The single European currency continues to weaken, and even the fact that the data in Europe came out better than forecasts, and the one from the United States turned out to be worse, could not prevent this. And the thing is that yesterday's macroeconomic data does not globally change anything.

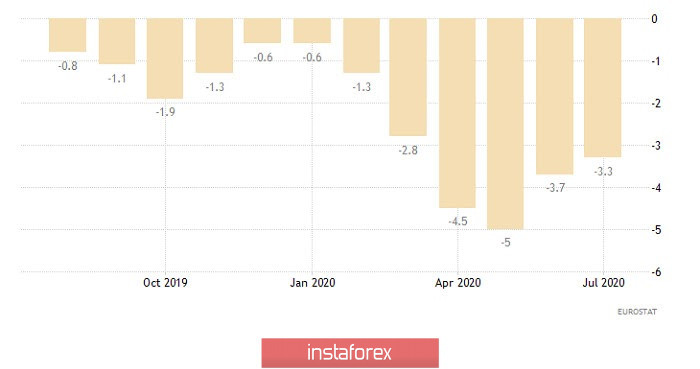

For example, the rate of decline in producer prices in Europe, which should have slowed from -3.7% to -3.5%, had instead dropped to -3.3%. But this doesn't change anything. It does not in any way change the fact that deflation has begun in the euro area. Also, the slowdown in the rate of decline in producer prices does not yet guarantee that consumer prices will rise next month. This only increases the likelihood of such a development of events. But nothing more. Although in fairness you should take note of the fact that these data have suspended the process of the euro's fall at least for quite some time.

Producer prices (Europe):

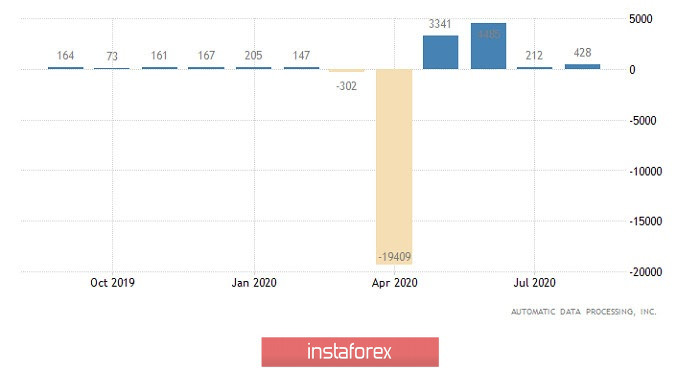

The dollar's growth immediately resumed after the US ADP employment data was released, which turned out to be worse than forecasted. The fact is that, according to forecasts, employment should have increased by 1,000,000. But in fact, it only grew by 428,000. However, this is still an increase in employment. And one that is impressive. This is one of the best indicators of employment growth in history. More importantly, employment has grown much more than in the previous month. In other words, after a slowdown in the recovery of the labor market, it has accelerated again. Even if it isn't as much as expected. Thus, the content of the Labor Department report that is set to be published on Friday will in any case reflect a noticeable improvement in the situation in this very labor market.

Employment Change from ADP (United States):

Given that the Labor Department report is due tomorrow, today's focus will be on claims for unemployment benefits in the United States. Moreover, it must also confirm the fact that the labor market is gradually recovering. Therefore, the number of initial applications should fall below 1,000,000 again. From 1,006,000 to 995,000. The number of repeated applications may decrease from 14,535,000 to 14,150,000. So employment is gradually recovering, although the unemployment rate is still very, very high. But what is important here is movement in the right direction.

Number of initial claims for unemployment benefits (United States):

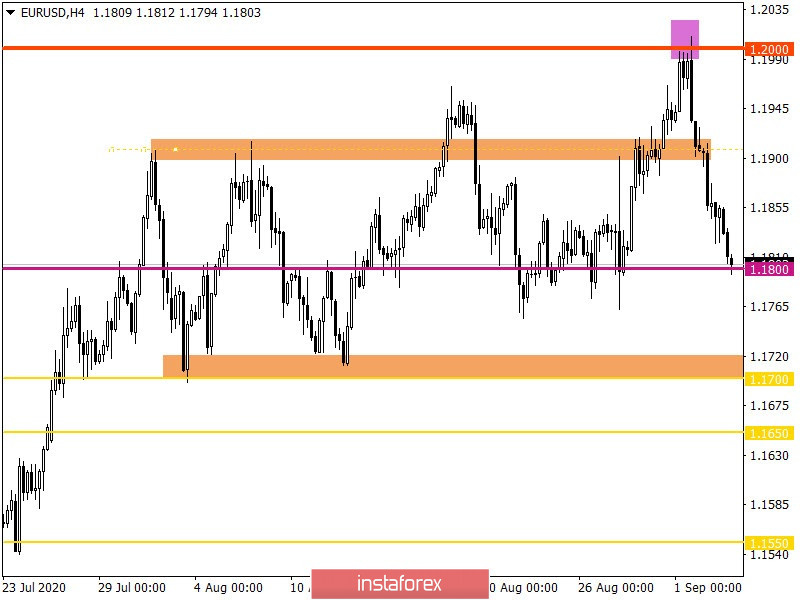

The euro/dollar pair has an intense price movement from the psychological level of 1.2000, where the quote managed to pass more than 200 points, without reducing the downward interest. The given mood indicates the possibility of a deeper decline, which will be justified in terms of the high degree of just how the European currency has been overbought over the past few months.

If we proceed from the quote's current location, we can see that market participants are already storming the 1.1800 level, and if it falls, then we can not exclude movement towards the local low of the beginning of August, which is around 1.1700/1.1710.

A high volatility indicator is recorded relative to the market dynamics, which is confirmed by speculative interest in the market.

Looking at the trading chart in general terms (the daily period), you can see that the quote has already returned to the borders of the previous side channel.

We can assume that a local stagnation may occur at the 1.1800 level, but if the downward interest remains and the price settles below 1.1780, a movement towards 1.1700/1.1710 is not excluded.

An alternative scenario will be considered if the slowdown process is delayed along the 1.1800 mark.

From the point of view of complex indicator analysis, we see that the indicators of technical instruments at minute and hour intervals signal sales due to an intensive downward movement of the price.