The British currency is expected to sharply fall throughout the market, even against the dollar. The devaluation of the pound was predictable, given the disposition of the upcoming negotiations between London and Brussels. But, apparently, traders were hoping for a miracle that did not happen. In my opinion, the prospects for the pound were clear last Friday, when the heads of the negotiating groups voiced their assessment of the results of the previous round of talks.

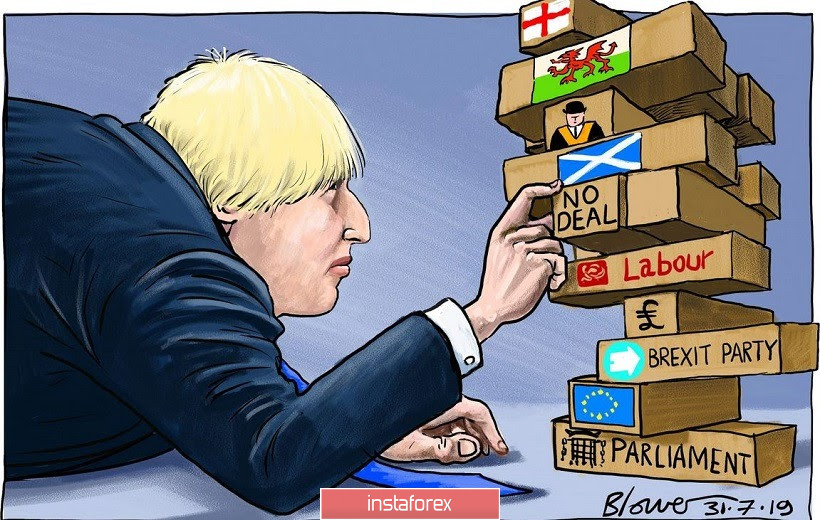

The "test shot" was fired over the weekend when Prime Minister Boris Johnson once again called for a deal in the Canadian or Australian scenario (Brussels repeatedly rejected both options) and announced a new deadline for the deal - October 15th. In turn, the head of the European negotiating group said that he was disappointed with the previous dialogue with the British, accusing them of not wanting to compromise. Such a peremptory position of the parties a priori could not lead to any significant breakthrough in the negotiation process. Moreover, today there is information that Johnson may initiate a revision of the deal that was already signed at the end of 2019. Some experts call this a bluff, but do not forget that after the last snap election, the Conservatives control the majority in the House of Commons, and therefore do not depend on the votes of any other parties. Therefore, in my opinion, traders underestimated the existing risk - apparently, many refer to Johnson's initiative as "raising the stakes before the game."

Let me remind you that Northern Ireland was the main stumbling block in the four-year talks between London and Brussels. As a result, Johnson was able to find a compromise between Leo Varadkar (who at that time was the Prime Minister of the Republic of Ireland), the local authorities of Northern Ireland, the British Parliament and the leadership of the European Union. According to the compromise reached, there will be no border between Ireland and Northern Ireland, and all goods destined for export to Ireland from England, Wales or Scotland will pass customs control en route to Northern Ireland. In other words, the parties will establish a maritime border "within" the UK.

Now Johnson intends to destroy this fragile structure. At least, according to the influential publication The Daily Telegraph, the British prime minister is going to announce this to Brussels in the near future. This initiative will formally be presented under the guise of the fact that the concluded deal on the part of the Irish border undermines the foundations of the integrity of the state structure of Great Britain, since de facto Northern Ireland becomes part of the European Union. But there is another reason that Johnson will not say this in the public plane - the fact is that, within the framework of the agreement concluded, Brussels can prevent Britain from subsidizing business in the UK in full, since Northern Ireland will de jure obey the economic rules of the EU.

According to The Daily Telegraph, this week the British Parliament may consider a corresponding amendment, which will allow the government to bypass such restrictions on subsidizing companies and entire industries. How Brussels will react to this is an open question.

As mentioned above, many experts do not believe that Johnson will really decide on such shifts that will hit not only the authority of the British government in the world, but also hit the positions of the Conservatives themselves within the country. Therefore, the market's reaction is currently muted, even despite a 150-point decline in the GBP/USD pair. If the concluded deal were under a real threat, the pair would fall by 300-500 points.

Nevertheless, Johnson knows how to bluff. And he can convince politicians (and along with them traders) of the firmness of his intentions. The prime minister can indeed submit a relevant bill to the House of Commons, accompanying his actions with anti-European rhetoric. In this case, the pound will continue to lose its positions, even contrary to common sense - the Conservatives will probably not shoot themselves in the foot by revising the points of the long-suffering deal.

According to analysts, if London violates the terms of the agreement, the political dispute will end with a lawsuit in the Luxembourg court. According to a court decision, the British can receive significant fines, and a trade war may begin between the UK and the European Union, within which the EU will impose sanctions on British exports.

But even if we exclude Johnson's possible political maneuver, it is worth recalling that there are many unresolved issues between London and Brussels at the moment. These include the access of European agricultural producers to the British market, regulation of the activities of European automobile giants, access of the French, Germans, and Spaniards to British waters for fishing, relations between Gibraltar and Spain, and so on. Such fundamental questions require careful and scrupulous study, and in this context, a 4-week time frame (remember that the deadline is set to October 15) looks too short. Obviously, the parties will not have enough time to discuss all the points of the upcoming deal. Therefore, tension regarding the prospects for Brexit will only grow in the near future, putting pressure on the pound.

From a technical point of view, the pair has the potential to fall in the long term - at least to the level of 1.2950 (the lower line of the BB indicator on the daily chart). The next support level is located a hundred points lower at 1.2850, which is the upper border of the Kumo cloud on the same timeframe.