During today's Asian session, the AUD/USD pair settles in the area of 0.72, reacting to strong Australian labor market data. The report published today reflected positive trends, despite the active spread of a new strain of coronavirus in the country.

However, the current growth of AUD/USD should only be considered as a corrective pullback. The pair continues to trade in the range of 0.7150-0.7280, reflexively reacting to the current news flow. At the same time, the Australian dollar is not able to develop the pair's upward trend on its own, but only due to the weakening of the US dollar. In turn, the US currency is standing still ahead of the Fed's January meeting. Therefore, the current price growth can be used to open short positions.

It can be recalled that exactly a month ago, Australia's Nonfarm data also surprised investors with their strong numbers. All components of the release came out in the "green zone", which was much better than expected. But despite a fairly strong report, the Australian dollar only showed an impulse short-term growth. As soon as the US dollar index rose, the AUD followed the USD, and the Australian Nonfarms immediately faded into the background.

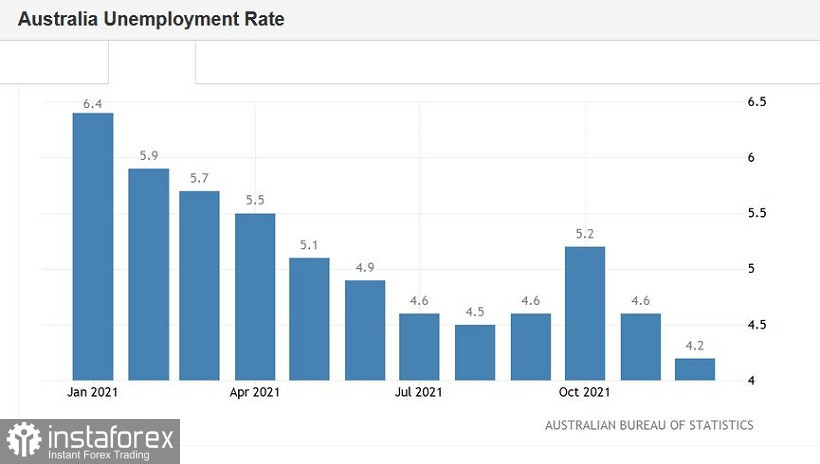

Today's situation is similar. The published data today surprised us with its "green color". For example, the unemployment rate in Australia sharply declined in December from 4.6% to 4.2%. This is a long-term record: the last time the indicator was at this level was in July 2008. Even before the pandemic, this indicator fluctuated in the range of 5.0% -5.4% for many months. In other words, Australia's unemployment not only returned to pre-crisis levels (and significantly ahead of schedule), but also updated a 13.5-year low.

