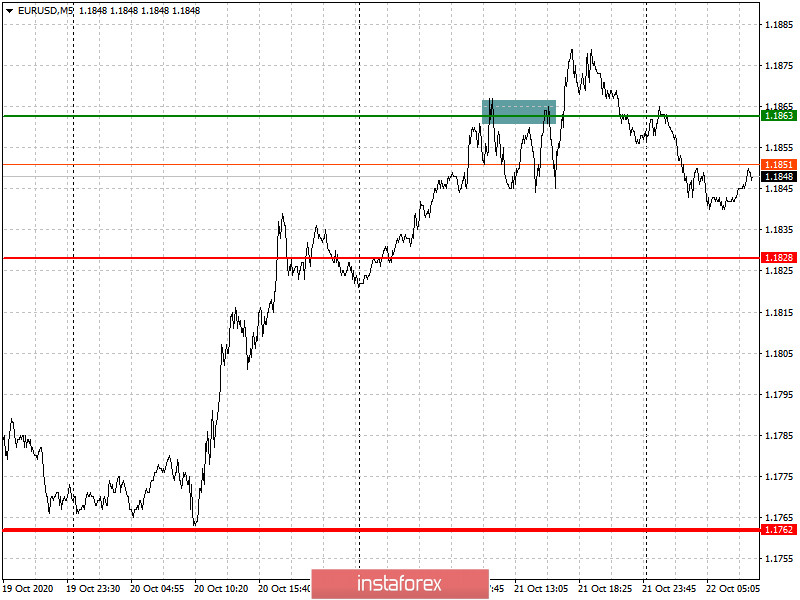

Analysis of transactions in the EUR / USD pair

Euro bulls tried all their might to raise the price higher, however, their positions did not bring the expected result. This suggests that the upside potential of the euro is slowing down.

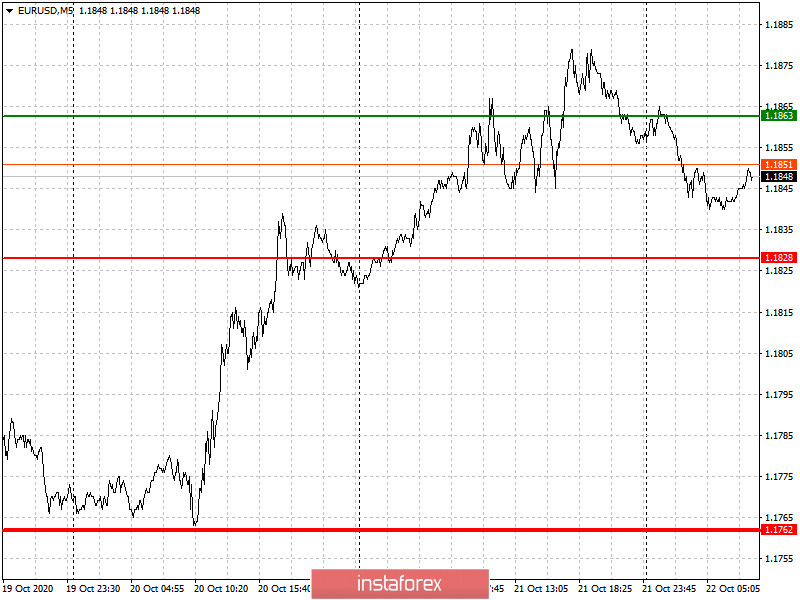

Trading recommendations for October 22

The main drivers of the market today are the upcoming reports on the US labor market. Most likely, their data will reverse the bullish momentum, thereby emerging a downward technical correction.

- Open a long position when the euro reaches a quote of 1.1863 (green line on the chart), and then take profit at the level of 1.1915.

