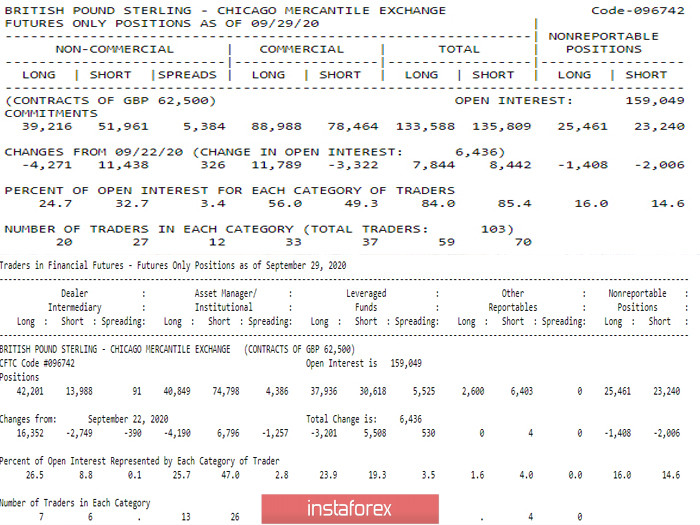

According to the COT report, open interest in the pound continued to grow (159049 (+6436)). At the same time, there is another special move and a change of preferences among the leading groups of major players. Non-Commercial (long -4271 - short +11438) and Commercial (long +11789 - short -3322) made almost equal efforts, but changed the basis of their net positions in opposite directions. Nevertheless, the total position retained the majority on the bears' side, just as clients of the leading Dealers continue to choose to decline.

The main conclusion

The sharp changes and frequent fluctuations in preferences indicate instability, a struggle of interests. Nevertheless, the final result still preserves the dominance of forces on the bears' side.

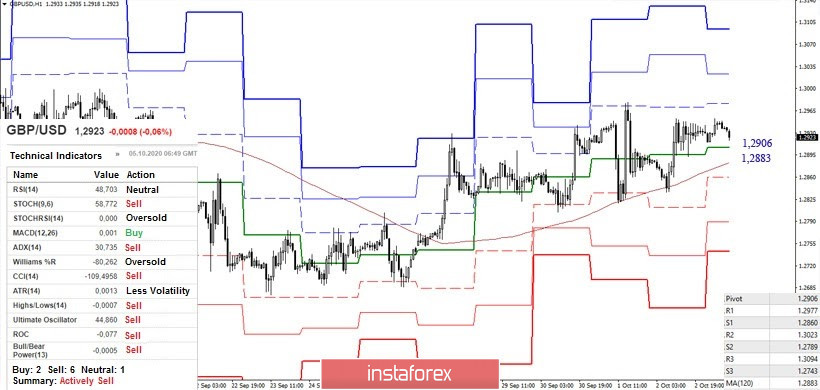

Technical picture

Technically, a slow development of the daily upward correction is observed. Last week, bulls leveled the previous gains of the bears and continued to insist on upward movement. Now, the pivot points for this are the resistance levels of 1.2943 (daily and weekly Fibo Kijun) - 1.3076 (weekly Tenkan + daily Kijun) - 1.32 (historical level + the final limits of the daily cross and cloud). In turn, the key support is still located in the area of 1.2777-11 (weekly Kijun + monthly Fibo Kijun).

The bulls' advantage in the smaller time frames is maintained due to the support levels of 1.2906 - 1.2883 (central pivot level + weekly long-term trend). The pivot points to continue the growth are at 1.2977 - 1.3023 - 1.3094. Meanwhile, a consolidation below the key supports 1.2906 - 1.2883 will change the current balance of power, making the main task for the bears to restore the downward trend (1.2674), while the nearest intraday support in the form of classic pivot levels can be noted today at 1.2860 - 1.2789 - 1.2743.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classical), Moving Average (120)