Outlook on September 22:

Analytical overview of currency pairs on the H1 TF:

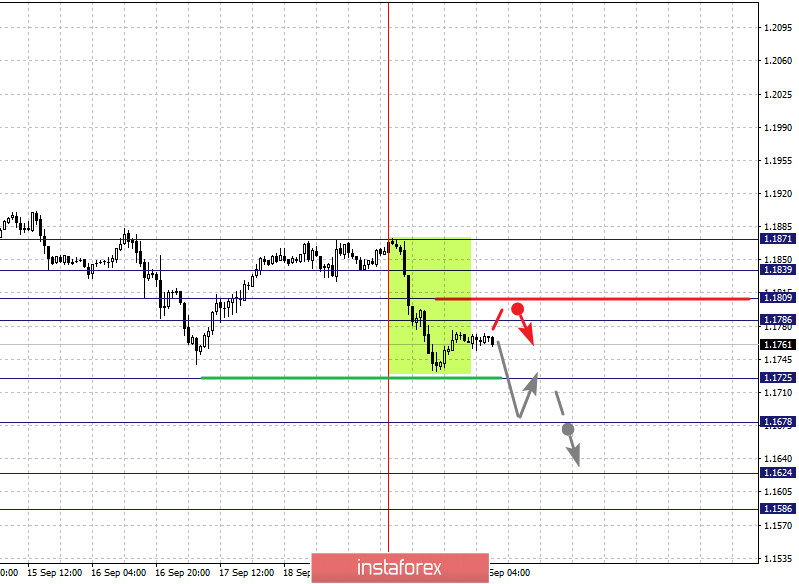

The key levels for the euro/dollar pair on the H1 chart are 1.1871, 1.1839, 1.1809, 1.1786, 1.1725, 1.1678, 1.1624 and 1.1586. The price here is forming a potential for the downside movement from September 21. The decline is expected to continue after the breakdown of 1.1725. In this case, the target is 1.1678. Breaking through which will be accompanied by a strong decline to the level of 1.1624. For the potential value for the bottom, we consider the level of 1.1586. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 1.1786 - 1.1809. If the last value breaks down, it will lead to a deep correction. Here, the target is 1.1839, which is the key support for the downward structure.

The main trend is building capacity for the downward cycle of September 21

Trading recommendations:

Buy: 1.1786 Take profit: 1.1808

Buy: 1.1811 Take profit: 1.1839

Sell: 1.1725 Take profit: 1.1680

Sell: 1.1677 Take profit: 1.1625

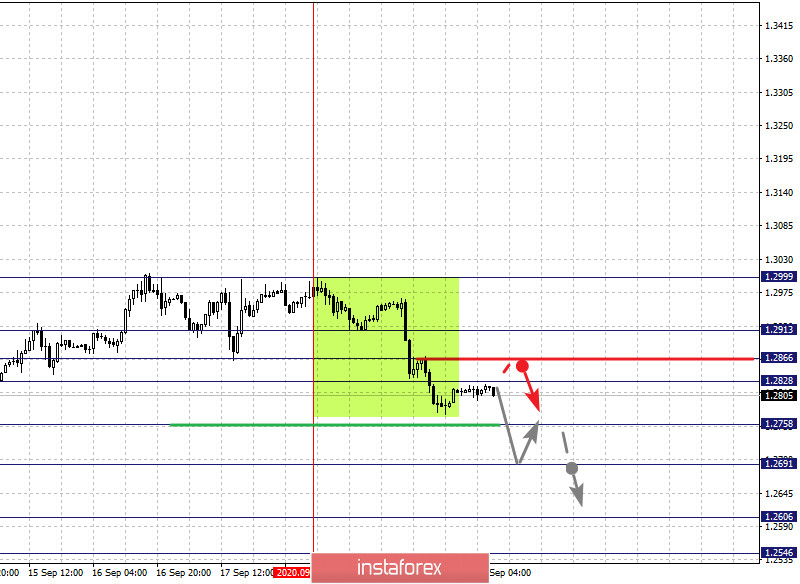

The key levels for the pound/dollar pair are 1.2913, 1.2866, 1.2828, 1.2758, 1.2691, 1.2606 and 1.2546. The price is forming a local potential for the downward movement from September 18. On the other hand, a short-term downward movement is expected in the range 1.2758 - 1.2691. In case of breakdown of the last value, it will lead to a strong downward movement. The target here is 1.2606. For the potential value for the bottom, we consider the level of 1.2546. Upon reaching which, we expect an upward pullback.

