To open long positions on EURUSD, you need: a

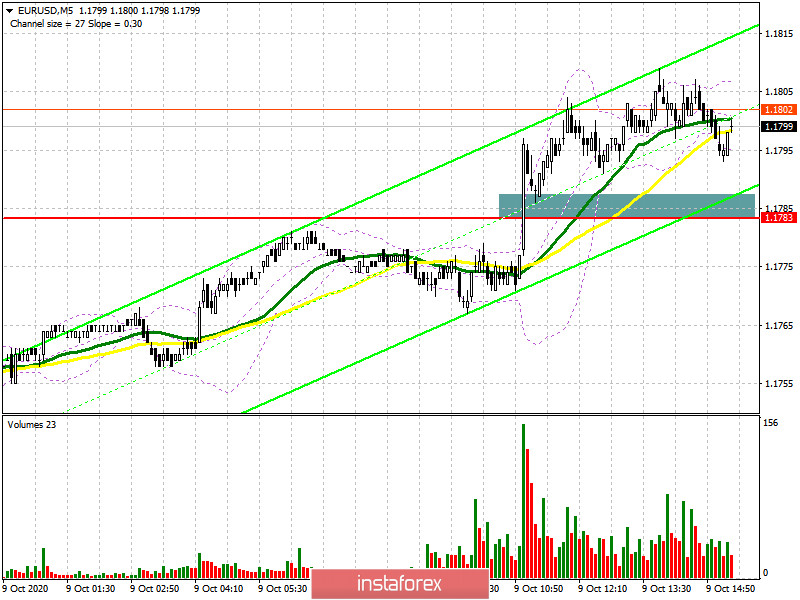

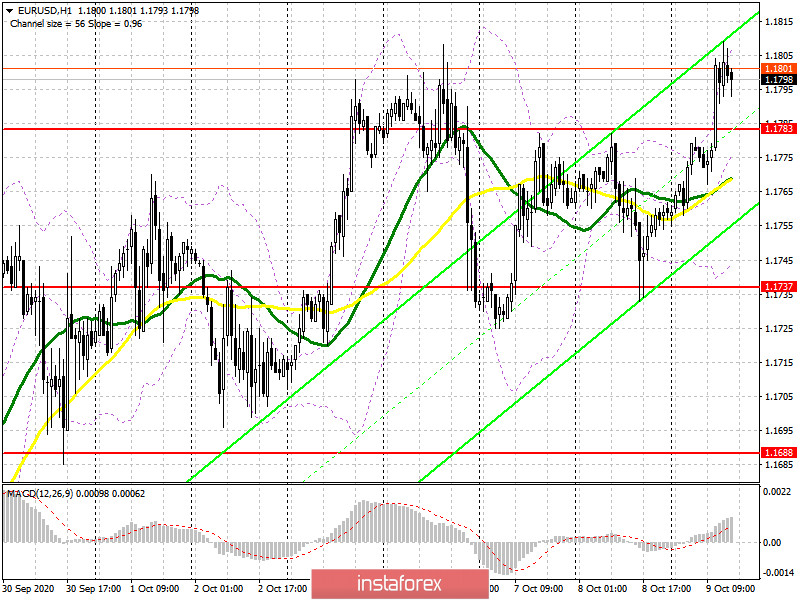

A sharp increase above the resistance of 1.1783 and no correction down to this level - all this did not allow the formation of a normal entry point for long positions on the euro. Thus, I had to skip the upward movement.

However, the focus will be on the North American session. You can open long positions from the level of 1.1783 only when a false breakout is formed there, after which the upward movement should take an active phase to update the maximum of 1.1828. A further area will be the maximum of 1.1868, where I recommend fixing the profits. If the rapid growth of the euro does not take place after the correction to the level of 1.1783, I recommend that you postpone long positions until the update of the larger support of 1.1737 and buy EUR/USD immediately for a rebound in the expectation of correction of 20-30 points within the day. Important fundamental statistics are not expected in the second half of the day, thus, volatility may remain at a fairly low level.

To open short positions on EURUSD, you need to:

The sellers' focus today is shifted to the protection of the resistance of 1.18286. You can sell from this level after a false breakout is formed there. But the bears' more important goal is to return the support of 1.1783 that they missed in the first half of the day today. For sure, at the first test, the bulls will try to return to the market from top to bottom, so I recommend opening short positions only after fixing under this level to reduce to the area of 1.1737, where I recommend fixing the profits. The longer-range target is at least 1.1688.

Let me remind you that the COT report (Commitment of Traders) for September 29 recorded a reduction in both long and short positions, which led to a decrease in the delta. The lack of benchmarks and a surge in the incidence of coronavirus in Europe discouraged major players from building up long positions in the euro, however, no one is in a hurry to buy the US dollar because of the upcoming US presidential election. Thus, long non-profit positions decreased from 247,049 to 241,967, while short non-profit positions decreased from 56,227 to 53,851. The total non-commercial net position also fell to 188,116 against 190,822 a week earlier, indicating a wait-and-see attitude for new players. However, bullish sentiment for the euro remains quite high in the medium term. The more the euro declines against the US dollar, the more attractive it will be for new investors.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates that the bullish mood in the market remains.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the General definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair declines, support will be provided by the lower border of the indicator in the area of 1.1740, from which you can open long positions immediately for a rebound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.