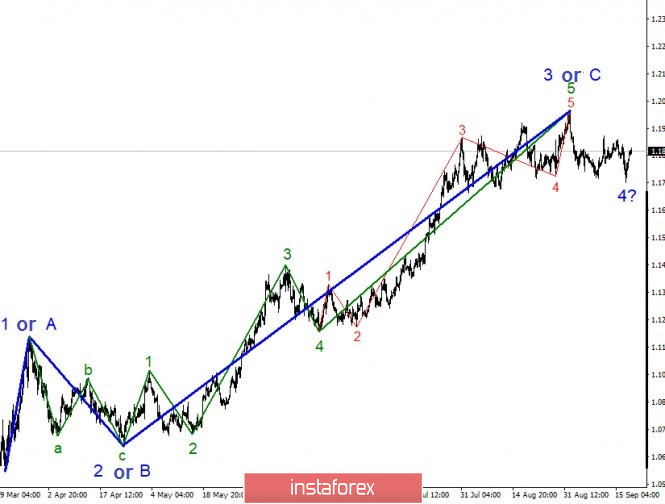

The wave counting of the EUR/USD instrument in global terms still looks quite convincing, and the daily movements of the instrument completely fit into it. Yesterday, a sharp retreat of quotes from the lows reached around the 17th figure began, which suggests that the instrument is ready to complete the construction of the expected wave 4. If this is true, then from the current positions, the instrument may start building upward wave 5, which will lead to complications of the entire upward trend. At the same time, wave 4 can take a much more complex and extended form.

A smaller-scale wave counting indicates that the intended wave 2 or b in 4 has completed its construction. In addition to it, wave 3 or C in 4 and, accordingly, the entire wave 4 could complete its construction. Thus, it should not be surprising if the increase in the euro quotes resumes from the current positions. However, you still need to be prepared for the fact that the entire wave 4 will take a longer and more complex form.

Economic publications, meetings of the ECB and the Fed were left behind. Thus, the markets are again focusing on other topics that are of great importance for America, its economy, and the euro/dollar instrument. There is less news from the European Union. The ECB meeting has passed and there is nothing more to say about it. In general, both the ECB and the Fed concluded that the economy is recovering, however, the risks of a pandemic are still high, and economic activity is lower than before the epidemic. Now it's time to switch to the new outbreak of coronavirus infection. In America, however, the situation with the coronavirus has not improved. Moreover, the country's authorities seem to have forgotten that 40-50 thousand Americans are infected every day. More "airtime" is devoted to elections. The situation in the European Union is much calmer. Only France and Spain are experiencing new COVID-2019 outbreaks. Thus, the epidemiological situation is now more favorable in the EU.

The topic of elections for America remains the main one. For example, Joe Biden, the Democratic presidential candidate, believes that "Trump should leave" because "he made too many mistakes in the fight against coronavirus," which is "almost a crime". Biden quoted the Director of the Federal Centers for Disease Control and Prevention as saying that "about 100,000 lives could have been saved if the mask regime had been introduced on time". However, "Trump was more interested in trading on the stock exchange at that time," according to Joe Biden. The US dollar may start to decline again, which will fit into the current wave pattern, which allows for the construction of a fifth upward wave.

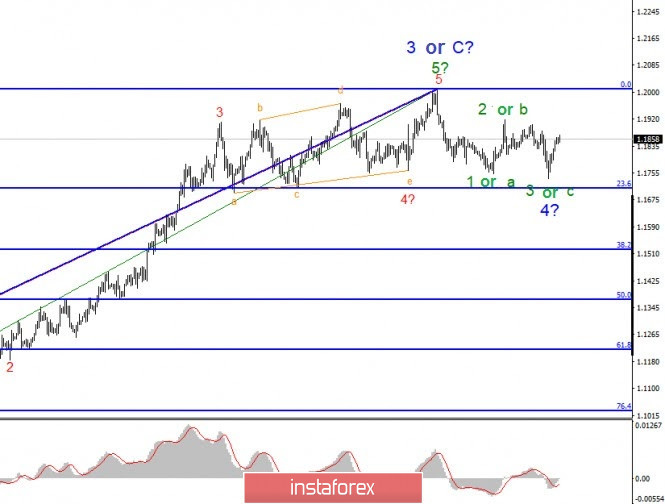

General conclusions and recommendations:

The euro/dollar pair presumably completed the construction of the global wave 3 or C and the second corrective wave as part of the trend section that begins on September 1. Thus, at this time, I still recommend selling the instrument with targets located near the calculated levels of 1.1706 and 1.1520, which corresponds to 23.6% and 38.2% Fibonacci, for each MACD signal down. However, it is also possible that wave 4 has already been completed.