A short-term upward movement is expected in the range of 1.2828 - 1.2866 and breaking through the last value will lead to a deep correction. Here, the target is 1.2913, which is the key support for the downward structure.

The main trend is the formation of a local structure for the low of September 18

Trading recommendations:

Buy: 1.2828 Take profit: 1.2864

Buy: 1.2867 Take profit: 1.2911

Sell: 1.2758 Take profit: 1.2693

Sell: 1.2689 Take profit: 1.2607

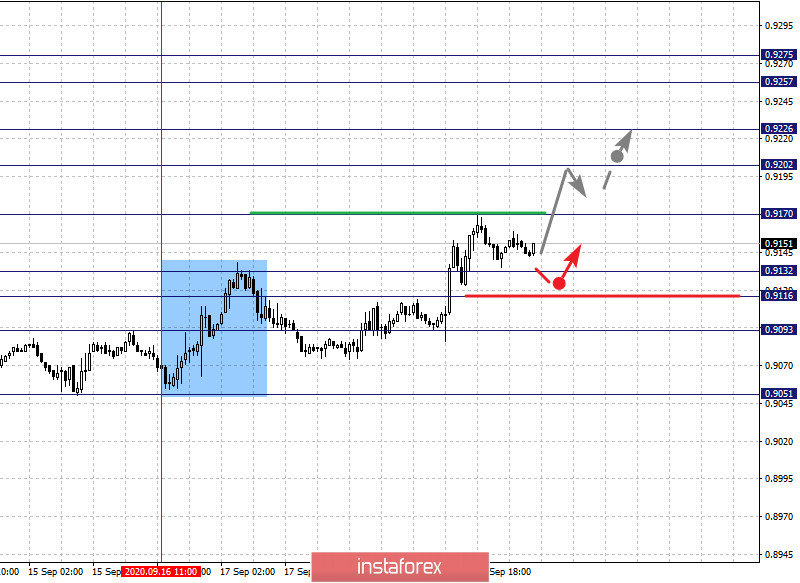

The key levels for the dollar/franc pair are 0.9275, 0.9257, 0.9226, 0.9202, 0.9170, 0.9132, 0.9116 and 0.9093. Here, we are following the upward pattern from September 16. Moreover, the downward movement is expected to continue after the breakdown of 0.9170. In this case, the target is 0.9202. There is a short-term upward movement and consolidation in the range of 0.9202 - 0.9226. If the last value breaks down, it will lead to a strong upward movement. The target is 0.9257. For the potential value for the top, we consider the level of 0.9275. Upon reaching which, we expect a downward pullback.

Now, a short-term downward movement is possible in the range of 0.9132 - 0.9116. The breakdown of the last value will lead to a deep correction and the target is 0.9093, which is a key support for the top.

The main trend is the upward cycle from September 16.

