Due to the growing fears for another coronavirus surge on the economy, global markets are going lower. European stocks are deep in the red, the Euro Stoxx 50 is losing more than 3%, November Brent and WTI futures are losing more than 2%, and the yen has strengthened against the dollar to a six-month high. Simultaneously, the explanation that the markets are afraid of coronavirus looks somewhat strained, but there is no other explanation. Similarly, the decline in the United States indices on Friday by more than 2% passed for no apparent reason, and the third consecutive weekly drop in the S&P 500 hints at a reversal, since Democrats and Republicans can not agree on the size of the next QE. And without QE, markets can not grow due to the complete lack of economic prerequisites for growth.

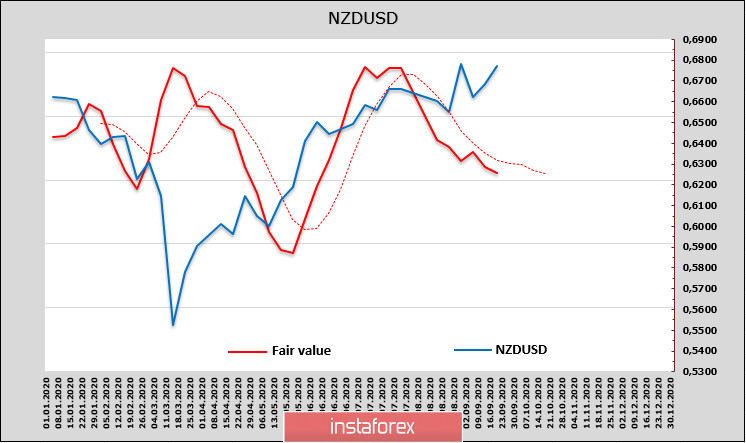

NZD / USD

The Reserve Bank of New Zealand will hold a meeting on monetary policy this coming Wednesday, September 23. In spite of the fact that most experts are inclined to change the tone in the statements of the RBNZ in a clearly dovish direction, it is not expected to reduce the rate from the current 0.25% at the next meeting, for this will happen a little later. More attention is focused on the possible expansion of the incentive program, and this is probably going to be announced as early as the day after tomorrow.

Although a lot of macroeconomic indicators were released during the week, they did not have a noticeable impact on the kiwi exchange rate. The obvious negative is contained in the Westpac survey on the dynamics of consumer sentiment in the 3rd quarter. Instead of the expected growth, a decrease was recorded from 97.2 p to 95.1 p. A negative result increases the likelihood of expanding the incentive program.

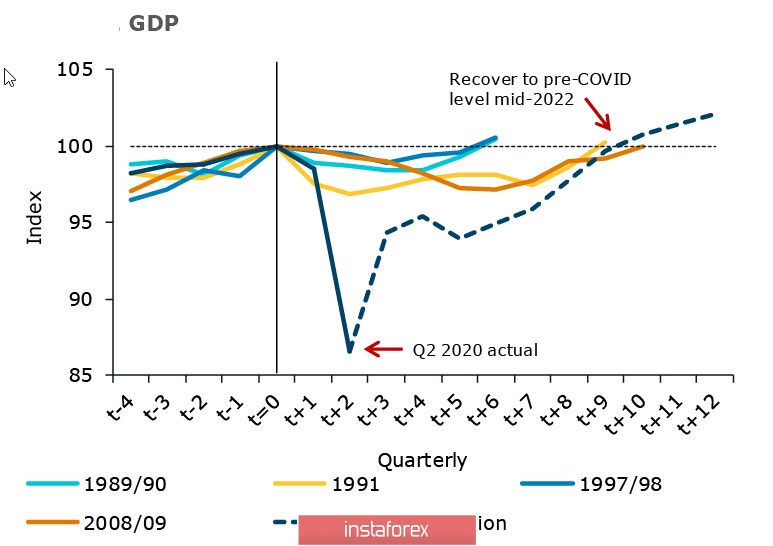

As for the sharp drop in GDP by 12.2% in Q2, the result is close to the forecast level. The fall is much deeper than in any recession before, so the picture is similar in all other countries.

After the Federal Reserve meeting last week, the kiwi rose on reports that the government has adjusted the bond issue program for 2020/21. downward by $ 10 billion, which was seen by markets as a bullish signal.

The opposite sentiment was noted, as for the CFTC report. The net long position of NZD decreased by 107 million to a symbolic 218 million, taking into account the dynamics of stock indexes and the alignment of the yield curve on Monday morning. The estimated price continues to look South. This means that the formation of the 0.6796 vertex can be finalized, and the double vertex (the first one from September 2) will serve as the basis for a deeper correction.

The most likely scenario is a downward movement below the trend line of 0.6710 and further to the support of 0.6670. The goal is a local minimum of 0.6596 with good chances to go lower.

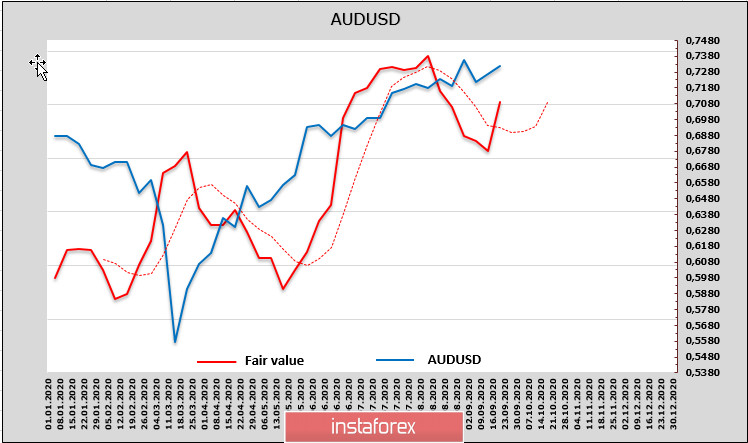

AUD / USD

The Australian dollar looks much more convincing than most G10 currencies. Last week, it moved from a net short position to a net long position, an increase of 1.332 billion, which is the largest weekly increase in 3 months. Thereby, the estimated price went up sharply, which gives additional grounds for AUD to continue growing.

This positive situation was supported by a good employment report for August. The growth of new jobs was 111 thousand, while a decrease of 50 thousand was expected, and unemployment fell from 7.5% to 6.8%.

An additional growth factor is an article published on the website of Reserve Bank of Australia on September 17, in which the Central Bank hints at the possibility of using non-traditional methods of stimulation, which will eventually lead to higher economic results, primarily positive changes in the labor market.

The Australian dollar oozes with confidence due to the reason that only the growth of anti-risk sentiment can prevent growth. Nevertheless, the growth of AUD/NZD looks very likely to continue. The target is 1.0840, against the dollar, a pullback down which can be used for purchases with the goal of going above the resistance of 0.7347 and further to 0.7415.