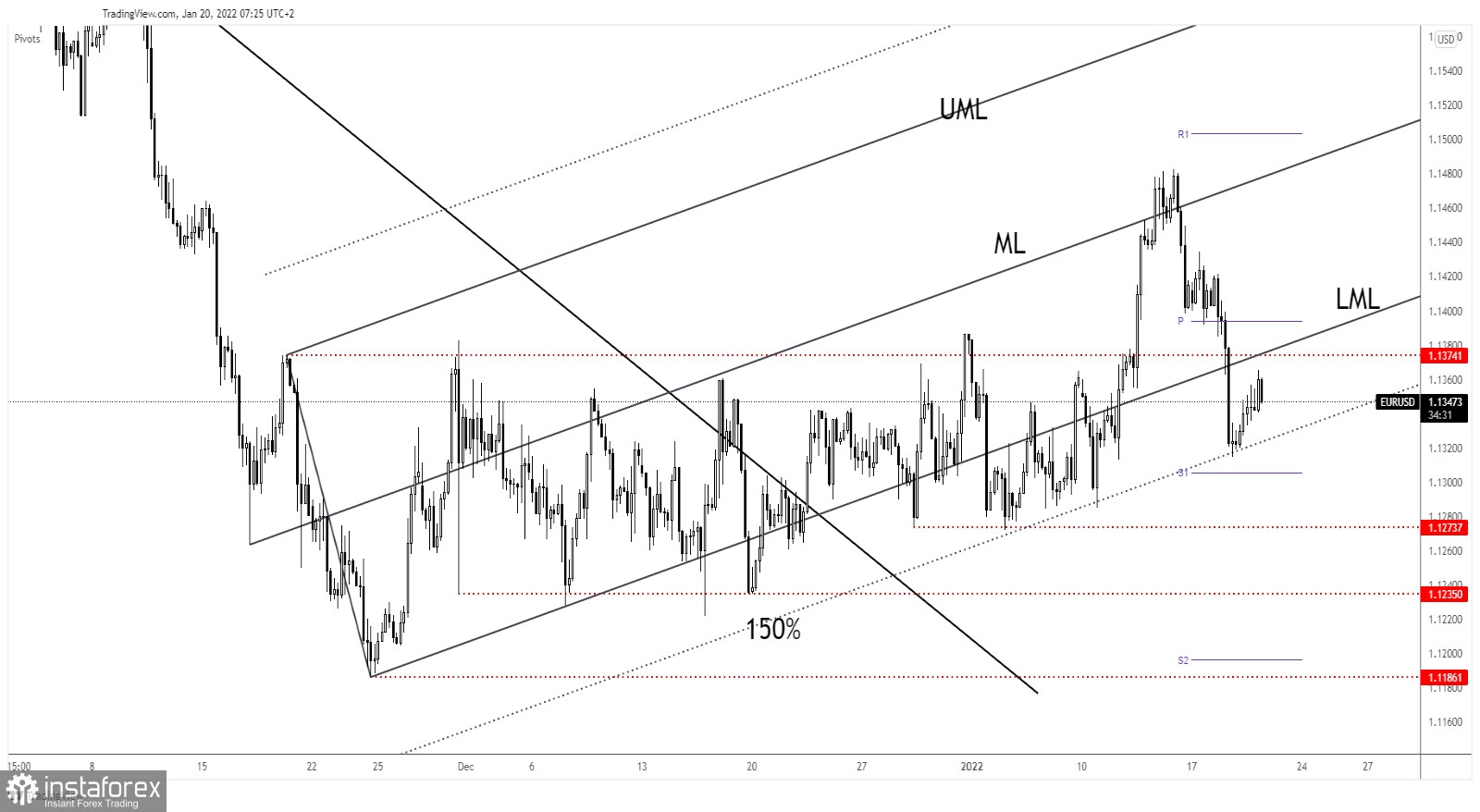

EUR/USD has found support on the 150% Fibonacci line and now it has tried tp come back towards the 1.1374 and up to the lower median line (LML). These are seen as upside obstacles. Staying below these levels and registering a valid breakdown below the 150% Fibonacci line could open the door for a larger downside movement.

Failing to stay above the 1.1374 signaled that the upside is limited and that the pair could drop deeper. A new lower low, a bearish closure under the 1.1314 immediate low could activate more declines.

EUR/USD Prediction!

Dropping and closing below the weekly S1 (1.1305) could announce potential downside continuation. The rebound could be only a temporary one. Only jumping and stabilizing above 1.1400 could invalidate the bearish scenario.

Technically, the current rebound could help the sellers to catch new downside movements. Registering false breakouts above the immediate upside obstacles could bring a selling opportunity sooner.