Latest COT report (Commitments of Traders) and weekly outlook for GBP/USD

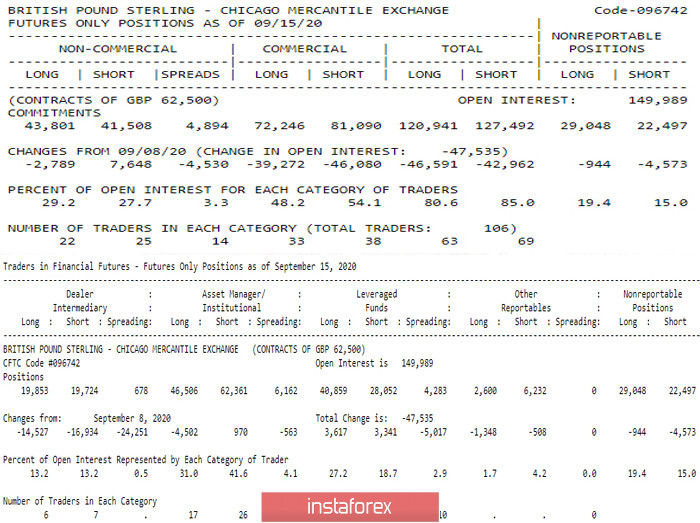

A sharp decline in the pound's open interest (149989 against 197524; -47535) can be observed. At the same time, the total position retained its adherence to the bearish direction, and it can be noted that it (p.p. 6551 (+3629)) is strengthening. All this became possible as a result of the fact that the Non-Commercial group changed its priority agai (p.p. short 2293), giving preference to investments in short positions (long -2789 - short +7648). Moreover, the latest COT report shows unity between Non-Commercial and Commercial, which are now supporting the bears.

The main conclusion

The COT report for 09/15/2020 was dominated by the bearish mood. After taking a break and reflecting, the majority of forces is tilted towards the bearish players, despite the decline in the pound's open interest.

Technical picture

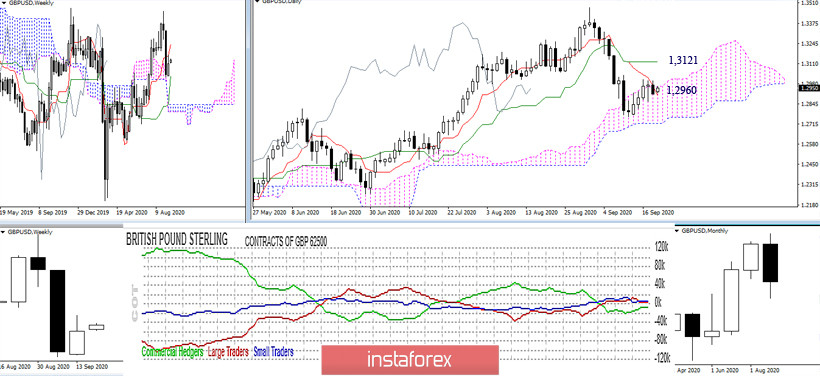

Technically, bullish traders rose to important corrective resistances (daily Tenkan + upper border of the daily cloud) last week, which is a good area to complete the upward correction and continue the decline. In case of a breakdown of the daily cloud (area 1.27), which is now reinforced by the weekly medium-term trend, a new downward target will be formed, and there will be new prospects for the downside. Meanwhile, Slowing down and breaking the accumulated resistance (1.30) will return the pair to the historic level of 1.32, which may delay the implementation of bearish plans for a long time.

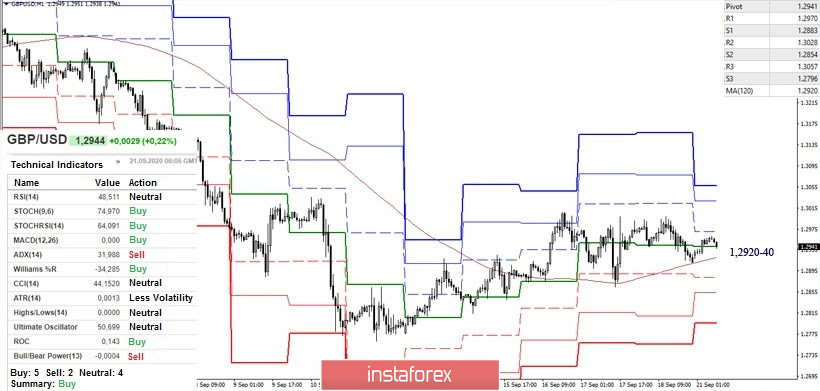

The pair is testing key levels again at the smaller time frames. Today, it is 1.2920-40 (central pivot level + weekly long-term trend). A consolidation below will return the relevance of the recovery of the downward trend (1.2762). On this path, the support of classic pivot levels within the day (1.2883-1.2854-1.2796) can be noted.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classical), Moving Average (120)