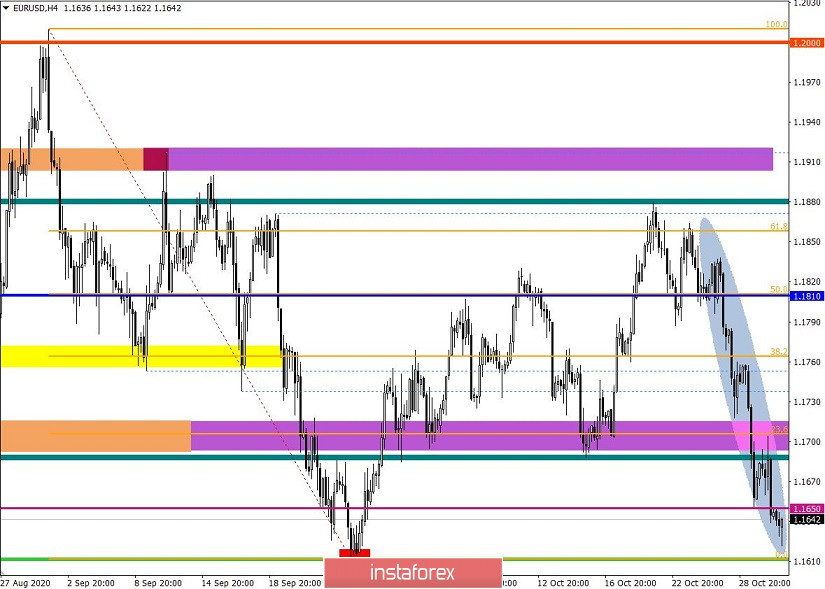

Last Friday, the EUR / USD pair managed not only to keep the downward interest in the market, but also consolidate the quote below the price level of 1.1650 in the four-hour time frame, which opens up even greater prospects for sellers.

As a result, the recovery relative to the price movement from 1.1612 to 1.1880 is almost complete, and only a breakout from the local low of September 25 remains. This means that we are very close to observing a trend change in the medium-term.

In fact, there are already plenty of signals for a downward development, both in terms of technical and fundamental analysis. This suggests that speculation can be very unpredictable and high, thus, traders should be prepared for sharp price changes during the current week.

And if we look at the M15 chart and analyze all the trades set up last Friday, we will see that a wave of short positions appeared during the American session, as a result of which a consolidation below 1.1650 occurred both in the four-hour and daily period.

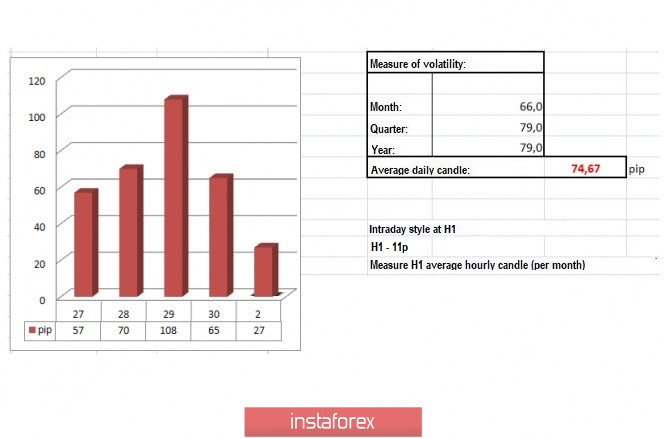

It gave a daily dynamics of 65 points, which is 12% below the average level. Yes, volatility is low, but it was enough to break price level 1.1650.

As for the dynamics of the whole October, a value of 66 points is recorded, which is 12% below the average level. In comparison with the dynamics for September, there is a deceleration of 12.6%. This indicates that there is a characteristic slowdown, but in terms of speculation, nothing has changed.

As for the ideas on the previous review , such a downward development is already expected, and this breakout only confirms the earlier forecast.

Thus, in the daily chart, there is a chance that the medium-term trend will change from bullish to bearish, in which the price will move towards the values: 1.1550; 1.1350; 1.1180; 1.1000.

With regards to news, a preliminary estimate on the EU's GDP was released last Friday, and it indicated a slowdown in economic recession from -14.7% to -4.3%. Although it is better than the forecasts, it is only a rebound after the economic collapse in the second quarter.

At the same time, preliminary data on inflation was also published, where consumer prices remain in the deflationary border, which aggravates the economic recovery process -0.3% (y / y).

As for hot topics such as the coronavirus, many countries have again implemented quarantine restrictions, in which some even returned to lockdown mode, closing shops, bars, restaurants and travel.

Because of this, there is a high chance of a downturn again, which will pull the economy to the bottom.

Further development

As we can see on the daily chart, the only move remaining is a breakout from the local low of September 25 (1.1612), however, this can only be achieved by consolidating the quote lower than 1.1600 in the four-hour time frame.

In fact, such a movement will ensure the medium-term trend to change from bullish to bearish, in which the levels 1.1550; 1.1350; 1.1180; 1.1000 will be the coordinates.

But, an alternative scenario could develop, if the quote rebounds from 1.1612 and stops moving downward in the market.

Indicator analysis

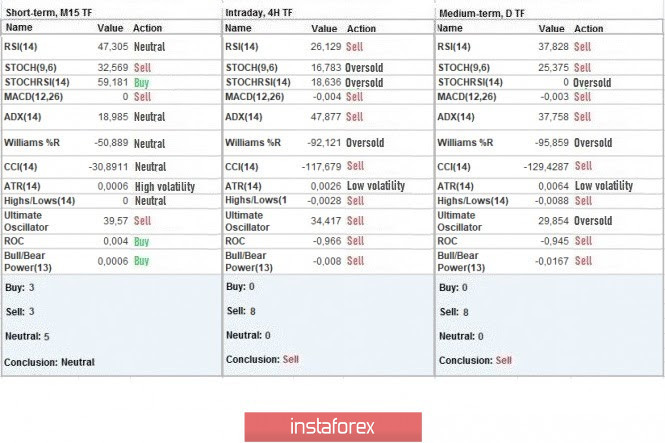

Looking at the different sectors of time frames (TF), we can see that the indicators are currently signaling SELL, following the bearish mood in the market. Meanwhile, the minute period has a variable signal, and this is because of the price convergence at the local low of September 25.

Weekly volatility / Volatility measurement: Month; Quarter; Year

Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year.

(The dynamics for today is calculated, all while taking into account the time this article is published)

Volatility is currently at 27 points, which is 63% below the average level.

An acceleration is expected to appear soon, after the quote consolidates lower than 1.1600, or against the background of the US presidential elections.

Key levels

Resistance zones: 1.1650 *; 1.1700; 1.1880; 1.1910; 1.2000 ***; 1.2100 *; 1.2450 **; 1.2550; 1.2825.

Support Zones: 1.1612 *; 1.1500; 1.1350; 1.1250 *; 1.1180 **; 1.1080; 1.1000 ***.

* Periodic level

** Range level

*** Psychological level

Also check the trading recommendations for the GBP / USD pair here , or the brief trading recommendations here .