Financial markets can punish investors for being overconfident. Most Forex players expected that due to uncertainty in the run-up to the US presidential election, the dollar would strengthen. However, after the announcement of the results of the vote on November 3, against the background of growing global risk appetite, they should turn over and buy EURUSD. Unfortunately, at the end of the week, by October 9, it became clear that the strategy was failing. The growth of stock indices due to the increase in the popularity of Joe Biden forced the "bears" on the main currency pair to go on the defensive.

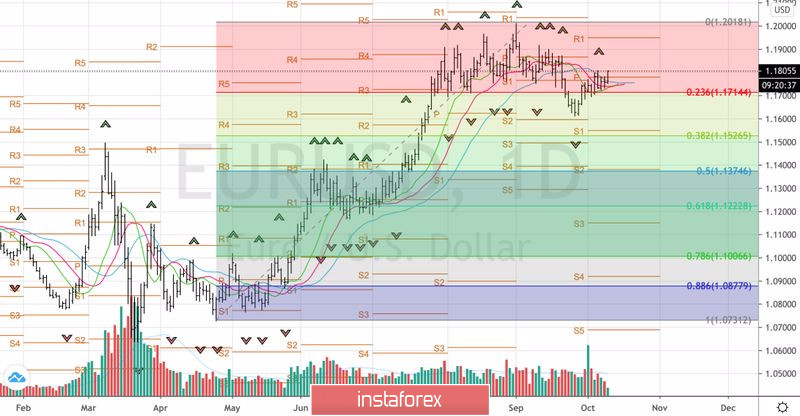

The Democrat is considered the best option for the S&P 500 in the short term, as his victory will raise the chances of a large-scale fiscal stimulus. Tax increases will be on the agenda, however, this is a long process. Thus, the stock market has a good opportunity to continue the rally after November 3. Supposedly, the dollar should come under pressure due to the growth of the double deficit, the budget, and the current account. However, this strategy does not guarantee success. Improving financial conditions in the United States increases the risks of inflation acceleration. How will the derivatives market react to CPI growth above 2% for several months in a row? Probably, it will begin to put in the quotes of dollar pairs the chances of normalization of the Fed's monetary policy, which is a "bullish" factor for the US currency.

Dynamics of financial conditions and inflation in the United States

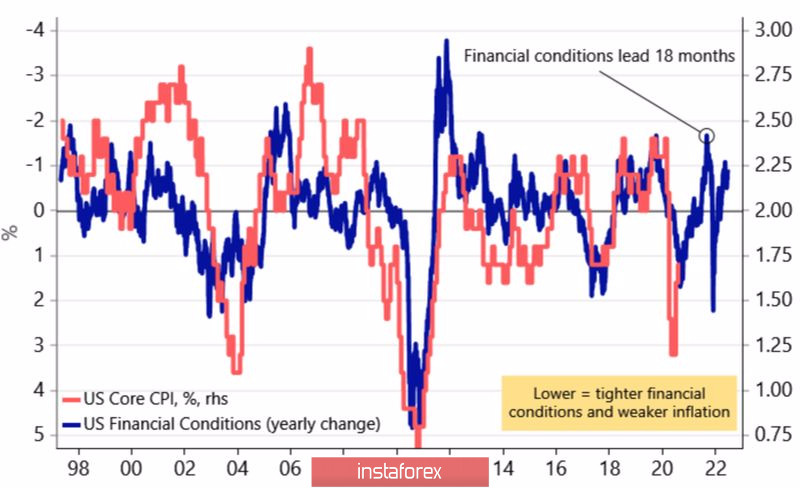

When forecasting the medium-term prospects for EUR/USD, one should also take into account such a factor as the ECB's unwillingness to let the pair go north. Verbal interventions, hints about increasing the scale of the emergency asset purchase program, and lowering rates are used by Christine Lagarde and her colleagues with enviable regularity. The degree of activity of the regulator is almost as high as in 2018 when the euro was trading near $ 1.25. This suggests that the 2017-2018 template will still be implemented. That is, after a pullback to 1.15-1.16, the EUR/USD pair will surely restore the upward trend.

Dynamics of EURUSD in 2017-2018 and 2020

Thus, one should not get carried away with buying euros. It is unlikely that the main currency pair will be able to storm the resistance at 1.188 and 1.195. First of all, Joe Biden has not won yet, and if this happens, there may be a wave of profit-taking on long positions. Second, we need to take into account the risks of Donald Trump not recognizing the results of the November elections, which will increase uncertainty and return investors' interest in the US dollar. Finally, due to political upheavals in the United States, Forex forgot about the second wave of COVID-19 in Europe, and it is gaining momentum.

Why do I believe in a EUR/USD rebound from the area of 1.15-1.16? In my opinion, the market will eventually be disappointed in the ability of US inflation to settle above 2% for a long time. The chances of holding the Fed rate will rise again, which will weaken the US dollar. European consumer prices, on the contrary, will start to accelerate, and China will support the economy of the currency bloc. As a result, the upward trend for the main currency pair will be restored. In the meantime, we should focus on selling it on the rebound from the resistance at 1.188 and 1.195.

EUR/USD, the daily chart