To open long positions on GBPUSD, you need:

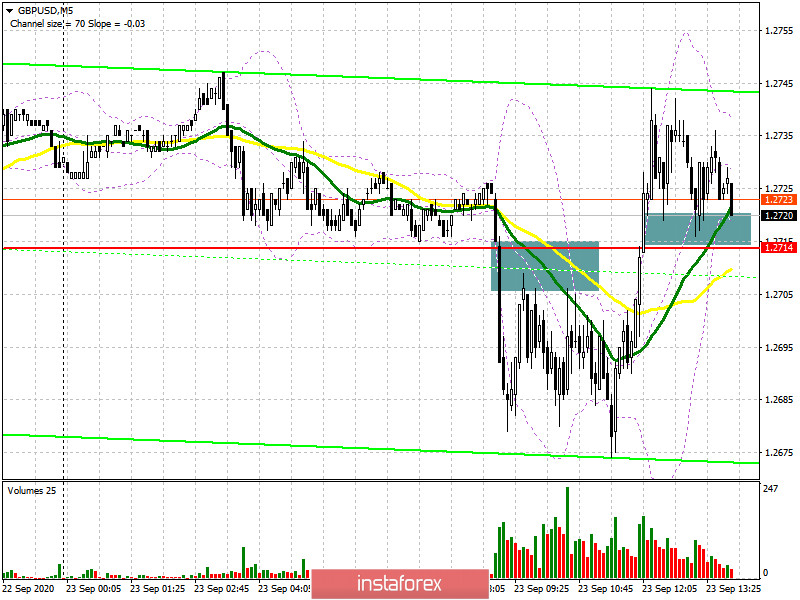

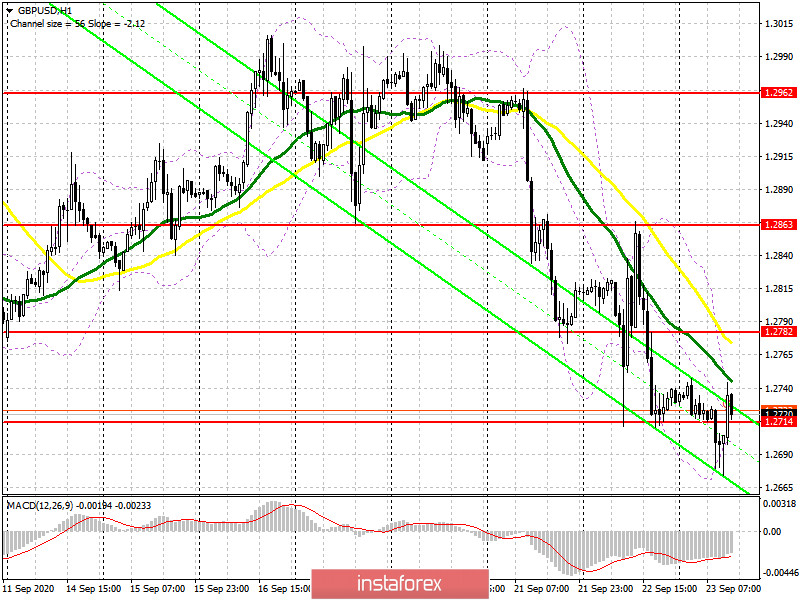

In the first half of the day, bears decided not to force events and retreated after the breakdown of support at 1.2714 and another lack of interest in short positions among major players, allowing buyers to prove themselves. On the 5-minute chart, the breakout and consolidation below the level of 1.2714 seem to allow us to enter short positions, however, it did not reach the normal test of the level of 1.2714 with the reverse, which was not a signal for further sale of the pound in my trading system. Now the pair has returned to the level of 1.2714 and a test of this area has already taken place from top to bottom. However, on the chart, we can see how a couple of points were not enough to form an unambiguous signal to buy the pound. Therefore, for those who are more conservative, it is best to wait for the real test of 1.2714 and open long positions in the expectation of continuing the upward correction. In any case, as long as trading is conducted above the range of 1.2714, you can expect the pound to grow in the short term and return to the resistance area of 1.2782. It is fixing above this range that will be the main task of the bulls for the second half of the day, which will form an additional signal to buy GBP/USD to return to 1.2863, where I recommend fixing the profits. If the pressure on the pound will be back in the afternoon, and the pair falls below the level of 1.2714, it is better not to hurry with the purchases, but wait until the minimum of 1.2645 is updated or buy GBP/USD immediately upon a rebound from the support of 1.2585 with the aim of an upward correction of 30-40 points inside day.

Let me remind you that the COT reports (Commitment of Traders) for September 15 recorded a reduction in long positions, and a large increase in short positions, which indicates the expectations of market participants and the high probability of a further decline in the pound, which may be caused by uncertainty with the conclusion of a trade agreement on Brexit. And if earlier in the week it was possible to say that further downward momentum may begin a gradual slowdown, which the market showed us, now the situation is again on the side of the sellers of the pound and the pair can continue its decline. During the reporting week, there was an increase in short non-commercial positions from the level of 33,860 to the level of 41,508. Long non-commercial positions declined from 46,590 to the level of 43,801. As a result, the non-profit net position fell sharply to 2,293 from 12,730 a week earlier.

To open short positions on GBP/USD, you need:

We see how the released reports on the UK PMI indices did not significantly affect the balance of power. The main task for the second half of the day for sellers remains to return and consolidate below the support of 1.2714, which they missed in the first half of the day. Only after testing this level from the bottom up can we expect a new signal to sell the pound with the main goal of falling to the area of the new weekly minimum of 1.2645, where I recommend fixing the profits. The longer-term target remains the area of 1.2585. If the GBP/USD continues to grow in the second half of the day, it is best to wait for the resistance update at 1.2782 and the formation of a false breakout. If there is no activity from the bears at 1.2782, it is best to abandon sales before updating the maximum of 1.2863 with the aim of a downward correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily averages, which indicates that the bear market is still in effect.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the upper limit of the indicator in the area of 1.2745 will lead to a new wave of growth of the pound. A break of the lower limit of the indicator in the area of 1.2690 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.