- Open a short position when the euro reaches a quote of 1.1828 (red line on the chart), and then take profit at the level of 1.1762. Weak statistics for Europe will put pressure on the European currency

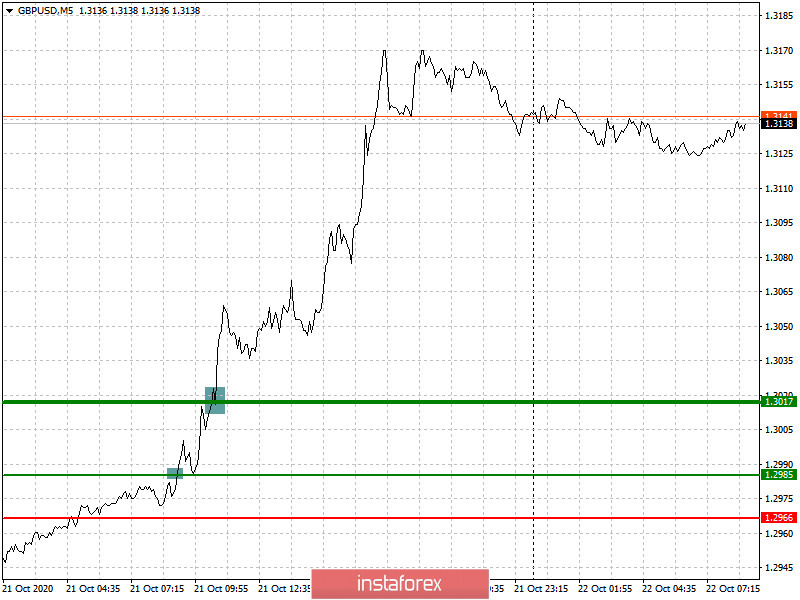

Analysis of transactions in the GBP / USD pair

News that the UK is ready to resume negotiations with the EU led to a very large increase in the British pound. The quote moved up from 1.2985 to the target level, which is 1.3017.

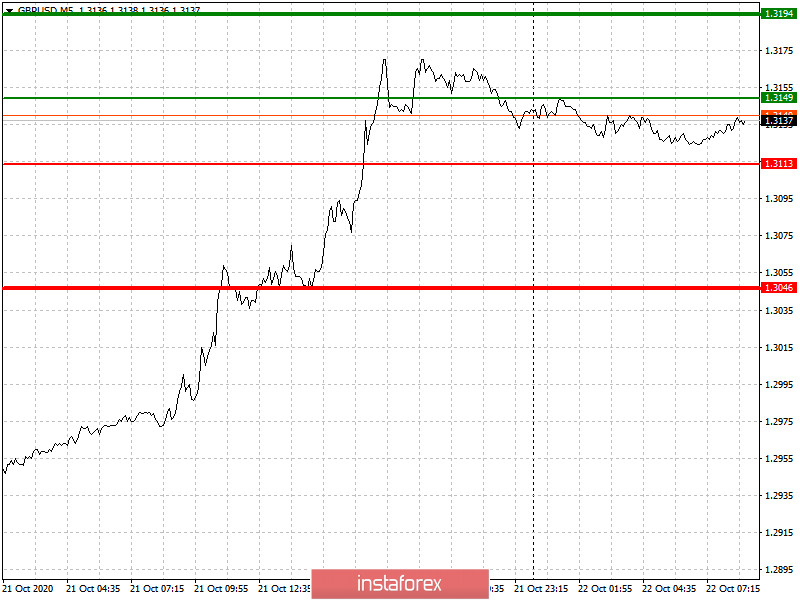

Trading recommendations for October 22

The upward trend will continue if there are specifics on the future negotiations between the UK and the EU. These are the concessions that the UK government can make in order to conclude an agreement. Without these details, the pound may collapse today as much as it rose yesterday.

- Open a long position when the pound reaches a quote of 1.3149 (green line on the chart), and then take profit around the level of 1.3194 (thicker green line on the chart).

- Open a short position when the pound reaches a quote of 1.3113 (red line on the chart), and then take profit at least at the level of 1.3046. Bad news on Brexit will resume the downward trend in the GBP/USD pair.