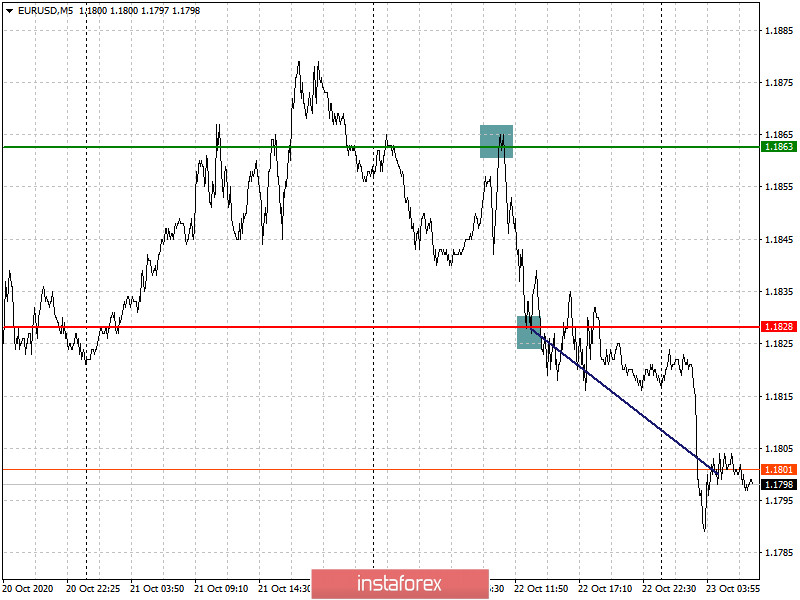

Analysis of transactions in the EUR / USD pair

The euro collapsed yesterday amid the debates of US presidential candidates, as well as due to strong reports on the US economy. The downward movement to about 30 pips.

Trading recommendations for October 23

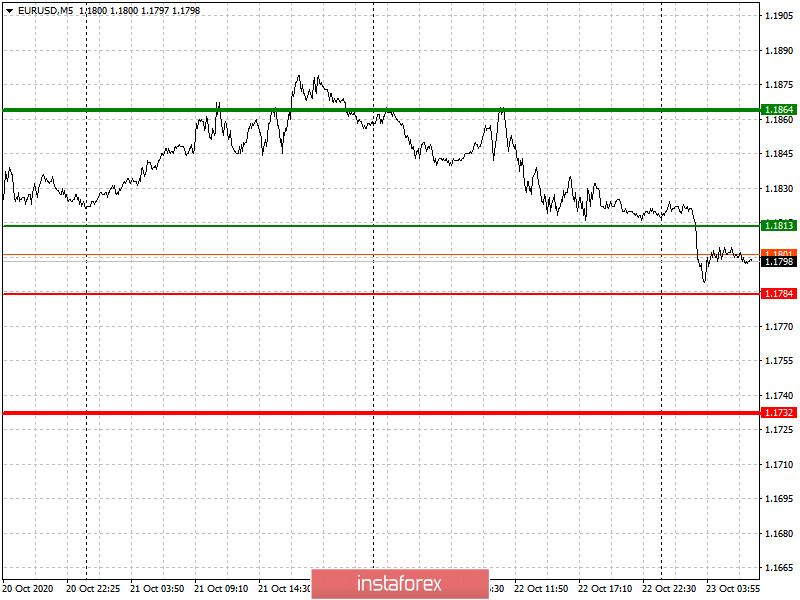

Very important reports on the eurozone's services and manufacturing sectors are scheduled to be published. If data comes out bad or worse than economists' forecast, pressure on the euro will increase, which will result in a new wave of decline in the EUR / USD pair.

- Open a long position when the euro reaches a quote of 1.1813 (green line on the chart), and then take profit at the level of 1.1864. However, this option is possible only with very good data on the composite PMI.

- Open a short position when the euro reaches a quote of 1.1784 (red line on the chart. If the indicators turn out to be worse than the forecasts, pressure on the European currency will return.

