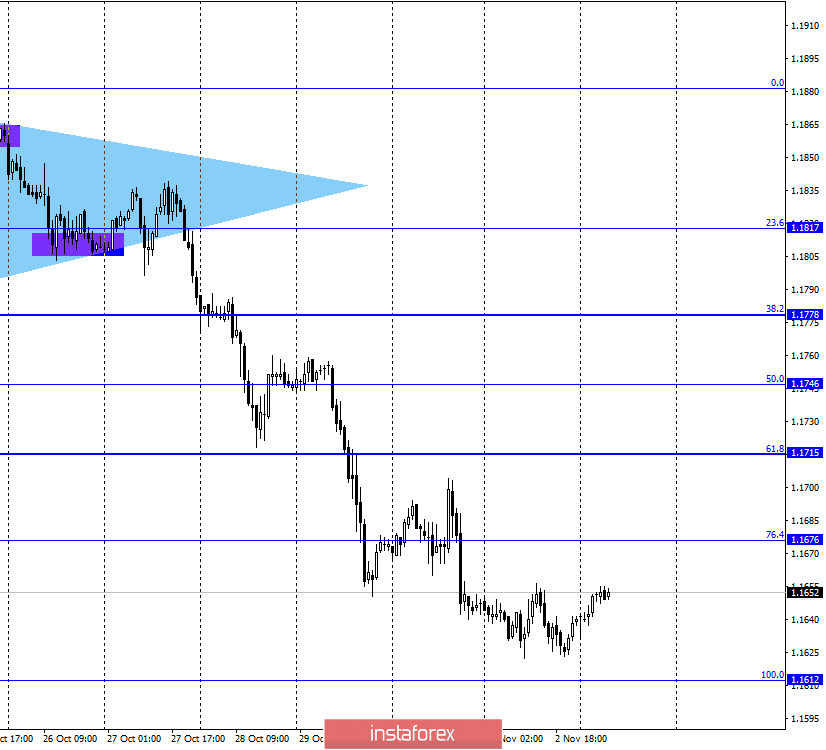

EUR/USD – 1H.

On November 2, the EUR/USD pair fell almost to the corrective level of 100.0% (1.1612), turned in favor of the European currency, and began the growth process towards the corrective level of 76.4% (1.1676). A rebound of the pair's quotes from this level will work again in favor of the US currency and resume falling towards the level of 1.1612. Meanwhile, the day has come on November 3, when the American presidential election will be held. This day was expected not only by the whole of America but also by all traders, as today and tomorrow, many pairs may experience the highest activity. It is not that traders like to move 300-400 points a day, and not that such trades are guaranteed today and tomorrow, however, this option is very likely. On election day in 2016, when Donald Trump won, the pair was very volatile. On the last day before the election, the results of all opinion polls and simulations were summed up, and the results remained approximately the same as before. Joe Biden is 90% likely to win the election, and his support rating among voters is at least 7-8% higher than Trump. By and large, the fate of the 2020 election depends on the "wavering" states, where the result cannot be predicted in advance. For example, in Texas, which provides 38 electoral votes at once, 49.5% of residents are ready to vote for Trump, and 48.2% for Biden. The gap is very small and the errors have not been canceled. Thus, as many as 28 electoral votes can easily go to either candidate.

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes were fixed under the side corridor. Thus, the probability of a further fall in the direction of the corrective level of 100.0% (1.1496) increased. The lower chart also supports this scenario. A bullish divergence is brewing for the CCI indicator, but completely different factors will rule the market today. The information background is in the first place today.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair quotes performed a new rebound from the corrective level of 261.8% (1.1825), after which the quotes continue to fall in the direction of the Fibo level of 200.0% (1.1566). Closing the pair's exchange rate below this level will work in favor of a further drop in quotes towards the level of 161.8% (1.1405).

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 2, the European Union released the index of business activity in the manufacturing sector, which exceeded the forecast values. The same ISM index in the US also exceeded traders' expectations.

News calendar for the United States and the European Union:

On November 3, the calendars of economic events in the United States and the European Union are empty. And traders are looking forward to the start of the US election, which may be accompanied by mass riots.

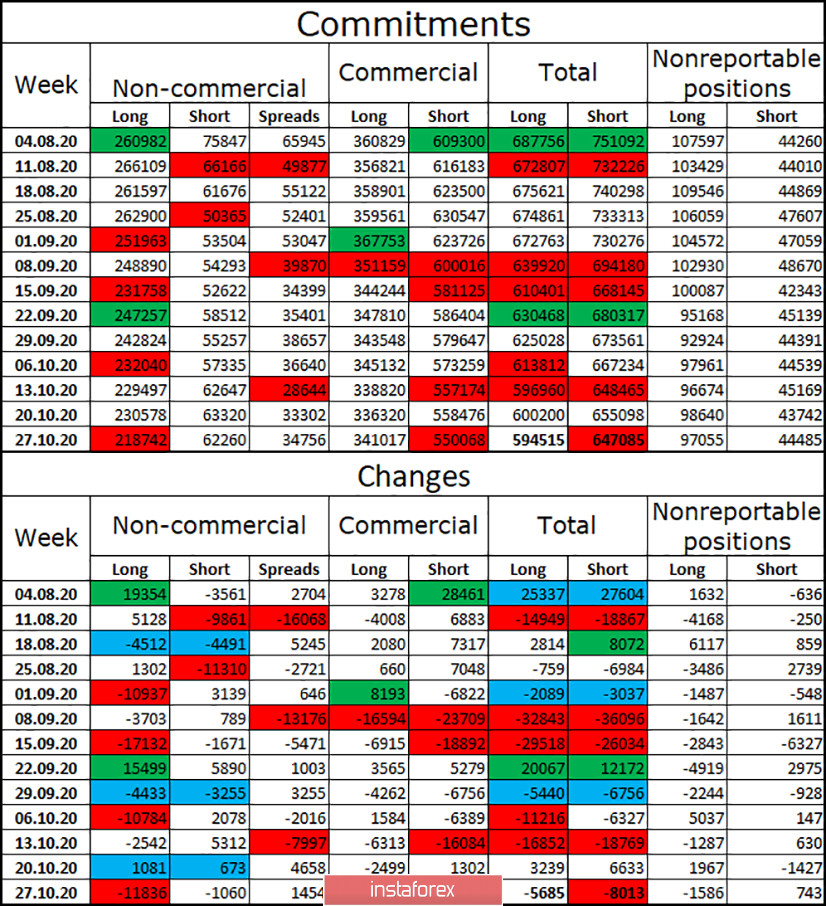

COT (Commitments of Traders) report:

The latest COT report was quite informative. The most important category of non-commercial traders got rid of 12 thousand long contracts and 1 thousand short contracts during the reporting week. Thus, speculators do not believe in the further growth of the European currency and get rid of more purchases of this currency. This process has been going on for several weeks, so a trend is emerging. Over the past two months, the total number of long contracts in the hands of speculators has been steadily falling, while the number of short contracts has been growing slightly. Thus, I am inclined to the option with a further fall in the euro currency quotes.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend opening new sales of the euro currency with a target of 1.1612, if the rebound from the Fibo level of 76.4% (1.1676) is completed. Purchases of the pair will be possible with a target of 1.1715 if the quotes consolidate above the level of 76.4% on the hourly chart. In the second half of the day, the activity of traders can grow significantly.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.