Trading recommendations:

Buy : 0.9170 Take profit: 0.9200

Buy : 0.9203 Take profit: 0.9224

Sell: 0.9132 Take profit: 0.9117

Sell: 0.9115 Take profit: 0.9095

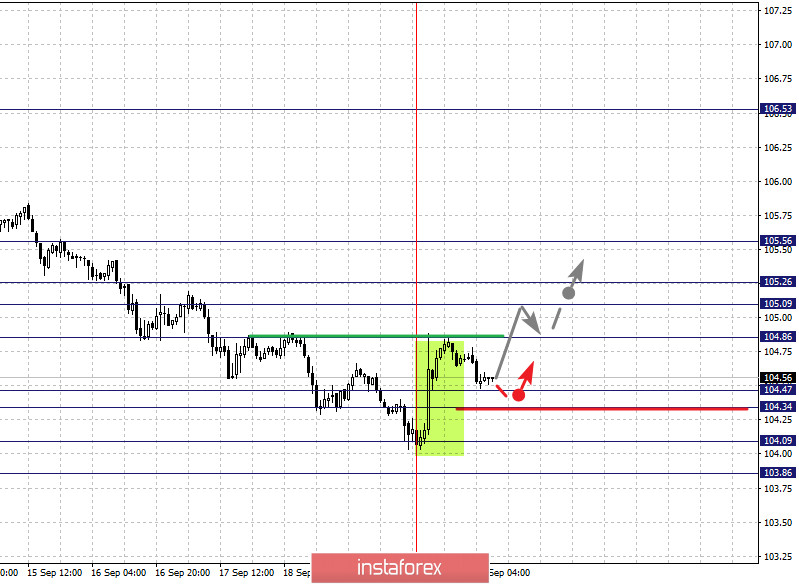

The key levels for the dollar/yen are 105.56, 105.26, 105.09, 104.86, 104.47, 104.34, 104.09 and 103.86. The price is in a correction from the downward trend and is forming a potential for the September 21 high. Now, the continuation of decline is expected after the price passes the noise range 104.47 - 104.34. In this case, the target is 104.09. For the potential value for the bottom, we consider the level 103.86. Upon reaching which, we expect an upward pullback.

The development of the upward structure from September 21 is expected after the breakdown of 104.86. In this case, the target is 105.09. The range of 105.09 - 105.26 is the key support for the downward structure and the price passing this level will dispose to the formation of initial conditions for the upward cycle. Here, the potential target is 105.56.

Main trend: descending structure from September 4, correction stage

Trading recommendations:

Buy: 104.88 Take profit: 105.09

Buy : 105.27 Take profit: 105.52

Sell: 104.34 Take profit: 104.10

Sell: 104.07 Take profit: 103.88

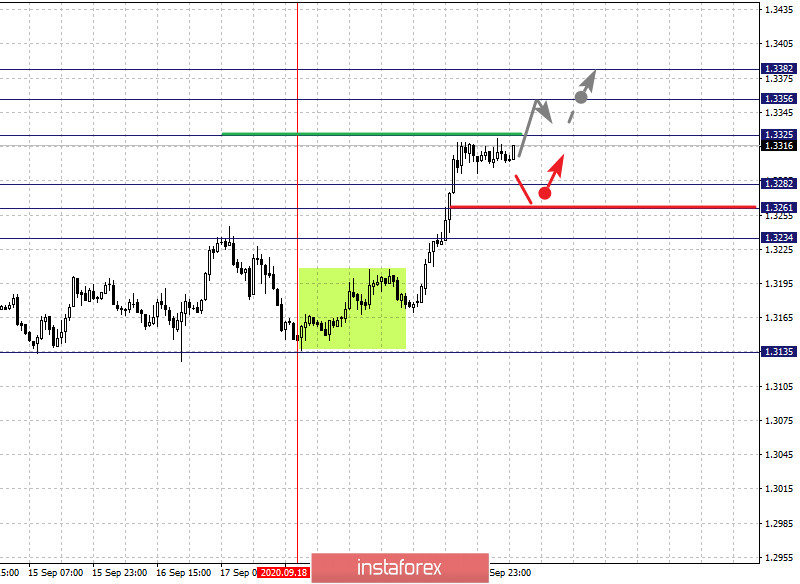

The key levels for the USD/CAD pair are 1.3382, 1.3356, 1.3325, 1.3282, 1.3261 and 1.3234. We are following the local upward structure from September 18th. Here, the continuation of the upward movement is expected after the breakdown of 1.3325 (level of 1.3261 is the key support). In this case, the target is 1.3356. On the other hand, we consider the level 1.3382 as a potential value for the top. Upon reaching which, we expect consolidation.

