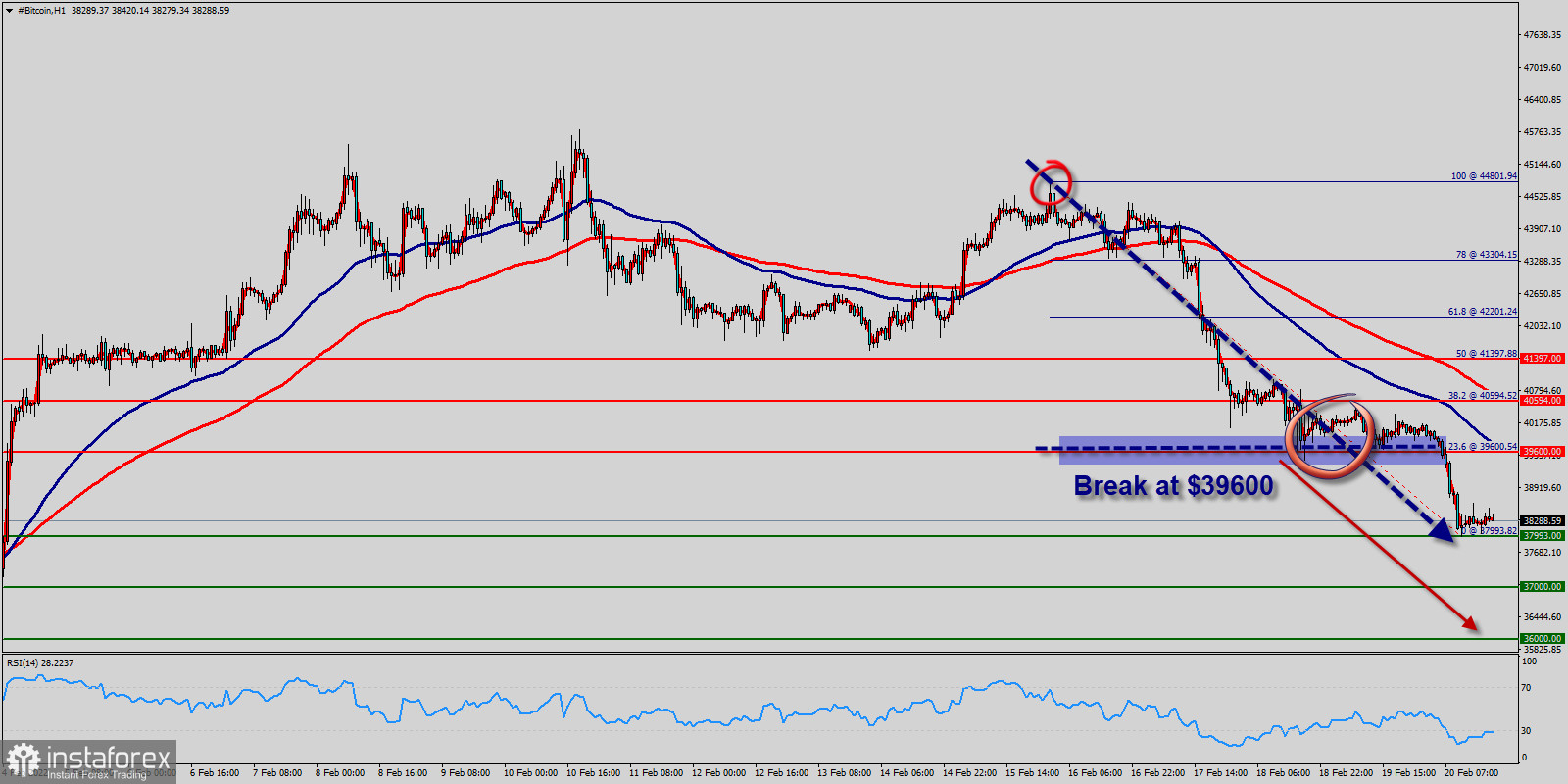

BTC dropped below the $39,600 level for the first time since weeks. The price of $39,600 is coincided with the ratio of 61.8% Fibonacci retracement levels in the hourly time frame.

Right now, BTC stood at $38,304 per 1USD, after touching a high of $39,600 earlier in the day. But the BTC has rebounded from the price of $39,600 to close at $37,993 at the same time frame.

Please, note that the prices of $40,594 and $41,397 coincide with the Fibonacci expansion of 38.2% and 50% respectively.

Bitcoin has been in a volatile trading range for almost a week now, bouncing between $ 40k and $ 36k.

Resistance of the Bitcoin pair is seen at the price of $39,600. The Bitcoin is trading below its resistance for a while. It is likely to trade in a lower range as long as it remains below resistance.

Furthermore, it should bear in mind that resistance has set at $39,600. The Bitcoin pair has not made a significant movement from yesterday. There are no changes in my technical outlook. The bias remains bearish in the nearest term testing $37,000 or lower.

If the trend can break the first target at $37,000, the market will call for a strong bearish trend towards the next target at $36,000.

However, stop loss has always been in consideration. Thus it will be useful to set it above the last double top at the level of $40,594 (notice that the major resistance today has set at 40,594).

Forecast:

- As a result, it is gainful to sell below this price of $ 39k with targets at $ 37k and $ 36k. However, the bullish trend is still expected for the upcoming days as long as the price is above $ 36k.

Daily Technical level (Bitcoin):

- Major resistance: $41,397

- Minor resistance: $40,594

- Intraday pivot point: $39,600

- Minor support: $37k

- Major support: $36k