The current situation further resembles a full-fledged correction that everyone has been waiting for. At the same time, it seems that all this is happening contrary to common sense, since European statistics came out slightly better than the forecasts, while the American one is much worse. But if we look closely, everything falls into place. It's not that the market is highly overheated and a correction has been forthcoming for quite some time. It's just about the same macroeconomic statistics.

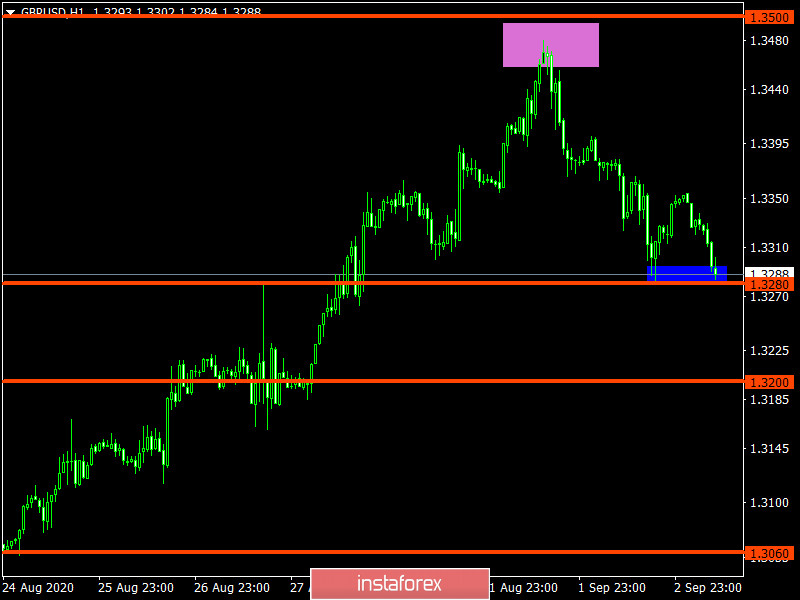

After preliminary data showed that Europe is slipping into deflation, investors are only concerned about how long it will last. This should be answered by data on producer prices, which seems to be just fine. After all, they expected a slowdown in the rate of decline from -3.7% to -3.5%, but it declined to -3.3%. So it seems that the single European currency should have resumed its growth immediately. However, a slowdown in the rate of decline in producer prices only increases the probability of growing inflation, and does not guarantee it. Moreover, producer prices continue to decline for over a year. Thus, the situation has not significantly changed. The prices in Europe are falling, and the best thing we can expect is zero inflation. So it comes out that in the best case, data on producer prices could only stop the decline of the Eurocurrency, which is exactly what happened.

Producer prices (Europe):

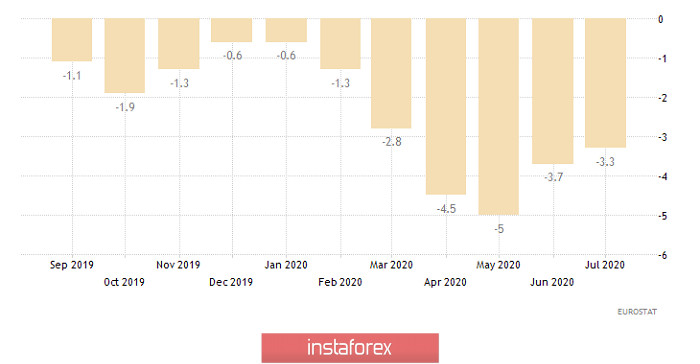

The same logic applies to ADP employment data, which turned out to be significantly worse than forecasted. After all, employment was expected to grow as much as 1,000 thousand, but it only grew by 428 thousand. So, in theory, the dollar should have immediately weakened, but it's not at all so simple. The fact is that even such results are among the best in history. In addition, compared to the previous month, when employment rose by 212 thousand, a rise in employment was observed. Consequently, the labor market continues to actively recover, together with the entire economy. Although it is a little slower than expected, there is still some progress. And if you add the upcoming publication of the report of the US Department of Labor, as well as the huge oversold dollar, then this is further strengthening it.

Employment Change from ADP (United States):

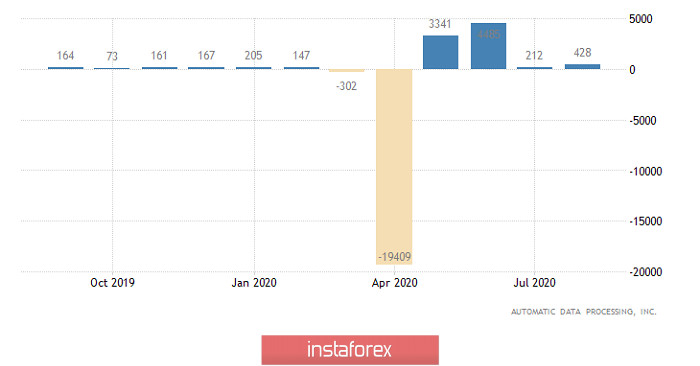

Today, the investors will focus their attention on retail sales in Europe, the growth rate of which could accelerate from 1.3% to 3.7%. Such an impressive growth in consumer activity largely compensates for the fact of a decline in consumer prices, so that these data can really provide support to the Euro. So, unlike yesterday, we will see not just a suspension of the decline in European currencies, but even their growth. After all, the euro currency will pull the pound along with it.

Retail Sales (Europe):

However, this will not change anything, since the main event of the day will be the publication of data on applications for unemployment benefits in the United States. Moreover, they should show further improvement of the situation on the labor market – the number of repeated applications for unemployment benefits may decline from 14,535 thousand to 14,150 thousand. Now, what's equally important and perhaps more, is the expected decline in the number of initial applications for unemployment benefits from 1,006 thousand to 995 thousand. The main thing is that the requests should be less than a million. This will have a psychological positive impact in many ways.

Number of initial claims for unemployment benefits (United States):

The EUR/USD pair is moving along a downward course from the psychological level of 1.2000, where the quote has already managed to decline to the next coordinate area 1.1800. It can be assumed that, if there is no deceleration at this coordinate and the price is consolidated below 1.1780, a following decline towards 1.1700/1.1710 is not excluded.

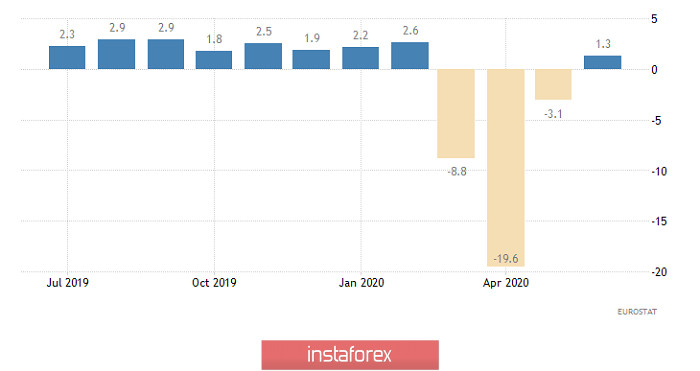

The GBP/USD pair has a similar downward trend, where the quote has already managed to decline to the 1.3280/1.3320 area. We can assume a temporary bump within these values, where if the price consolidates below 1.3270, a further decline towards 1.3200 is considered.