A short-term downward movement is possible in the range of 1.3282 - 1.3261. If the last value breaks down, it will lead to a deep correction. The target is 1.3234, which is the key support for the main trend.

The main trend is the local upward structure of September 18

Trading recommendations:

Buy: 1.3325 Take profit: 1.3356

Buy : 1.3357 Take profit: 1.3380

Sell: 1.3282 Take profit: 1.3262

Sell: 1.3259 Take profit: 1.3234

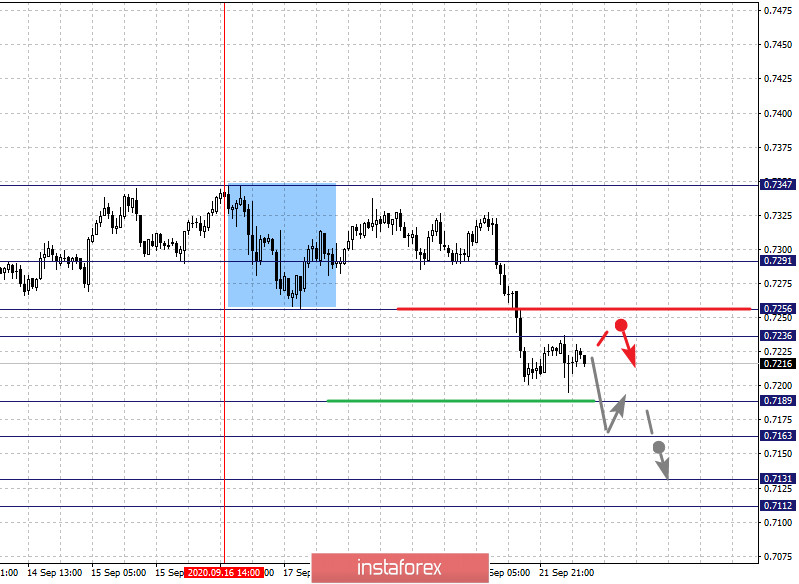

The key levels for the AUD/USD pair are 0.7291, 0.7256, 0.7236, 0.7189, 0.7163, 0.7131 and 0.7112. We are following the development of the downtrend cycle from September 16. At the moment, the continuation of decline is expected after the breakdown of 0.7189 (level of 0.7256 is the key support). In this case, the target is 0.7163. There is consolidation near this level. The breakdown of the indicated target will lead to a strong decline. Our next target is 0.7131. For the potential value for the top, we consider the level of 0.7112, from which an upward pullback is expected.

A short-term upward movement is possible in the range of 0.7236 - 0.7256 and breaking through the last value will lead to a deep correction. Here, the target is 0.7291.

The main trend is the downward cycle from September 16

Trading recommendations:

