USD/CAD is trading in the red at 1.2601 at the time of writing. In the short term, the bias is bearish after the rebound ended. The Dollar Index's retreat forced the USD to lose ground versus its rivals. The pair could come back to test and retest the immediate downside obstacles. A temporary drop was somehow expected after registering a sharp swing higher.

It remains to see what will really happen as the BOC and FOMC are seen as high-impact events. As you already know, the Bank of Canada is expected to keep its monetary policy unchanged, to hold the Overnight Rate at 0.25%. On the other hand, the Federal Reserve could really shake the markets. The Federal Funds Rate is expected to remain at 0.25% in the January meeting but anything could happen as the inflationary pressure is high. The FED is expected to hike rates three times during the year and end its pandemic QE program.

The FOMC Statement, FOMC Press Conference, BOC Rate Statement, and the BOC Press Conference could bring high volatility and sharp movements.

USD/CAD Natural Retreat!

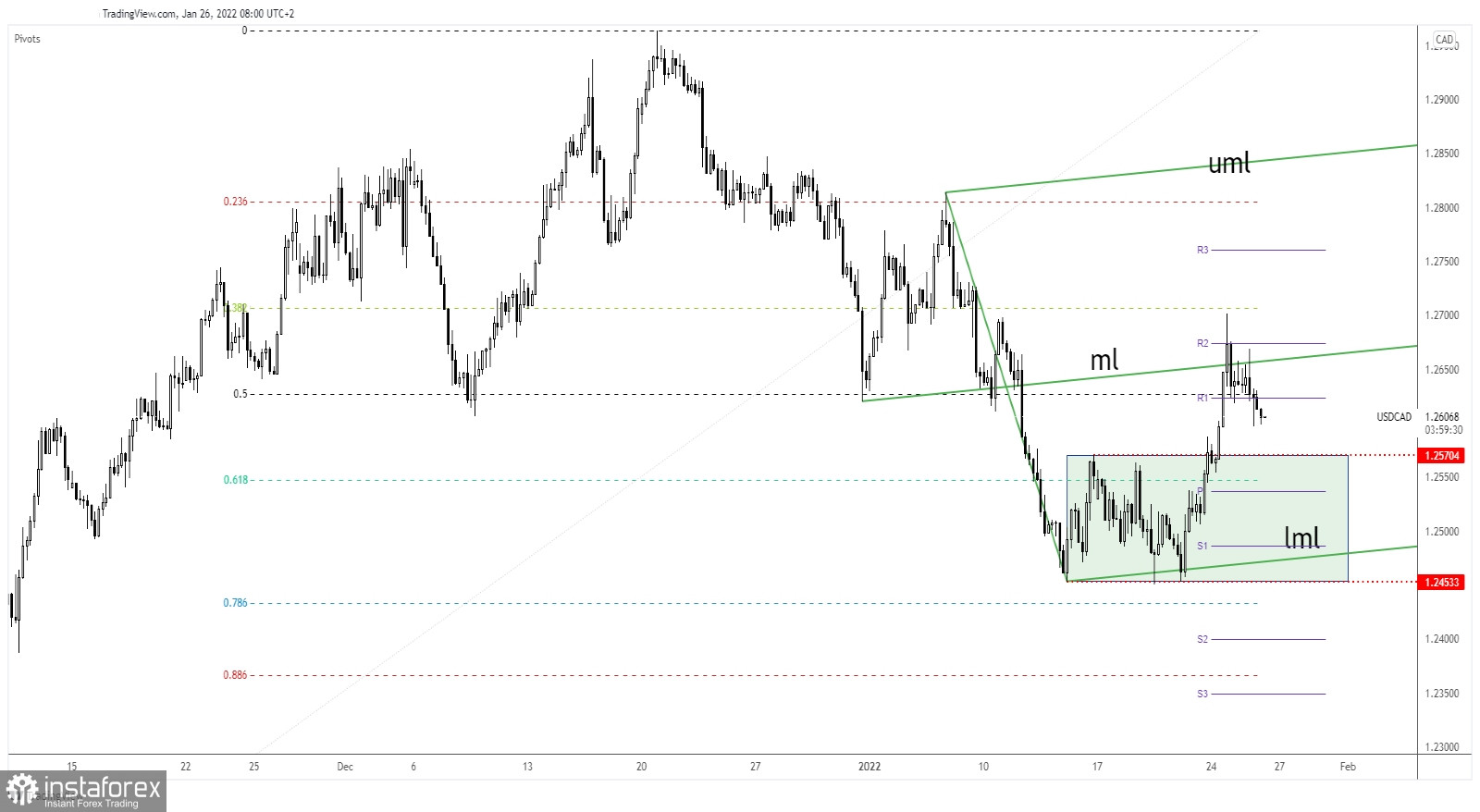

As you can see on the h4 chart, the pair found resistance at the downtrend line, R2 (1.2674), and above the ascending pitchfork's median line (ml). Now, it could reach and retest 1.2570 static support. After its false breakouts, a temporary downside movement is natural.

As long as it stays under the downtrend line, USD/CAD could extend its downside movement. Still, the price action signaled that the downwards movement ended around the 1.2453 level. Staying near the downtrend line could announce an imminent upside breakout.

USD/CAD Prediction!

The current retreat could end around 1.2570. A minor drop was natural after reaching the near-term resistance levels and after its amazing rally. The decline could help the buyers to catch new buying opportunities from around the immediate support levels. A valid breakout above the downtrend line could really announce a strong leg higher.