GBP/USD rebounded after the DXY's retreat. Still, the downside pressure remains high. The pair could extend its downwards movement anytime. A temporary growth was expected after its massive drop. The bounce-back could help us to catch new downside movements.

The GBP/USD pair increased a little only because the Dollar Index slipped lower. DXY's rally could push the pair down. Today, the US economic data and the FOMC will drive the pair. So, you have to be careful as the fundamentals will have a big impact.

The Federal Reserve is expected to keep its current monetary policy at the January meeting but it could announce rate hikes in the next meeting. Hawkish FED could boost the USD while a dovish tone could weaken the greenback.

GBP/USD Bearish Bias Intact!

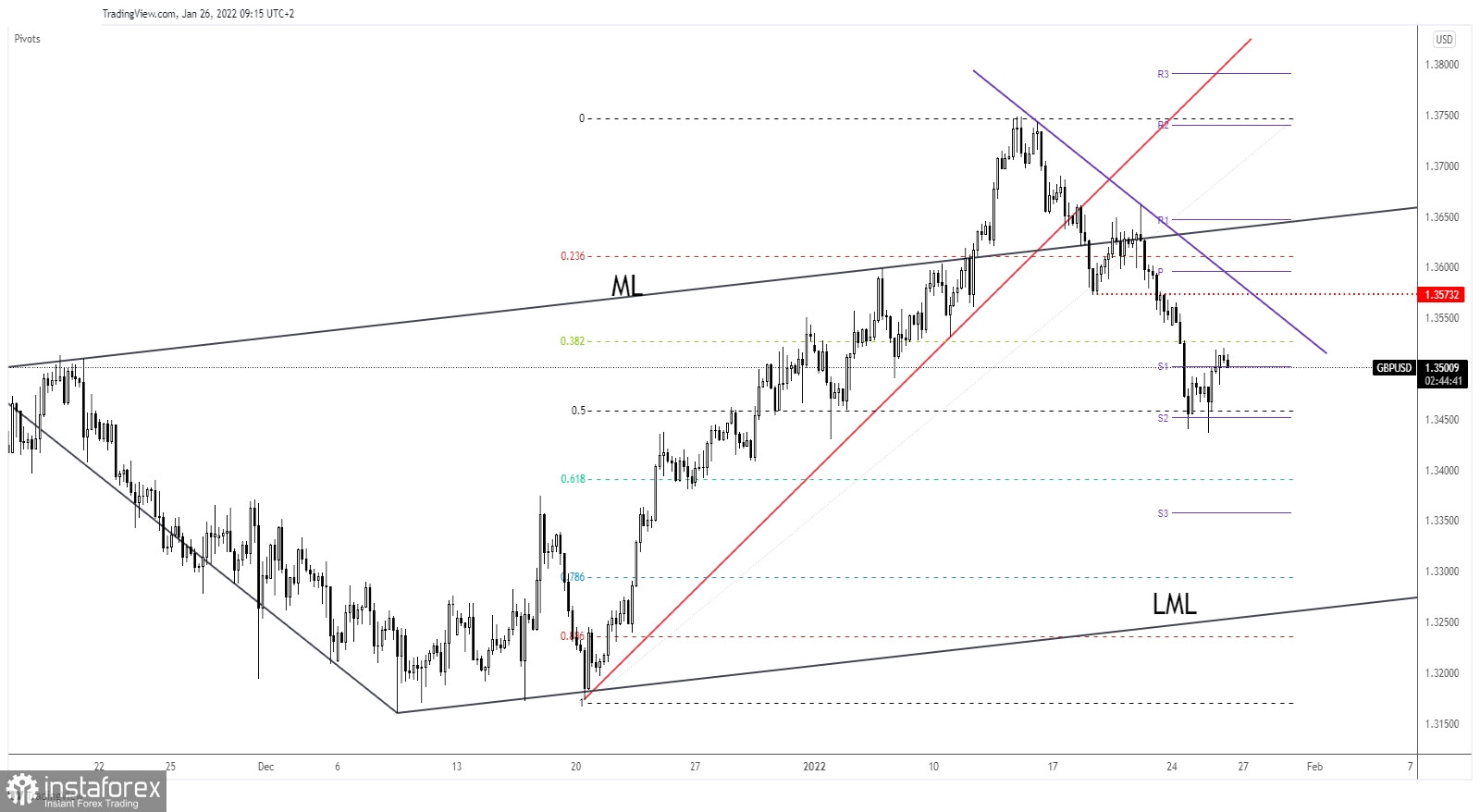

GBP/USD is struggling to stabilize above the weekly S1 (1.3502) level. It has found support on the 50% (1.3458) and now it could try to approcah and reach the 38.2% retracement level and the downtrend line. As long as it stays under the downtrend line, the bias remains bearish.

The rebound could bring new selling opportunities, personally, I will keep an eye on it trying to identify a new short signal from around the downtrend line. A downside continuation could be invalidated only if the GBP/USD makes a valid breakout above the downtrend line.

GBP/USD Outlook!

GBP/USD could activate a larger downside movement if it drops and closes below the weekly S2 (1.3452) level. A false breakout with great separation above the immediate resistance levels could bring a new short opportunity as well.