The resignation of a political leader is always a shock to financial markets. Especially if this leader has held office longer than his predecessors since the end of World War II. We are talking about the retirement of Japanese Prime Minister Shinzo Abe for health reasons, information about which dropped the USD/JPY quotes to the base of the 105th figure. Investors ran to safe-haven assets, which the yen immediately took advantage of.

During Shinzo Abe's nearly 8-year tenure, unemployment has fallen to the lowest level in a quarter of a century, and the capitalization of the stock indices of the Land of the Rising Sun has doubled. However, Abenomics left more questions than answers. It was marked by unresolved problems and unfulfilled goals, one of which was the 2% inflation target. In a state where the percentage of people aged 65 and over exceeds 80% of the working-age population, it is very difficult to achieve CPI acceleration. Older people prefer to save more than spend, which slows down inflation. Shinzo Abe, with the help of Haruhiko Kuroda, tried to solve this problem with a large-scale monetary stimulus, however, the global recession put an end to ambitious plans.

The market is shaken by the resignation of the Prime Minister, but most likely it is a one-time political news. It is unlikely that the outlook of the Bank of Japan will radically change, and the fact that Chief Secretary of the Cabinet of Ministers Yoshihide Suga is running for the post of head of government allows us to speak of the continuity of the policy pursued in the Land of the Rising Sun.

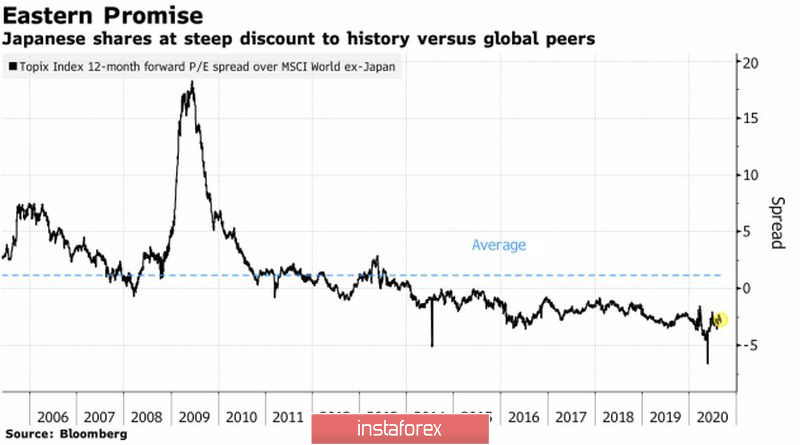

An important driver of the strengthening of the yen can be the repatriation of capital by Japanese investors to their homeland. Information that Warren Buffett has invested about $6 billion in trading companies in the world's third-largest economy can act as a catalyst for demand for local stocks. From a P/E point of view, they look undervalued compared to their global counterparts and can be considered an effective way to invest capital during the recovery of global GDP.

Dynamics of the P/E ratio of Japanese and global stocks

Simultaneously with the growth of demand for the yen and its nominated shares, the development of a "bearish" trend for USD/JPY will be facilitated by the weakening of the US dollar. According to Societe Generale, the downward trend in the USD index is just beginning and the greenback could fall to £100 within 12 months. This figure is also mentioned by Eisuke Sakakibara – a man who was called "Mr. Yen" in the 1990s for his ability to influence exchange rate formation on Forex.

In my opinion, if the Fed does not move forward in raising the federal funds rate, at least until the end of 2023, then the Bank of Japan will not rush to tighten monetary policy, which paints a picture of long-term consolidation of the USD/JPY in the range of 100-110. Growth to the upper border of the trading channel is possible only if the August peak is updated near 107. In this scenario, the "Expanding Wedge" pattern will be formed. On the contrary, a break in support at 105.2 will signal the opening of shorts.

USD/JPY, the daily chart