Buy: 0.7236 Take profit: 0.7255

Buy: 0.7258 Take profit: 0.7290

Sell : 0.7189 Take profit : 0.7165

Sell: 0.7161 Take profit: 0.7131

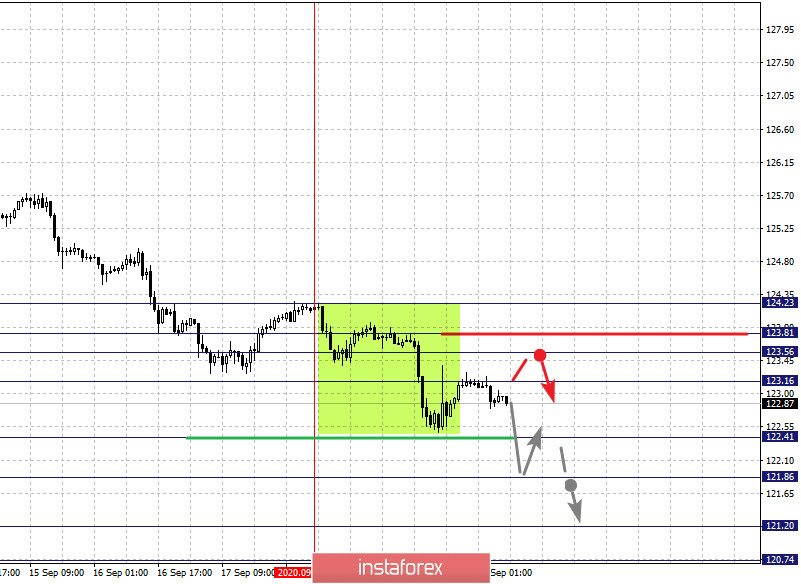

The key levels for the euro/yen pair are 124.23, 123.81, 123.56, 123.16, 122.41, 121.86, 121.20 and 120.74. Here, the price has formed a local descending structure from September 18th. The decline is expected to continue after breaking through the level of 122.41. In this case, the target is 121.86 and there is consolidation near this level. If the target breaks down, it will lead to a sharp decline. Here, our next target is 121.20. For the potential value for the bottom, we consider the level of 120.74. Upon reaching which, we expect consolidation and upward pullback.

Meanwhile, leaving into correction is expected after the breakdown of 123.16. The target is 123.56, while the range of 123.56 - 123.81 is the key support for the downward structure. The price passing this range will lead to the development of an upward structure. Here, the first potential target is 124.23.

The main trend is the local descending structure of September 18

Trading recommendations:

Buy: 123.16 Take profit: 123.56

Buy: 123.81 Take profit: 124.23

Sell: 122.40 Take profit: 121.88

Sell: 121.84 Take profit: 121.20

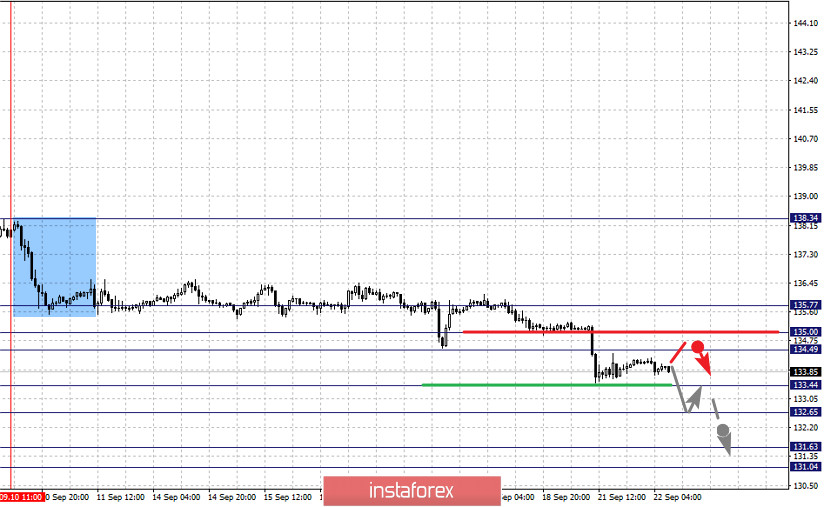

The key levels for the pound/yen pair are 135.77, 135.00, 134.49, 133.44, 132.65, 131.63 and 131.04. We are following the local descending structure from September 10th. Now, a short-term downward movement is expected in the range of 133.44 - 132.65. If the last value breaks down, it will lead to a sharp decline. Here, the target is 131.63. For the potential value for the bottom, we consider the level of 131.04. Upon reaching which, we expect an upward pullback.

A short-term upward movement is expected in the range of 134.49 - 135.00. If the last value breaks down, it will lead to a deep correction. The target here is 135.77, which is the key support for the downward structure.

The main trend is the local descending structure of September 10

Trading recommendations:

Buy: 134.49 Take profit: 135.00

Buy: 135.03 Take profit: 135.75

Sell: 133.44 Take profit: 132.67

Sell: 132.63 Take profit: 131.63