In anticipation of the Fed's next meeting, many analysts have relied on strengthening the dollar. Experts' expectations came true: the US currency briefly rose, but this did not add optimism to the market. There is still tension among investors and traders, as surprises can be expected from the regulator.

Following the meeting of the FOMC of the US Federal Reserve System, the target range of the federal funds rate remained at the same level (0.00% –0.25%), as well as the rate on required reserves (0.10%). The speed of implementation of the asset purchase program (QE) has also remained unchanged, but the Fed has adjusted its forecasts for inflation, GDP and other indicators.

According to the revised data, the regulator expects inflation to increase in the near future. This year, the projected inflation rate will be 1.2%, and it will rise to the target 2% by 2023. If such a three-year scenario is implemented, the Fed will not increase the rate.

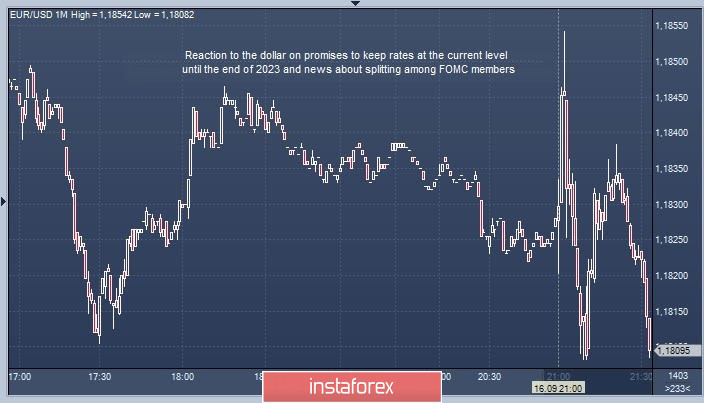

The news about maintaining the current level of rates until 2023 upset the market. According to experts, the dollar bulls may lose. Their position looks shaky, although the US currency increased after the statements of Jerome Powell. However, analysts emphasize that its growth was temporary.

Moreover, the price growth was also provoked by J. Powell's refusal to expand the QE program, although he already announced his readiness to use any means to support the market and the national economy. Another unpleasant surprise for the market was a kind of split in the ranks of the FOMC.

It turned out that not all representatives of the FOMC support long-term maintenance of ultra-low rates. Robert Kaplan, president of the Fed's Dallas and Neel Kashkari, president of the Minneapolis FRB expressed doubts about this strategy. They voted against prolonging the US rate cut. R. Kaplan offered to show more flexibility in this matter, while N. Kashkari is suggesting that ultra-low rates are needed by the FRS only until the moment when core inflation reaches a stable level of 2%. The current situation did not allow the USD to drop, since the current inflation coincided with the expected one, but did not exceed the forecast.

According to the specialists' observations, the market considered this discrepancy in the FOMC's views a "hawkish" signal. Against this background, the EUR/USD pair updated new lows near the 18th figure. Last night, the classic pair traded around the level of 1.1803 and this morning, it met at 1.1755, but later began to increase sharply. The current rise of the pair has reached the range of 1.1765-1.1766, and this is not the limit.

Macro statistics, which also bring surprises, contribute to the rise of the dollar. According to the latest data, the level of consumer spending in the United States has fallen, and employment growth has taken a break. Experts also recorded increased activity in the manufacturing sector and stabilization in the service sector.

Another source of uncertainty for the US economy and the national currency is the upcoming US presidential elections. They can greatly undermine the dollar's position, although the outcome of the elections is difficult to predict. Therefore, many experts recommend buying the USD on the wave of the Fed's relative optimism, despite plans to raise rates in 2023. But the situation may change several times for the next three years, and the market needs to consider this. Analysts consider the further tightening of the Fed's monetary policy in 2024 to be one of the most likely scenarios.