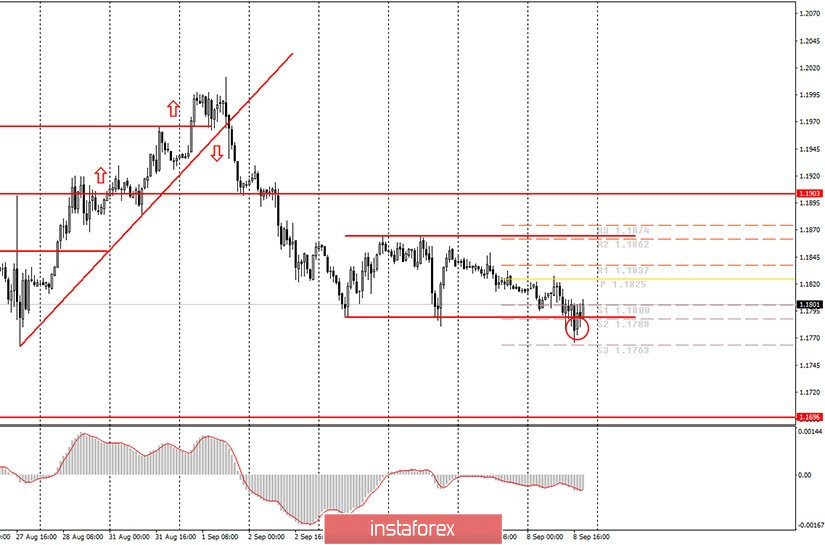

Hourly chart of the EUR/USD pair

The EUR/USD pair, as a whole, continued to weakly move down on Tuesday, September 8, and eventually it reached the lower line of the small side channel, which is limited by the levels of 1.1790 and 1.1865. The price even managed to gain a foothold below this channel, which we told novice traders to consider as a signal to sell the EUR/USD pair. However, literally on the next candle, the quotes of the pair returned to the channel and are traded there at this time. Thus, the sell signal turned out to be false, as well as the breakout of the lower border of the side channel. The price did not manage to abruptly go up, so losses on this trade should be minimal. In general, the volatility for the pair is extremely low, no more than 60 points a day. Unlike, for example, the pound/dollar pair, which is traded much more actively. Now we need to wait for new possible signals, but in the current situation, when a pronounced rebound from the lower channel line has not occurred, we believe that any signal can be false. Nothing prevents the price from executing a second false breakout at this time.

We only had one report to serve as the fundamental background. The eurozone has released the second estimate of GDP for the second quarter. It turned out that this indicator slightly improved compared to its first estimate and reached -11.8% in quarterly terms and -14.7% in annual terms. However, market participants did not appreciate this improvement, considering it insignificant. Thus, the euro did not receive much support after this report was released. In addition, there was practically no news that could have an impact on the pair's movement. US President Donald Trump has traditionally commented a lot on everything that concerns his country at this time, the upcoming elections and his enemies and competitors, but nothing that was particularly interesting to market participants. Many people have long regarded Trump's words as meaningless speeches. Because what Trump says is very rarely true.

No macroeconomic data at all on Wednesday, September 9. Therefore, the pair can spend the whole day in absolutely indistinct trading without even moving in a trend within the day. Moreover, the pair can produce false signals near the lower border of the side channel, so we advise novice traders to be extremely careful when opening any positions. The results of the meeting of the European Central Bank will be summed up on Thursday, as well as a press conference by its head Christine Lagarde. That day promises to be more interesting.

Possible scenarios for September 9:

1) Novice traders are advised to not consider buy positions at this time, since the trend is formally downward, but in fact - it is going from side to side, but not upward. There are no signals or technical patterns that support the upward movement at the moment. Formally, you can try to trade for a rebound from the lower border of the side channel while aiming for the upper border, but this signal is absolutely indistinct.

2) Sell positions continue to look more relevant despite the fact that the pair is currently within the sideways channel. If quotes settle below this channel again, then formally it will be possible to open short positions again with the targets of 1.1763 and 1.1700. However, today we have already witnessed a false breakout, so we recommend not to make hasty decisions at least until the morning.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.