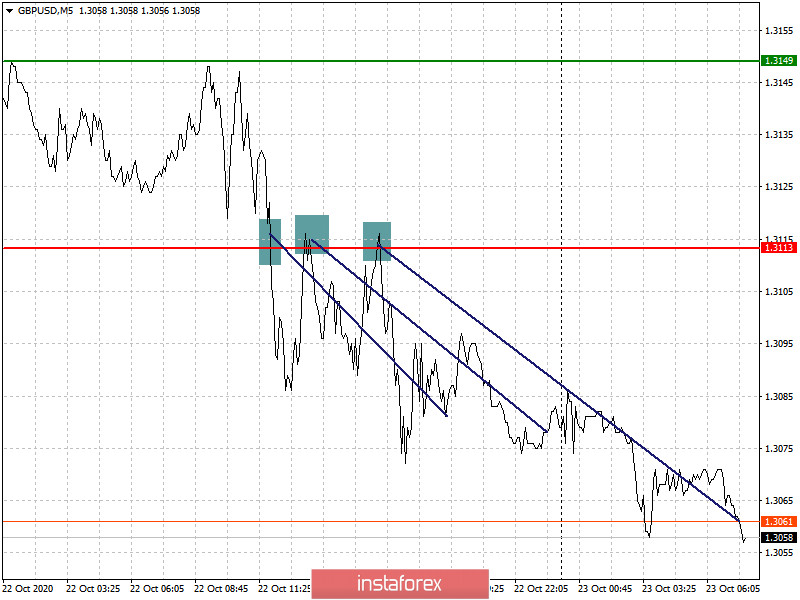

Analysis of transactions in the GBP / USD pair

Three sell signals emerged on the British pound yesterday, which resulted in a 40-pip downward movement in the GBP / USD pair.

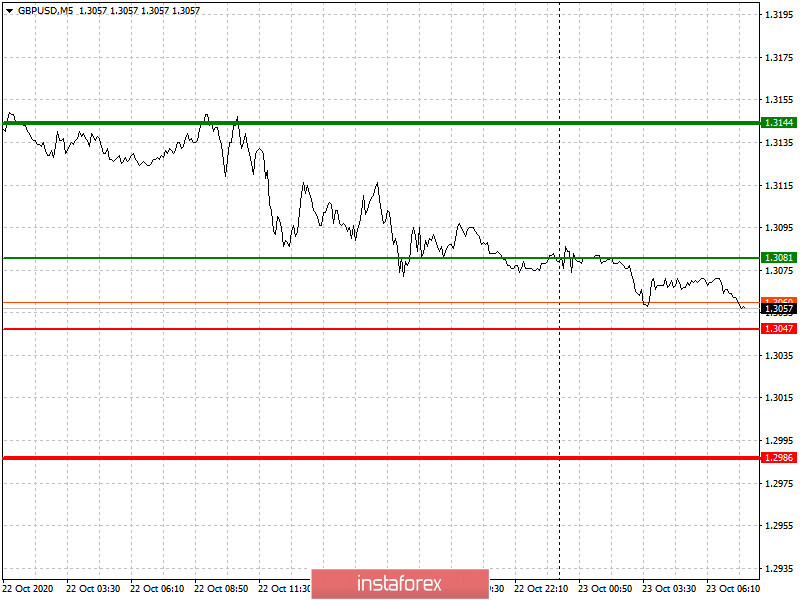

Trading recommendations for October 23

Very important reports on the UK services sector will be published today. If they come out better than the forecasts, a good increase shall be seen in the British pound.

At the same time, data on the manufacturing sector will also be released, and it would affect market sentiment as well.

- Open a long position when the pound reaches a quote of 1.3081 (green line on the chart), and then take profit around the level of 1.3144 (thicker green line on the chart).

- Open a short position when the pound reaches a quote of 1.3047 (red line on the chart), and then take profit at least at the level of 1.2986. Bad news on Brexit, together with a weak report on the UK services sector, will resume the downward trend in the GBP/USD pair.