The worst month since March for US stock indexes allowed safe-haven assets to feel comfortable. By the end of October, the yen strengthened even against the US dollar, what can we say about the other G10 currencies? The increased attention to the Japanese yen, responsive to the events taking place in the US, is associated with the busiest week of 2020. Along with the presidential election, investors are concerned about the results of the Fed meeting and the report on the state of the US labor market for October.

Despite the fact that Joe Biden is leading in the ratings, it is very difficult to predict the S&P 500's reaction to the results of the November 3 vote. Theoretically, the best option for US stocks is a blue wave. In this scenario, the probability of a large-scale fiscal stimulus will increase, which is a bullish factor for stock indexes. However, note that in 2016, when in the run-up to the election, most were confident that Donald Trump's victory would lead to a massive S&P 500 sell-off. This did not happen, so there is no assurance that if Biden becomes the 46th President, the stock will go up.

The uncertainty risks continuing, because Trump may challenge the results of the vote, as he has repeatedly hinted. If the stock index manages to update the September low, the yen will continue to strengthen. It has been doing it best against the euro, recently. This is not surprising, given the pair's correlation with the S&P 500.

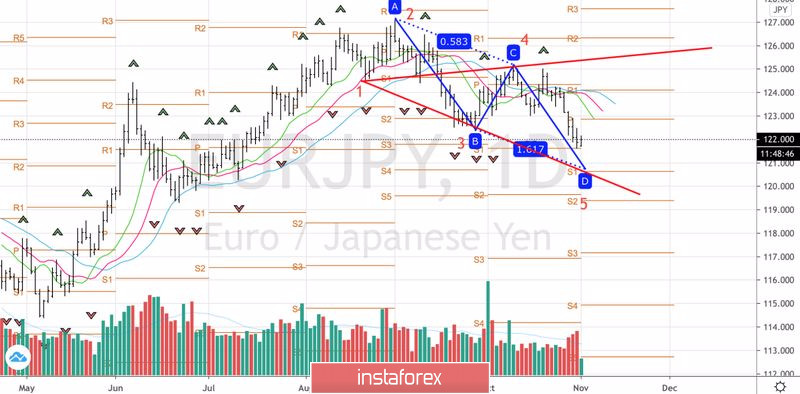

Dynamics of EUR / JPY and S&P 500:

The second wave of the pandemic in Europe, the introduction of new restrictions on social distancing by a number of Eurozone countries led by Germany and France, the associated risks of a double recession, and Christine Lagarde's confidence in the ECB's expansion of the stimulus package in December contributed to the massive sell-off of the euro. In this regard, the BOJ's passive position, the insignificant number of covid-19 cases compared to other developed countries, and the high demand for safe-haven assets allow the yen to strengthen against the euro.

Despite the fact that Haruhiko Kuroda has stated that it is possible to act if necessary, he does not yet see the need to expand monetary stimulus measures. Moreover, an increase in asset purchases will further raise the BoJ's share of the Japanese government bond market structure and seriously destabilize it when the time comes to normalize monetary policy.

It seems that the Fed is not going to change anything either. The US Central Bank is currently buying $120 billion in Treasury and mortgage bonds a month, and 59% of Bloomberg experts do not expect it to make any adjustments to its plans until the end of 2021. The passive positions of the Fed and the Bank of Japan allow investors to sell the euro in contrast to the ECB.

Technically, a breakdown of the EUR / JPY at the support level of 121.5 will allow the formation of shorts, but you should not get carried away with sales. Near the 120.65 mark, there is not only an important pivot level but also a sweet zone based on the "Wolfe Waves" pattern, as well as a target based on AB=CD. Such a serious reversal area suggests the possibility of buying on the rebound.

EUR / JPY daily chart: