To be honest, the results of the meeting of the Federal Committee on Open Market Operations (FOMC) was pleasantly surprising. We did not expect aggressive rhetoric. Formally, the Federal Reserve has left everything as it is, which distinguishes it from the European Central Bank, which, in fact, is only engaged in expanding stimulus measures. But the US regulator does not intend to engage in such meaningless. In addition, Jerome Powell uttered during his press conference the familiar phrase that interest rates will remain at current levels until inflation and unemployment are close to target levels. So, at first glance, nothing has changed. However, the Fed has significantly raised its own economic forecasts, hinting that it may start considering raising interest rates as early as next year, especially since inflation in the United States is rising, and the unemployment rate is gradually going down. So the result of yesterday's meeting is that the US regulator sent a signal about the imminent tightening of monetary policy. And judging by the rapid strengthening of the dollar, investors got it right.

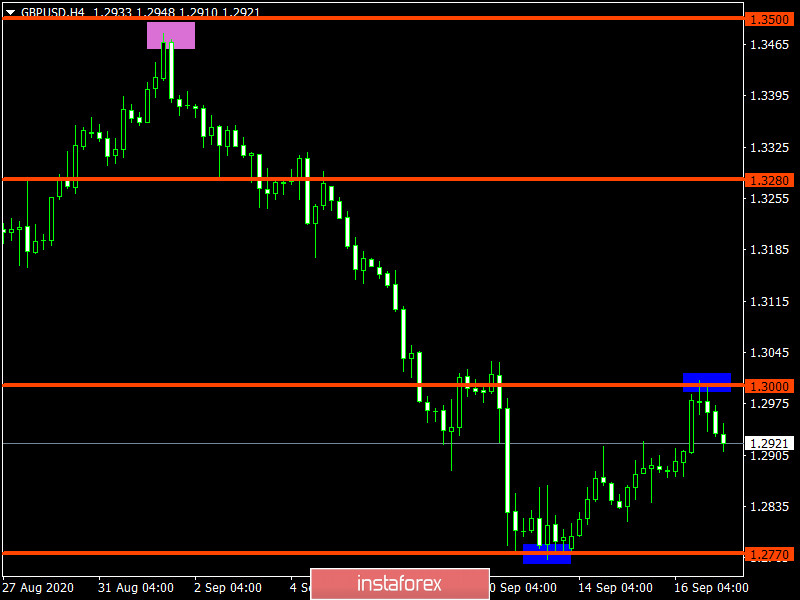

At the same time, the US statistics were relatively positive yesterday. Retail sales growth accelerated from 2.4% to 2.6%. However, the acceleration in growth rates occurred only due to the revision of previous data for the worse, from 2.7% to the same 2.4%. Therefore, to some extent, we are talking about a slowdown in growth rates.

Retail Sales (United States):

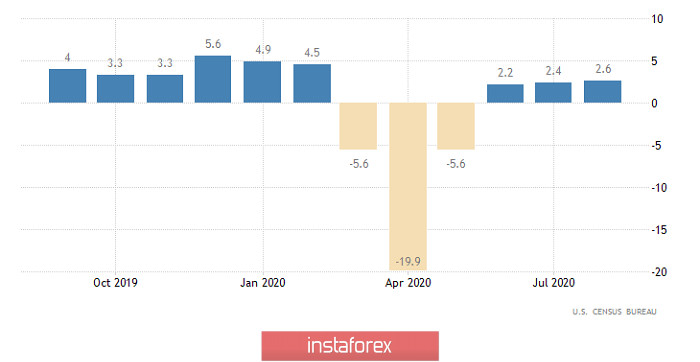

We have an extremely busy day today, and it will begin with the publication of the final data on inflation in Europe. They must confirm the fact that consumer prices have fallen by -0.2%, despite the fact that the growth rate was 0.4% last month. That is, Europe plunged into deflation. Nevertheless, we should not expect some kind of panic, because investors have known about this since the publication of preliminary data. However, this is clearly not a factor contributing to the strengthening of the single European currency. That is, there seems to be no reason to decline, but there is nothing to grow from either.

Inflation (Europe):

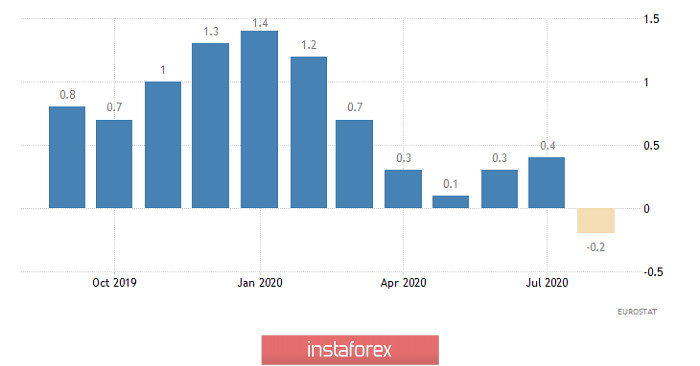

Yesterday, the pound behaved differently from other currencies, it even sharply rose briefly. However, Jerome Powell's speech brought it back. The fact is that Boris Johnson made certain concessions regarding the law on the protection of the UK internal market. If the Prime Minister of the United Kingdom initially proposed to give the ministries the full right to independently decide on the introduction of certain restrictions on the movement of goods between Northern Ireland and the rest of the UK, this now requires the approval of the House of Commons. In short, parliamentarians really do their best to ensure that the final version of the bill is not so extreme, which will allow the EU to negotiate again. Otherwise, we will face unregulated Brexit, with all its dire consequences for the British economy. Most likely, there will be new information about the course of the negotiations today, which will also be perceived with investors' optimism. However, we should not rely on the pound's growth, since it will be hindered by the Bank of England. Given all these issues, the Bank of England may hint at possible more easing of monetary policy in the near future. So if investors do not get another batch of positive news about the progress of the discussion of the law on the protection of the UK internal market, the pound will continue to decline.

The day will end with data on applications for US unemployment benefits, forecasts for which cause some concern. On the one hand, the number of initial applications should decline from 884 thousand to 830 thousand, but the number of repeated applications may increase from 13 385 thousand to 13 500 thousand. So, in general, there may be growth in the number of applications for benefits, which indicates that the pace of recovery of the labor market is significantly slowing down again, although the unemployment rate continues to remain so high. This is a negative factor for the dollar, so it definitely has no place to rise at least with the Euro. In view of this, the dollar's growth yesterday was quite impressive. Therefore, we can expect a small technical correction in the afternoon.

Repetitive Unemployment Insurance Claims (United States):

The EUR/USD pair managed to rebound from the resistance level of 1.1900, where the quote came a few days ago. As a result, a move was formed in the direction of the variable level of 1.1755, where the price slowed down and rebounded during the periods of August 21, August 27 and September 9. We can assume that the level of 1.1755 will affect short positions in terms of slowing down, where a repetition of the price rebound is not excluded. If the downward interest persists and the quote manages to consolidate below 1.1750, then we can consider further declining towards the main support point of 1.1700.

The GBP/USD pair at the correction stage from the level of 1.2770, reached the psychological level of 1.3000, where the price rebounded in the opposite direction. In this situation, we should closely monitor the level of 1.2885, since price consolidation below it will lead to the resumption of the inertial move on September 1. Otherwise, a turbulence awaits between the levels 1.2885/1.3000.