The results of the US election will clearly be decisive for assessing the prospects for global markets, as it is fast approaching. Thus, no other factors can greatly influence the mood of investors.

Since the week started, there is a rising demand for risky assets, US stock indices, followed by the entire world on expectations that negotiations between the House Speaker, Ms. Pelosi and Finance Minister, Mr. Mnuchin is close to reaching an agreement even before the elections on November 3. However, the situation changed dramatically last night – European indices lost more than 1.5% on average, US indices also went into the "red zone", while oil and gold declined. The reason is obvious. There are still no results regarding the negotiations for three days already, which lowered the possibility of a positive decision before the elections. US Senate Majority Leader, M. McConnell, does not want to bring the bill to the Senate before the election, and Trump accused Democrats again of unwillingness to come to a compromise acceptable to both sides.

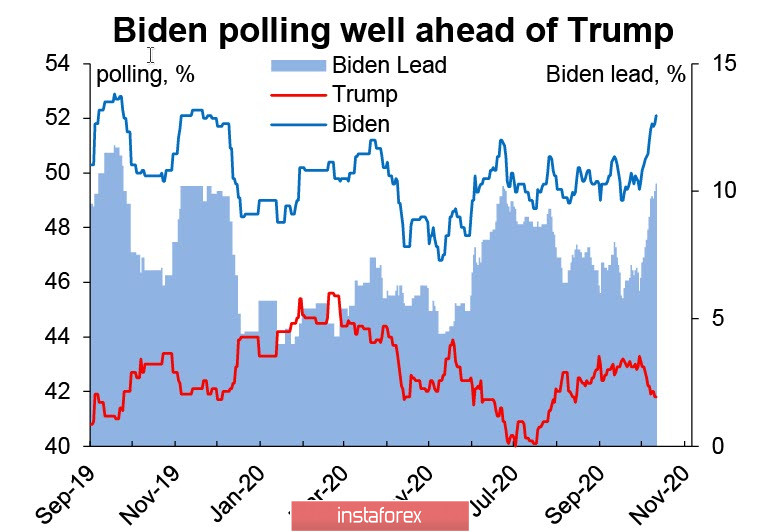

However, the negotiations are just the surface of the issue. The media continues to actively influence investors, which is aimed at convincing the markets that Biden will inevitably win. Moreover, the "blue wave" (Democrats official color) scenario is becoming dominant – Biden's victory, followed by the formation of a Democratic majority in both chambers. Many banks conduct their own research and eventually get very similar results – Biden is ahead of Trump by 10-15%, which is extremely high, given of course, that the respondents give truthful answers.

The above-mentioned scenario, which is now considered dominant, brings clarity to market expectations and allows you to predict the market's reaction to the election results.

In view of this, Mizuho Bank believes that for corporations, Biden's plan looks worse than Trump's plan, but budget expenditures are assumed to be more ambitious, which ultimately will help support the stock market and inflationary expectations, but at the cost of a rapid growth of the budget deficit.

National Australia Bank, in turn, believes that it is necessary to wait for the growth of net stimulus with a simultaneous increase in both taxes and expenses, that is, essentially the same expectations as in Mizuho.

On the other hand, Nordea has practically no doubts about the upcoming total victory of the Democrats, but assumes that this victory has already been considered by the market, and so the initial reaction will be to take profit. Moreover, this bank conducted its own large-scale survey to assess market sentiment. The results are as follows: long-term bond yields will grow, 67% of respondents expect the dollar to weaken, while 71% expect it to rise in shares.

Bookmakers estimate the chances of a "blue wave" with almost 80% probability.

In conclusion, all banks expect the dollar to weaken in 2021.

It should also be noted that multi-directional changes in yields began during the last day between the European bonds and American one. Meanwhile, US Treasuries showed a significant increase in yields at the opening of the day, European bonds were also steadily declining, and the trend was reversed by the end of the day – US closed in the red zone, while the German closed in the green zone.

Tomorrow's CFTC report will show how the banks actively promoted the position of the futures market shares in the media. Over the past few weeks, the short position on the dollar has been declining, which clearly contradicts public estimates.

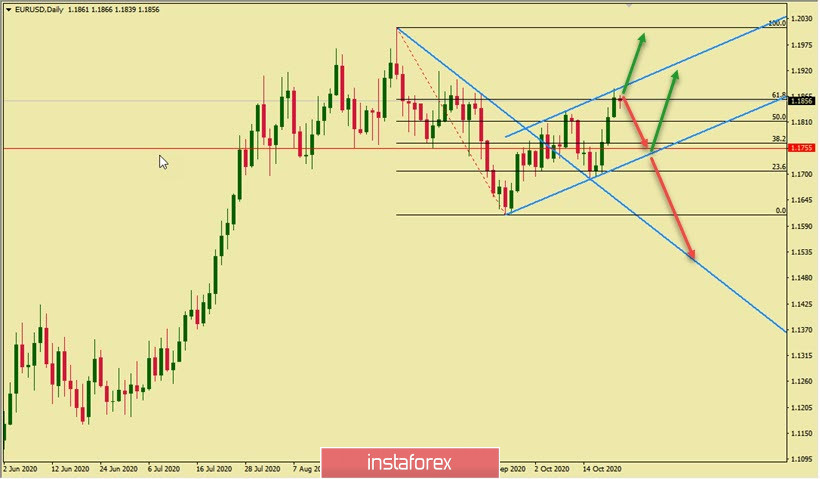

If the reaction of the markets follows the most obvious scenario, then we should wait for the exit from the channel up and retest the level of 1.20 with a break above.

On the other hand, if Nordea is right and the markets start taking profits, then a pullback to the lower border of the 1.1730/60 channel is likely, followed by an upward turn and the formation of a long wave with a target above 1.25.

At the moment, the third, least likely scenario is Trump's victory. Polls also predicted a landslide victory for Clinton four years ago, but in reality, Trump managed to win even in the native "Democratic" States. In this case, the scenario of moving to 1.15 will become relevant again.