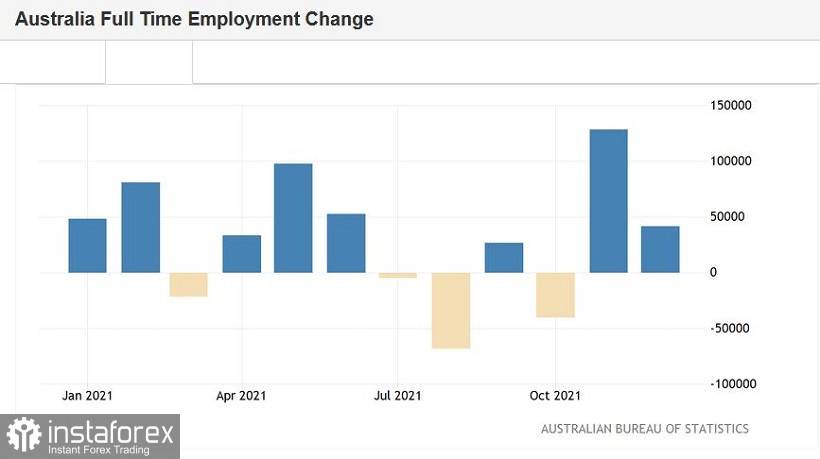

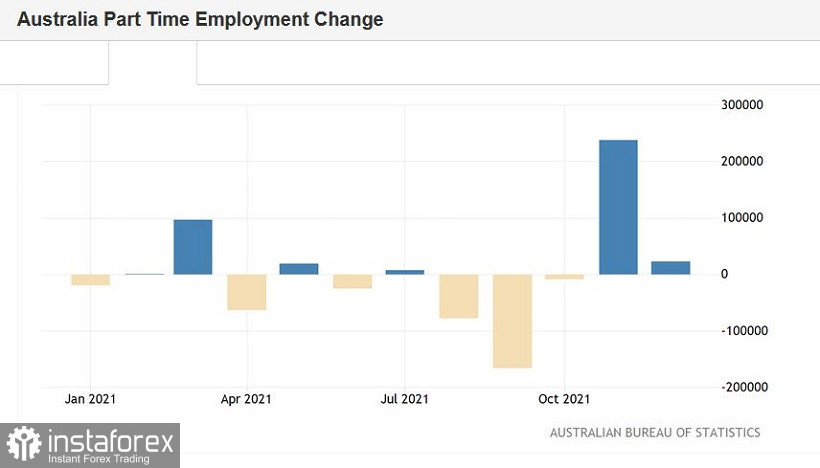

It is also worth noting the positive dynamics in the number of employees in December. The overall figure also turned out to be better than expected, coming out at around 65 thousand against the expected growth of 59 thousand. In addition, the structure of this indicator indicates that the overall growth was due to both part-time and full-time employment (ratio 41.5/23.5 thousand). At the same time, it is known that full-time positions, as a rule, offer a higher level of wages and a higher level of social security, compared to temporary part-time jobs. Therefore, the current dynamics in this regard are extremely positive.

All this suggests that the report in the field of the labor market turned out to be strong in all respects: it reflected not only an increase in employment but also a sharp decrease in unemployment amid an increase in the proportion of the working-age population. The indicator rose to 66.1%.

The reaction of the Australian dollar is quite logical. It strengthened throughout the market and has updated the semi-annual price high paired with the New Zealand dollar. But when paired with the US currency, the Australian dollar behaves more modestly but also shows character.

However, longs on AUD/USD pair should still be treated with caution despite the positive release due to the continuing divergence of the positions of the RBA and the Fed. A month ago, immediately after the release of strong data on the growth of the labor market, RBA Governor Philip Lowe voiced dovish remarks. On the one hand, he noted the success of the Australian economy, but on the other hand, he ruled out the option of raising the rate in 2022. According to him, the appropriate conditions for tightening monetary policy will not be created this year. He also noted that Australia's inflation outlook is very different from that of the US. In a separate line, the head of the Central Bank stressed that the regulator would not raise the rate in order to control real estate prices. Remarkably, Lowe later made a hint to AUD/USD buyers, saying that the RBA will continue to wind down the asset purchase program in February and be completed in May. However, this remark did not support the Australian dollar because this fact is already taken into account in prices.

In one of his speeches at the end of last year, Philip Lowe also noted that the Central Bank will not tighten monetary policy "until actual inflation is firmly settled in the target range of 2-3%." According to the forecasts of the Central Bank, this will happen around 2023. It should be noted that we currently have data on inflation growth for the 3rd quarter of last year. More recent data (Q4 2021) will be published next week, January 25th.

As a result, the RBA actually leveled the importance of the Australian Nonfarm by excluding a rate increase in 2022. In addition, the head of the Central Bank brought inflation to the forefront, which shows quite modest growth. All this suggests that the current price increase can be used as a reason to enter sales.

Technically, the pair retains the potential for its further upward correction. On the daily chart, the price is located on the middle line of the Bollinger Bands indicator, in the Kumo cloud. The target of the corrective pullback is the level of 0.7280, which is the upper line of the Bollinger Bands on the D1 timeframe and the middle line of the Bollinger Bands on the W1 timeframe. This is a fairly powerful resistance level that protects the 0.73 area. Buyers of AUD/USD traded above the 0.7300 level only in mid-November last year. After that, they hit the price barrier of 0.7280 only once (on January 13) and found themselves in the area of the 73rd figure – but only for a few hours. After that, the Australian dollar returned to the area of the 0.7150-0.7280 price range. Therefore, when approaching the above resistance level, it is advisable to consider the option of short positions, with the first target of 0.7200 and the main target of 0.7150.