Stock indices of the countries of the Asia-Pacific region closed in the red on Friday, a similar trend has developed in the US stock market. Analysts attribute the fall in world markets to the prospects for a more aggressive than expected increase in rates by the Federal Reserve System.

Meanwhile, retail sales in the UK fell 3.7% in December from the previous month, showing the biggest drop since January, according to data from the National Statistics Office (ONS). Analysts on average had forecast a decline of just 0.6%. In annual terms, sales decreased by 0.9% instead of the expected growth of 3.4%.

Despite the decline in December, retail sales this month were up 2.6% compared to pre-pandemic February 2020. For 2021 as a whole, sales jumped 5.1%, the fastest pace since 2004.

The composite index of the largest enterprises in the Stoxx Europe 600 region fell by 1.8% to 474.44 points as a result of trading. At the same time, all sectoral sub-indices declined, the financial and technology sectors the most.

Losses of the indicator for the entire past week amounted to 1.5% on fears of tightening the monetary policy of the world's central banks and increased tensions between Russia and the United States.

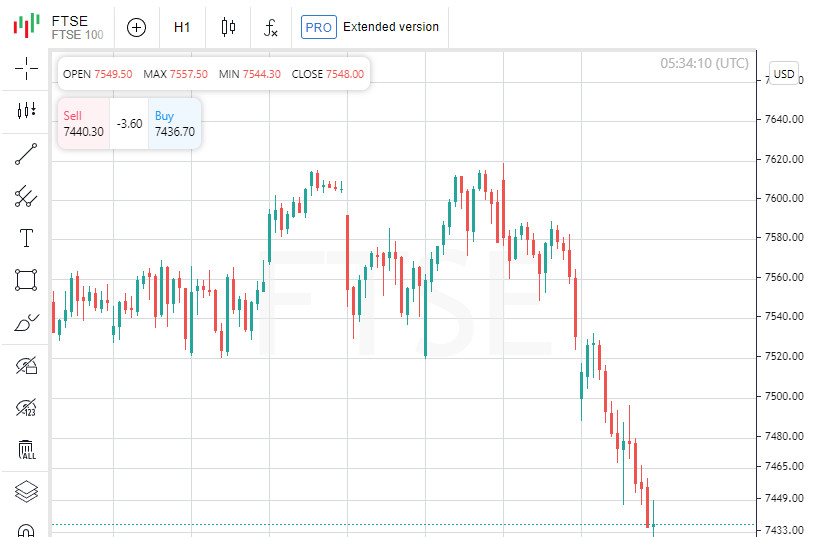

The German DAX index fell by 1.9% during the day, the French CAC 40 - by 1.75%, the British FTSE 100 - by 1.2%. Spain's IBEX 35 shed 1.4% and Italy's FTSE MIB shed 1.9%.

German Siemens Energy AG shares plunged 16.6% on Friday after Siemens Gamesa subsidiary Renewable Energy SA released preliminary financial results for the first quarter.

The price of Siemens Gamesa fell 14%. The company posted an adjusted EBIT loss of €309m against a profit of €121m in the same period a year earlier, while its revenue fell to €1.8bn from €2.3bn. Siemens Gamesa also downgraded its forecasts for the main financial indicators for the 2022 financial year.

The fall leader in the Stoxx Europe 600 index, in addition to Siemens and Siemens Gamesa, was the Danish wind turbine manufacturer Vestas Wind Systems A/S (-9%). Also, steel ThyssenKrupp AG (-7.2%) and e-commerce platform InPost S.A. (-8.6%).

The energy sector went into the red zone following the fall in oil prices, including the value of Royal Dutch Shell Plc decreased by 1.7% and BP Plc - by 1.8%.

TotalEnergies on Friday announced its decision to pull out of a natural gas project in Myanmar and stop doing business in the country, which suffered a military coup in February 2021. The company will not receive financial compensation, its share in the Yadana field and the MGTC gas pipeline will be distributed among project partners. Capitalization of TotalEnergies for the day fell by 2.1%.

In addition, securities of the semiconductor industry, including ASML Holding (-1.7%) and AMS (-3.6%), as well as software developer SAP (-1.2%), fell in price.

Meanwhile, the shares of the German developer of software for remote connection TeamViewer AG (+4.3%) and the Polish retailer Dino Polska (+3.6%) grew most significantly.